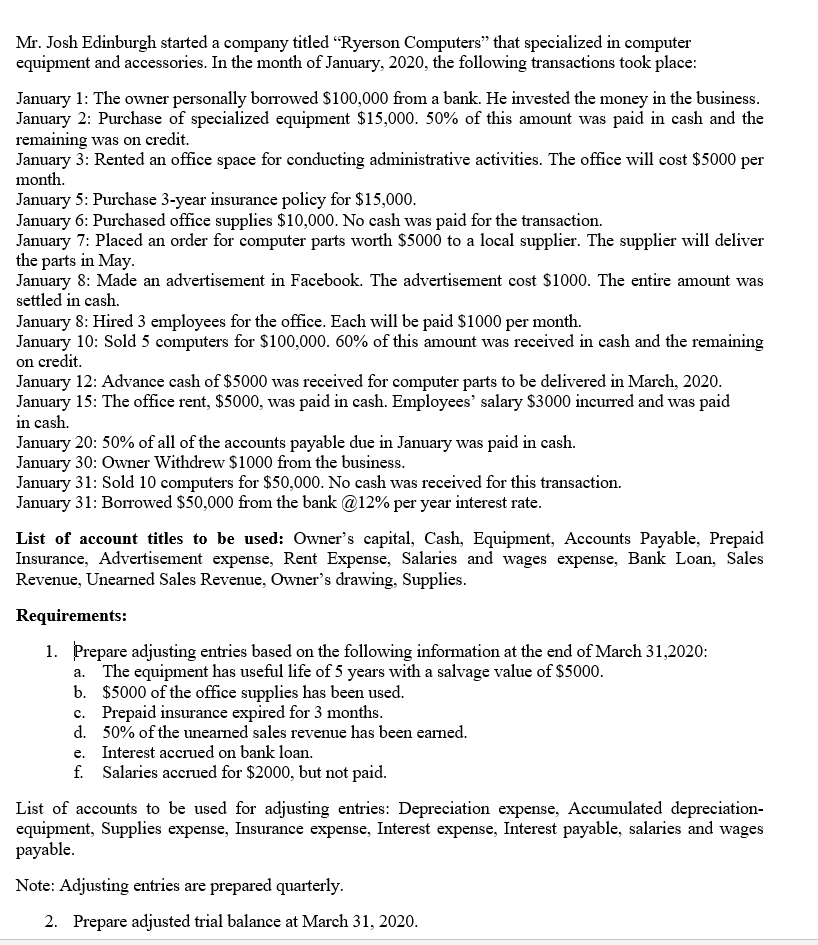

Mr. Josh Edinburgh started a company titled "Ryerson Computers" that specialized in computer equipment and accessories. In the month of January, 2020, the following transactions took place: January 1: The owner personally borrowed $100,000 from a bank. He invested the money in the business. January 2: Purchase of specialized equipment $15,000. 50% of this amount was paid in cash and the remaining was on credit. January 3: Rented an office space for conducting administrative activities. The office will cost $5000 per month. January 5: Purchase 3-year insurance policy for $15,000. January 6: Purchased office supplies $10,000. No cash was paid for the transaction. January 7: Placed an order for computer parts worth $5000 to a local supplier. The supplier will deliver the parts in May. January 8: Made an advertisement in Facebook. The advertisement cost $1000. The entire amount was settled in cash. January 8: Hired 3 employees for the office. Each will be paid $1000 per month. January 10: Sold 5 computers for $100,000. 60% of this amount was received in cash and the remaining on credit. January 12: Advance cash of $5000 was received for computer parts to be delivered in March, 2020. January 15: The office rent, $5000, was paid in cash. Employees' salary $3000 incurred and was paid in cash. January 20: 50% of all of the accounts payable due in January was paid in cash. January 30: Owner Withdrew $1000 from the business. January 31: Sold 10 computers for $50,000. No cash was received for this transaction. January 31: Borrowed $50,000 from the bank @12% per year interest rate. List of account titles to be used: Owner's capital, Cash, Equipment, Accounts Payable, Prepaid Insurance, Advertisement expense, Rent Expense, Salaries and wages expense, Bank Loan, Sales Revenue, Unearned Sales Revenue, Owner's drawing, Supplies. Requirements: 1. Prepare adjusting entries based on the following information at the end of March 31,2020: a. The equipment has useful life of 5 years with a salvage value of $5000. b. $5000 of the office supplies has been used. c. Prepaid insurance expired for 3 months. d. 50% of the unearned sales revenue has been earned. e. Interest accrued on bank loan. f. Salaries accrued for $2000, but not paid. List of accounts to be used for adjusting entries: Depreciation expense, Accumulated depreciation- equipment, Supplies expense, Insurance expense, Interest expense, Interest payable, salaries and wages payable. Note: Adjusting entries are prepared quarterly. 2. Prepare adjusted trial balance at March 31, 2020.

