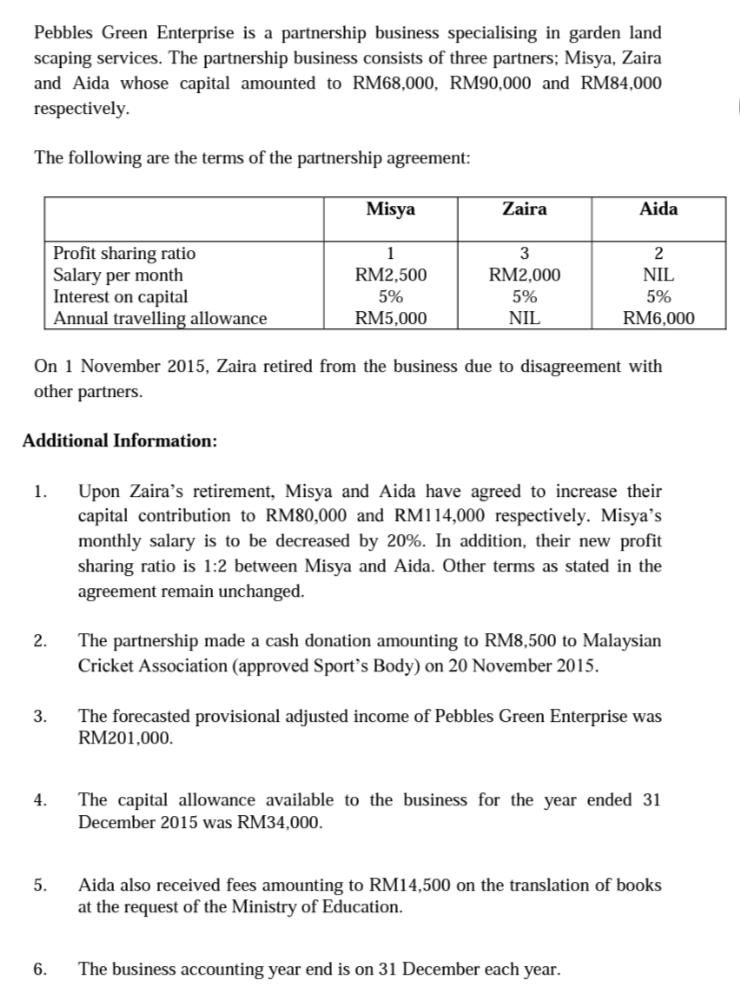

Pebbles Green Enterprise is a partnership business specialising in garden land scaping services. The partnership business consists of three partners; Misya, Zaira and Aida whose capital amounted to RM68,000, RM90,000 and RM84,000 respectively. The following are the terms of the partnership agreement: Misya Zaira Aida Profit sharing ratio Salary per month Interest on capital Annual travelling allowance 1 3 RM2,500 RM2,000 NIL 5% RM5,000 5% NIL 5% RM6,000 On 1 November 2015, Zaira retired from the business due to disagreement with other partners. Additional Information: Upon Zaira's retirement, Misya and Aida have agreed to increase their capital contribution to RM80,000 and RM114,000 respectively. Misya's monthly salary is to be decreased by 20%. In addition, their new profit 1. sharing ratio is 1:2 between Misya and Aida. Other terms as stated in the agreement remain unchanged. 2. The partnership made a cash donation amounting to RM8,500 to Malaysian Cricket Association (approved Sport's Body) on 20 November 2015. The forecasted provisional adjusted income of Pebbles Green Enterprise was RM201,000. 3. The capital allowance available to the business for the year ended 31 December 2015 was RM34,000. 4. Aida also received fees amounting to RM14,500 on the translation of books at the request of the Ministry of Education. 5. 6. The business accounting year end is on 31 December each year.

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Compute the total income of each partner for the year of assessment 2015.

Step by step

Solved in 2 steps with 4 images