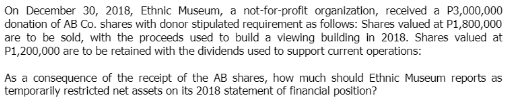

On December 30, 2018, Ethnic Museum, a not-for-profit organlzation, recelved a P3,000,000 donation of AB Co. shares with donor stipulated requirement as follows: Shares valued at P1,800,000 are to be sold, with the proceeds used to buld a viewing bullding in 2018. Shares valued at P1,200,000 are to be retained with the dividends used to support current operations: As a consequence of the receipt of the AB shares, how much should Ethnic Museum reports as temporarily restricted net assets on its 2018 statement of financial position?

On December 30, 2018, Ethnic Museum, a not-for-profit organlzation, recelved a P3,000,000 donation of AB Co. shares with donor stipulated requirement as follows: Shares valued at P1,800,000 are to be sold, with the proceeds used to buld a viewing bullding in 2018. Shares valued at P1,200,000 are to be retained with the dividends used to support current operations: As a consequence of the receipt of the AB shares, how much should Ethnic Museum reports as temporarily restricted net assets on its 2018 statement of financial position?

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 15DQ

Related questions

Question

Transcribed Image Text:On December 30, 2018, Ethnic Museum, a not-for-profit organization, received a P3,000,000

donation of AB Co. shares with donor stipulated requirement as follows: Shares valued at P1,800,000

are to be sold, with the proceeds used to build a viewing building in 2018. Shares valued at

P1,200,000 are to be retained with the dividends used to support current operations:

As a consequence of the receipt of the AB shares, how much should Ethnic Museum reports as

temporarily restricted net assets on its 2018 statement of financial position?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,