Mr. Josh Edinburgh started a company titled "Ryerson Computers" that specialized in computer equipment and accessories. In the month of January, 2020, the following transactions took place: January 1: The owner personally borrowed $100,000 from a bank. He invested the money in the business. January 2: Purchase of specialized equipment $15,000. 50% of this amount was paid in cash and the remaining was on credit. January 3: Rented an office space for conducting administrative activities. The office will cost $5000 per month. January 5: Purchase 3-year insurance policy for $15,000. January 6: Purchased office supplies $10,000. No cash was paid for the transaction. January 7: Placed an order for computer parts worth $5000 to a local supplier. The supplier will deliver the parts in May. January 8: Made an advertisement in Facebook. The advertisement cost $1000. The entire amount was settled in cash. January 8: Hired 3 employees for the office. Each will be paid $1000 per month. January 10: Sold 5 computers for $100,000. 60% of this amount was received in cash and the remaining on credit. January 12: Advance cash of $5000 was received for computer parts to be delivered in March, 2020. January 15: The office rent, $5000, was paid in cash. Employees' salary $3000 incurred and was paid in cash. January 20: 50% of all of the accounts payable due in January was paid in cash. January 30: Owner Withdrew $1000 from the business. January 31: Sold 10 computers for $50,000. No cash was received for this transaction. January 31: Borrowed $50,000 from the bank @12% per year interest rate. List of account titles to be used: Owner's capital, Cash, Equipment, Accounts Payable, Prepaid Insurance, Advertisement expense, Rent Expense, Salaries and wages expense, Bank Loan, Sales Revenue, Unearned Sales Revenue, Owner's drawing, Supplies. Requirements: 1. Prepare adjusting entries based on the following information at the end of March 31,2020: a. The equipment has useful life of 5 years with a salvage value of $5000. b. $5000 of the office supplies has been used. c. Prepaid insurance expired for 3 months. d. 50% of the unearned sales revenue has been earned. e. Interest accrued on bank loan. f. Salaries accrued for $2000, but not paid. List of accounts to be used for adjusting entries: Depreciation expense, Accumulated depreciation- equipment, Supplies expense, Insurance expense, Interest expense, Interest payable, salaries and wages payable. Note: Adjusting entries are prepared quarterly. 2. Prepare adjusted trial balance at March 31, 2020.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 5PA: Inner Resources Company started its business on April 1, 2019. The following transactions occurred...

Related questions

Question

plz do it for me

Transcribed Image Text:Mr. Josh Edinburgh started a company titled "Ryerson Computers" that specialized in computer

equipment and accessories. In the month of January, 2020, the following transactions took place:

January 1: The owner personally borrowed $100,000 from a bank. He invested the money in the business.

January 2: Purchase of specialized equipment $15,000. 50% of this amount was paid in cash and the

remaining was on credit.

January 3: Rented an office space for conducting administrative activities. The office will cost $5000 per

month.

January 5: Purchase 3-year insurance policy for $15,000.

January 6: Purchased office supplies $10,000. No cash was paid for the transaction.

January 7: Placed an order for computer parts worth $5000 to a local supplier. The supplier will deliver

the parts in May.

January 8: Made an advertisement in Facebook. The advertisement cost $1000. The entire amount was

settled in cash.

January 8: Hired 3 employees for the office. Each will be paid $1000 per month.

January 10: Sold 5 computers for $100,000. 60% of this amount was received in cash and the remaining

on credit.

January 12: Advance cash of $5000 was received for computer parts to be delivered in March, 2020.

January 15: The office rent, $5000, was paid in cash. Employees' salary $3000 incurred and was paid

in cash.

January 20: 50% of all of the accounts payable due in January was paid in cash.

January 30: Owner Withdrew $1000 from the business.

January 31: Sold 10 computers for $50,000. No cash was received for this transaction.

January 31: Borrowed $50,000 from the bank @12% per year interest rate.

List of account titles to be used: Owner's capital, Cash, Equipment, Accounts Payable, Prepaid

Insurance, Advertisement expense, Rent Expense, Salaries and wages expense, Bank Loan, Sales

Revenue, Unearned Sales Revenue, Owner's drawing, Supplies.

Requirements:

1. Prepare adjusting entries based on the following information at the end of March 31,2020:

a. The equipment has useful life of 5 years with a salvage value of $5000.

b. $5000 of the office supplies has been used.

c. Prepaid insurance expired for 3 months.

d. 50% of the unearned sales revenue has been earned.

e. Interest accrued on bank loan.

f. Salaries accrued for $2000, but not paid.

List of accounts to be used for adjusting entries: Depreciation expense, Accumulated depreciation-

equipment, Supplies expense, Insurance expense, Interest expense, Interest payable, salaries and wages

payable.

Note: Adjusting entries are prepared quarterly.

2. Prepare adjusted trial balance at March 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT