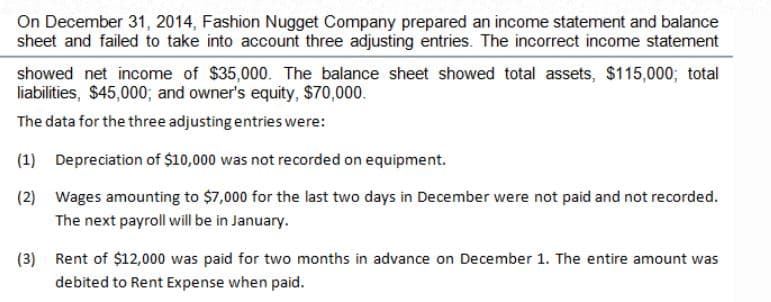

On December 31, 2014, Fashion Nugget Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $35,000. The balance sheet showed total assets, $115,000; total liabilities, $45,000; and owner's equity, $70,000. The data for the three adjusting entries were: (1) Depreciation of $10,000 was not recorded on equipment. (2) Wages amounting to $7,000 for the last two days in December were not paid and not recorded. The next navroll will be in January Ihe

On December 31, 2014, Fashion Nugget Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $35,000. The balance sheet showed total assets, $115,000; total liabilities, $45,000; and owner's equity, $70,000. The data for the three adjusting entries were: (1) Depreciation of $10,000 was not recorded on equipment. (2) Wages amounting to $7,000 for the last two days in December were not paid and not recorded. The next navroll will be in January Ihe

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10P: At the beginning of 2020, Tanham Company discovered the following errors made in the preceding 2...

Related questions

Question

See attachments please

Transcribed Image Text:On December 31, 2014, Fashion Nugget Company prepared an income statement and balance

sheet and failed to take into account three adjusting entries. The incorrect income statement

showed net income of $35,000. The balance sheet showed total assets, $115,000; total

liabilities, $45,000; and owner's equity, $70,000.

The data for the three adjusting entries were:

(1)

Depreciation of $10,000 was not recorded on equipment.

(2) Wages amounting to $7,000 for the last two days in December were not paid and not recorded.

The next payroll will be in January.

(3)

Rent of $12,000 was paid for two months in advance on December 1. The entire amount was

debited to Rent Expense when paid.

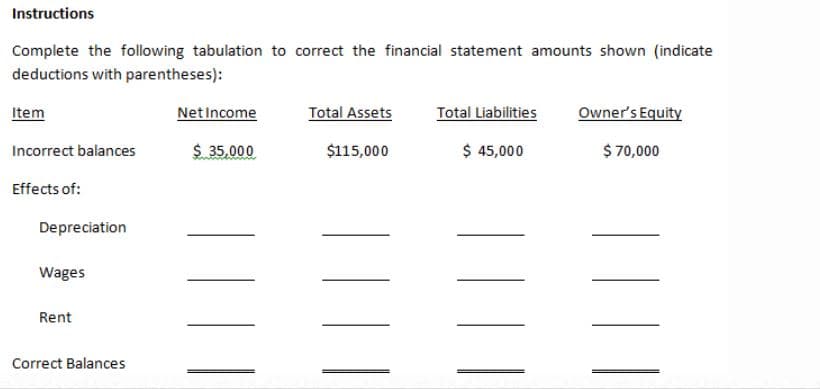

Transcribed Image Text:Instructions

Complete the following tabulation to correct the financial statement amounts shown (indicate

deductions with parentheses):

Item

NetIncome

Total Assets

Total Liabilities

Owner's Equity

Incorrect balances

$. 35,000

$115,000

$ 45,000

$ 70,000

Effects of:

Depreciation

Wages

Rent

Correct Balances

| |

|| ||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning