On August 1, 2020, Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased office furniture on account; $4,700. 1 Mark Diamond invested $6,100 cash into his new business. 2. Collected $2,550 in advance for a three-week guided caribou watching tour beginning later in August. Paid $4,650 for six months' rent for office space effective August 1. Received $2,100 for a four-day northern lights viewing tour just completed. Paid $1,050 for hotel expenses regarding the August 4 tour. 15 Mark withdrew cash of $600 for personal use. 3 4 22 Met with a Japanese tour guide to discuss a $100,000 tour contract. 31 Paid wages of $1,210. Required 1. Prepare general journal entries to record the August transactions. 2. Set up the following T-accounts: Cash (101); Prepaid Rent (131); Office Furniture (161); Accumulated Depreciation, Office Furniture (162); Accounts Payable (201); Unearned Revenue (233); Mark Diamond, Capital (301); Mark Diamond, Withdrawals (302); Revenue (401); Depreciation Expense, Office Furniture (602); Wages Expense (623); Rent Expense (640); Telephone Expense (688); and Hotel Expenses (696). 3. Post the entries to the accounts; calculate the ending balance in each account. 4. Prepare an unadjusted trial balance at August 31, 2020.

On August 1, 2020, Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased office furniture on account; $4,700. 1 Mark Diamond invested $6,100 cash into his new business. 2. Collected $2,550 in advance for a three-week guided caribou watching tour beginning later in August. Paid $4,650 for six months' rent for office space effective August 1. Received $2,100 for a four-day northern lights viewing tour just completed. Paid $1,050 for hotel expenses regarding the August 4 tour. 15 Mark withdrew cash of $600 for personal use. 3 4 22 Met with a Japanese tour guide to discuss a $100,000 tour contract. 31 Paid wages of $1,210. Required 1. Prepare general journal entries to record the August transactions. 2. Set up the following T-accounts: Cash (101); Prepaid Rent (131); Office Furniture (161); Accumulated Depreciation, Office Furniture (162); Accounts Payable (201); Unearned Revenue (233); Mark Diamond, Capital (301); Mark Diamond, Withdrawals (302); Revenue (401); Depreciation Expense, Office Furniture (602); Wages Expense (623); Rent Expense (640); Telephone Expense (688); and Hotel Expenses (696). 3. Post the entries to the accounts; calculate the ending balance in each account. 4. Prepare an unadjusted trial balance at August 31, 2020.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 5PA: In April, J. Rodriguez established an apartment rental service. The account headings are presented...

Related questions

Topic Video

Question

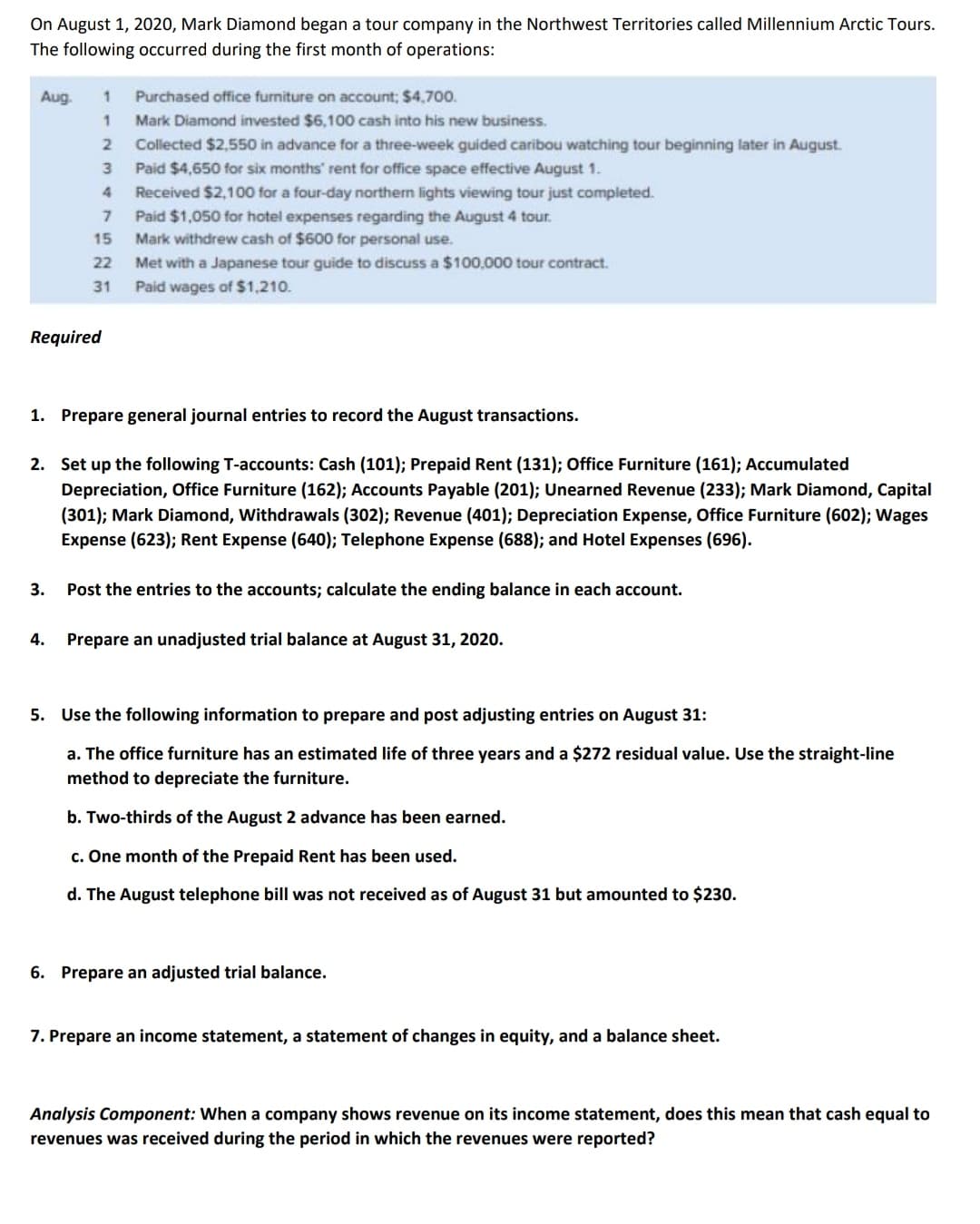

Transcribed Image Text:On August 1, 2020, Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours.

The following occurred during the first month of operations:

Aug.

Purchased office furniture on account; $4,70o.

1.

Mark Diamond invested $6,100 cash into his new business.

2.

Collected $2,550 in advance for a three-week guided caribou watching tour beginning later in August.

3

Paid $4,650 for six months' rent for office space effective August 1.

Received $2,100 for a four-day northern lights viewing tour just completed.

Paid $1,050 for hotel expenses regarding the August 4 tour.

Mark withdrew cash of $600 for personal use.

4.

15

22

Met with a Japanese tour guide to discuss a $100,000 tour contract.

31

Paid wages of $1,210.

Required

1. Prepare general journal entries to record the August transactions.

2. Set up the following T-accounts: Cash (101); Prepaid Rent (131); Office Furniture (161); Accumulated

Depreciation, Office Furniture (162); Accounts Payable (201); Unearned Revenue (233); Mark Diamond, Capital

(301); Mark Diamond, Withdrawals (302); Revenue (401); Depreciation Expense, Office Furniture (602); Wages

Expense (623); Rent Expense (640); Telephone Expense (688); and Hotel Expenses (696).

3.

Post the entries to the accounts; calculate the ending balance in each account.

4.

Prepare an unadjusted trial balance at August 31, 2020.

5. Use the following information to prepare and post adjusting entries on August 31:

a. The office furniture has an estimated life of three years and a $272 residual value. Use the straight-line

method to depreciate the furniture.

b. Two-thirds of the August 2 advance has been earned.

c. One month of the Prepaid Rent has been used.

d. The August telephone bill was not received as of August 31 but amounted to $230.

6. Prepare an adjusted trial balance.

7. Prepare an income statement, a statement of changes in equity, and a balance sheet.

Analysis Component: When a company shows revenue on its income statement, does this mean that cash equal to

revenues was received during the period in which the revenues were reported?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning