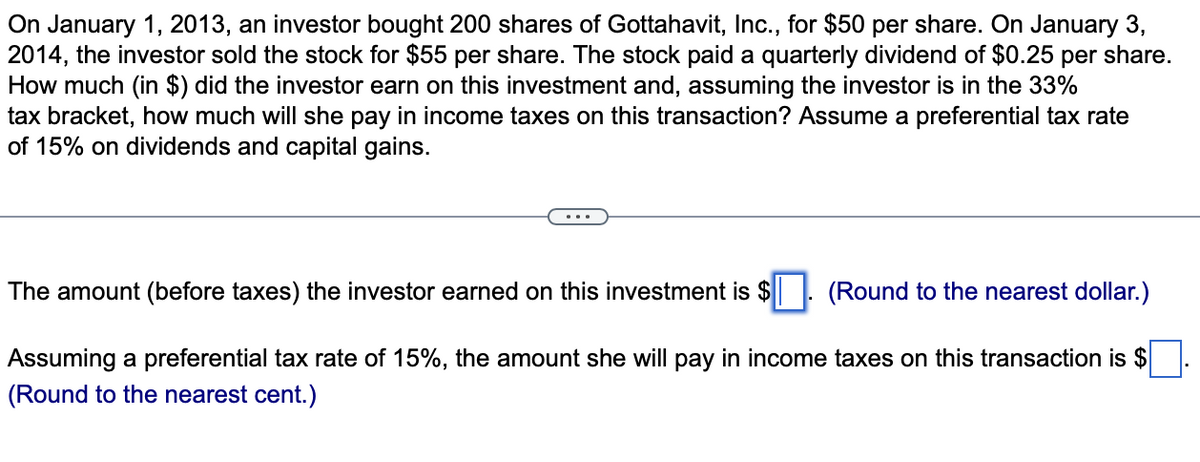

On January 1, 2013, an investor bought 200 shares of Gottahavit, Inc., for $50 per share. On January 3, 2014, the investor sold the stock for $55 per share. The stock paid a quarterly dividend of $0.25 per share How much (in $) did the investor earn on this investment and, assuming the investor is in the 33% tax bracket, how much will she pay in income taxes on this transaction? Assume a preferential tax rate of 15% on dividends and capital gains. The amount (before taxes) the investor earned on this investment is $ (Round to the nearest dollar.) Assuming a preferential tax rate of 15%, the amount she will pay in income taxes on this transaction is $[ (Round to the nearest cent)

On January 1, 2013, an investor bought 200 shares of Gottahavit, Inc., for $50 per share. On January 3, 2014, the investor sold the stock for $55 per share. The stock paid a quarterly dividend of $0.25 per share How much (in $) did the investor earn on this investment and, assuming the investor is in the 33% tax bracket, how much will she pay in income taxes on this transaction? Assume a preferential tax rate of 15% on dividends and capital gains. The amount (before taxes) the investor earned on this investment is $ (Round to the nearest dollar.) Assuming a preferential tax rate of 15%, the amount she will pay in income taxes on this transaction is $[ (Round to the nearest cent)

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 44P

Related questions

Question

Answer in typing

Transcribed Image Text:On January 1, 2013, an investor bought 200 shares of Gottahavit, Inc., for $50 per share. On January 3,

2014, the investor sold the stock for $55 per share. The stock paid a quarterly dividend of $0.25 per share.

How much (in $) did the investor earn on this investment and, assuming the investor is in the 33%

tax bracket, how much will she pay in income taxes on this transaction? Assume a preferential tax rate

of 15% on dividends and capital gains.

The amount (before taxes) the investor earned on this investment is $

(Round to the nearest dollar.)

Assuming a preferential tax rate of 15%, the amount she will pay in income taxes on this transaction is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT