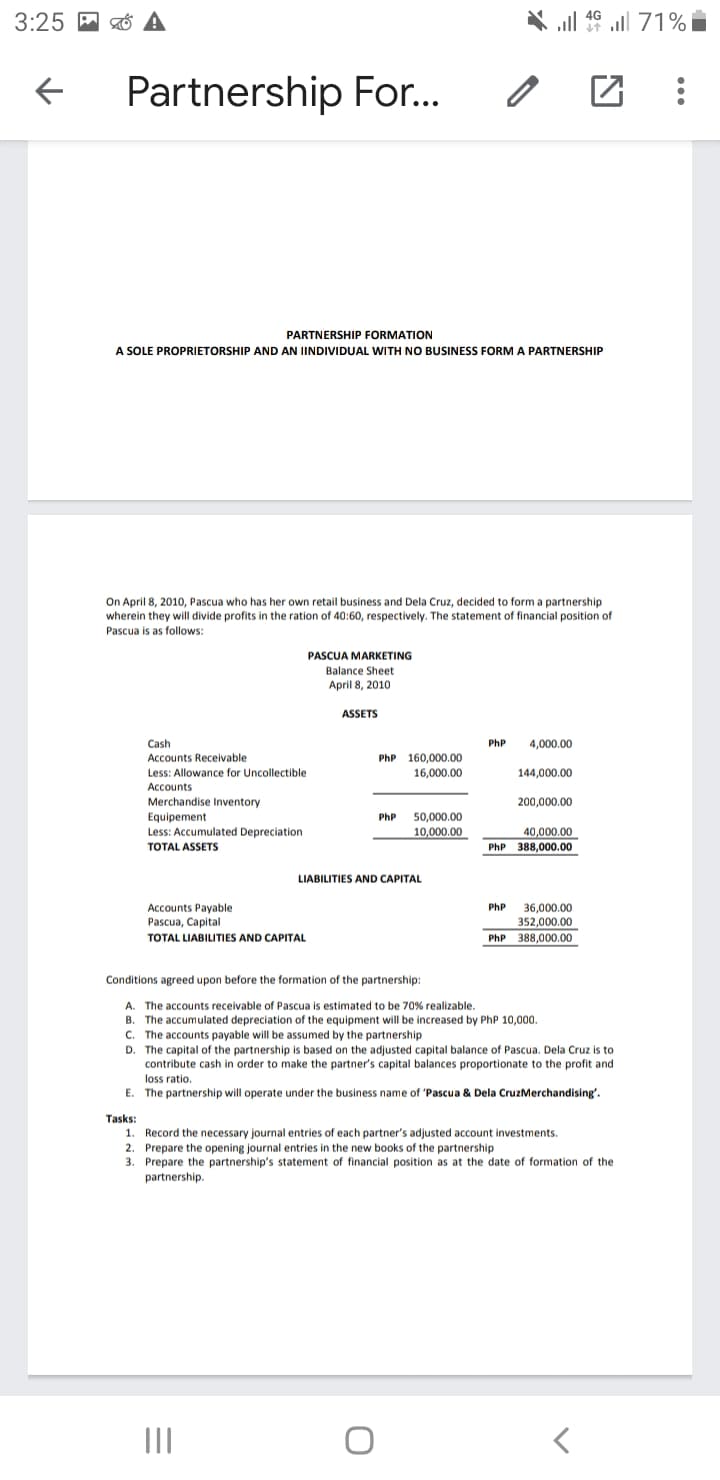

On April 8, 2010, Pascua who has her own retail business and Dela Cruz, decided to form a partnership wherein they will divide profits in the ration of 40:60, respectively. The statement of financial position of Pascua is as follows: PASCUA MARKETING Balance Sheet April 8, 2010 ASSETS Cash PhP 4,000.00 Accounts Receivable PhP 160,000.00 16,000.00 Less: Allowance for Uncollectible 144,000.00 Accounts 200,000.00 Merchandise Inventory Equipement Less: Accumulated Depreciation TOTAL ASSETS PhP 50,000.00 10,000.00 40,000.00 PhP 388,000.00 LIABILITIES AND CAPITAL Accounts Payable Pascua, Capital PhP 36,000.00 352,000.00 PhP 388,000.00 TOTAL LIABILITIES AND CAPITAL Conditions agreed upon before the formation of the partnership: A. The accounts receivable of Pascua is estimated to be 70% realizable. B. The accumulated depreciation of the equipment will be increased by PhP 10,000. c. The accounts payable will be assumed by the partnership D. The capital of the partnership is based on the adjusted capital balance of Pascua. Dela Cruz is to contribute cash in order to make the partner's capital balances proportionate to the profit and loss ratio. E. The partnership will operate under the business name of 'Pascua & Dela CruzMerchandising'. Tasks: 1. Record the necessary journal entries of each partner's adjusted account investments. 2. Prepare the opening journal entries in the new books of the partnership 3. Prepare the partnership's statement of financial position as at the date of formation of the partnership.

On April 8, 2010, Pascua who has her own retail business and Dela Cruz, decided to form a partnership wherein they will divide profits in the ration of 40:60, respectively. The statement of financial position of Pascua is as follows: PASCUA MARKETING Balance Sheet April 8, 2010 ASSETS Cash PhP 4,000.00 Accounts Receivable PhP 160,000.00 16,000.00 Less: Allowance for Uncollectible 144,000.00 Accounts 200,000.00 Merchandise Inventory Equipement Less: Accumulated Depreciation TOTAL ASSETS PhP 50,000.00 10,000.00 40,000.00 PhP 388,000.00 LIABILITIES AND CAPITAL Accounts Payable Pascua, Capital PhP 36,000.00 352,000.00 PhP 388,000.00 TOTAL LIABILITIES AND CAPITAL Conditions agreed upon before the formation of the partnership: A. The accounts receivable of Pascua is estimated to be 70% realizable. B. The accumulated depreciation of the equipment will be increased by PhP 10,000. c. The accounts payable will be assumed by the partnership D. The capital of the partnership is based on the adjusted capital balance of Pascua. Dela Cruz is to contribute cash in order to make the partner's capital balances proportionate to the profit and loss ratio. E. The partnership will operate under the business name of 'Pascua & Dela CruzMerchandising'. Tasks: 1. Record the necessary journal entries of each partner's adjusted account investments. 2. Prepare the opening journal entries in the new books of the partnership 3. Prepare the partnership's statement of financial position as at the date of formation of the partnership.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.1APR

Related questions

Question

Transcribed Image Text:3:25 M ở A

X ll 16 ull 71% i

Partnership For..

PARTNERSHIP FORMATION

A SOLE PROPRIETORSHIP AND AN IINDIVIDUAL WITH NO BUSINESS FORM A PARTNERSHIP

On April 8, 2010, Pascua who has her own retail business and Dela Cruz, decided to form a partnership

wherein they will divide profits in the ration of 40:60, respectively. The statement of financial position of

Pascua is as follows:

PASCUA MARKETING

Balance Sheet

April 8, 2010

ASSETS

Cash

PhP

4,000,00

PhP 160,000.00

16,000.00

Accounts Receivable

Less: Allowance for Uncollectible

144,000.00

Accounts

Merchandise Inventory

Equipement

Less: Accumulated Depreciation

200,000.00

50,000.00

10,000.00

PhP

40,000.00

PhP 388,0000.00

TOTAL ASSETS

LIABILITIES AND CAPITAL

Accounts Payable

PhP

36,000.00

352,000.00

Pascua, Capital

TOTAL LIABILITIES AND CAPITAL

PhP

388.000.00

Conditions agreed upon before the formation of the partnership:

A. The accounts receivable of Pascua is estimated to be 70% realizable.

B. The accumulated depreciation of the equipment will be increased by PhP 10,000.

C. The accounts payable will be assumed by the partnership

D. The capital of the partnership is based on the adjusted capital balance of Pascua. Dela Cruz is to

contribute cash in order to make the partner's capital balances proportionate to the profit and

loss ratio.

E. The partnership will operate under the business name of 'Pascua & Dela CruzMerchandising'.

Tasks:

1. Record the necessary journal entries of each partner's adjusted account investments.

2. Prepare the opening journal entries in the new books of the partnership

3. Prepare the partnership's statement of financial position as at the date of formation of the

partnership.

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,