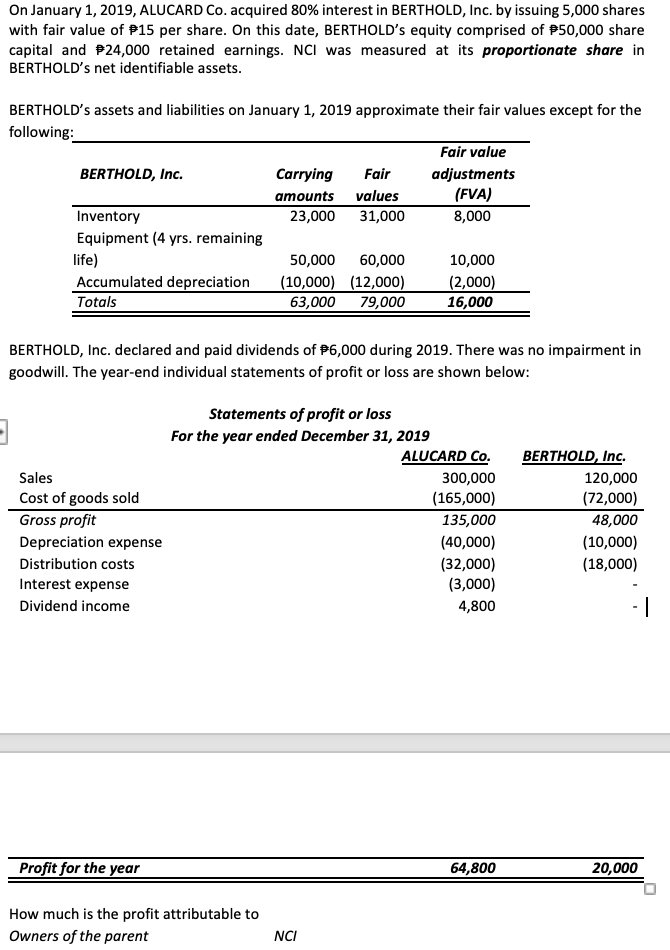

On January 1, 2019, ALUCARD Co. acquired 80% interest in BERTHOLD, Inc. by issuing 5,000 shares with fair value of P15 per share. On this date, BERTHOLD's equity comprised of P50,000 share capital and P24,000 retained earnings. NCI was measured at its proportionate share in BERTHOLD's net identifiable assets. BERTHOLD's assets and liabilities on January 1, 2019 approximate their fair values except for the following: Fair value Carrying Fair adjustments (FVA) BERTHOLD, Inc. amounts values Inventory 23,000 31,000 8,000 Equipment (4 yrs. remaining life) 50,000 60,000 10,000 Accumulated depreciation (10,000) (12,000) 63,000 (2,000) 16,000 Totals 79,000 BERTHOLD, Inc. declared and paid dividends of P6,000 during 2019. There was no impairment in goodwill. The year-end individual statements of profit or loss are shown below: Statements of profit or loss For the year ended December 31, 2019 ALUCARD Co. BERTHOLD, Inc. Sales 300,000 120,000 Cost of goods sold (165,000) (72,000) Gross profit 135,000 48,000 Depreciation expense (40,000) (32,000) (3,000) (10,000) Distribution costs (18,000) Interest expense - | Dividend income 4,800 Profit for the year 64,800 20,000 How much is the profit attributable to Owners of the parent NCI

On January 1, 2019, ALUCARD Co. acquired 80% interest in BERTHOLD, Inc. by issuing 5,000 shares with fair value of P15 per share. On this date, BERTHOLD's equity comprised of P50,000 share capital and P24,000 retained earnings. NCI was measured at its proportionate share in BERTHOLD's net identifiable assets. BERTHOLD's assets and liabilities on January 1, 2019 approximate their fair values except for the following: Fair value Carrying Fair adjustments (FVA) BERTHOLD, Inc. amounts values Inventory 23,000 31,000 8,000 Equipment (4 yrs. remaining life) 50,000 60,000 10,000 Accumulated depreciation (10,000) (12,000) 63,000 (2,000) 16,000 Totals 79,000 BERTHOLD, Inc. declared and paid dividends of P6,000 during 2019. There was no impairment in goodwill. The year-end individual statements of profit or loss are shown below: Statements of profit or loss For the year ended December 31, 2019 ALUCARD Co. BERTHOLD, Inc. Sales 300,000 120,000 Cost of goods sold (165,000) (72,000) Gross profit 135,000 48,000 Depreciation expense (40,000) (32,000) (3,000) (10,000) Distribution costs (18,000) Interest expense - | Dividend income 4,800 Profit for the year 64,800 20,000 How much is the profit attributable to Owners of the parent NCI

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 8RE: On January 2, 2019, Brust Corporation grants its new CFO 2,000 restricted share units. Each of the...

Related questions

Question

Transcribed Image Text:On January 1, 2019, ALUCARD Co. acquired 80% interest in BERTHOLD, Inc. by issuing 5,000 shares

with fair value of P15 per share. On this date, BERTHOLD's equity comprised of P50,000 share

capital and P24,000 retained earnings. NCI was measured at its proportionate share in

BERTHOLD's net identifiable assets.

BERTHOLD's assets and liabilities on January 1, 2019 approximate their fair values except for the

following:

Fair value

Carrying

Fair

adjustments

(FVA)

8,000

BERTHOLD, Inc.

атоunts

values

Inventory

23,000

31,000

Equipment (4 yrs. remaining

life)

Accumulated depreciation

Totals

50,000

60,000

10,000

(10,000) (12,000)

63,000

(2,000)

16,000

79,000

BERTHOLD, Inc. declared and paid dividends of P6,000 during 2019. There was no impairment in

goodwill. The year-end individual statements of profit or loss are shown below:

Statements of profit or loss

For the year ended December 31, 2019

ALUCARD Co.

BERTHOLD, Inc.

Sales

300,000

(165,000)

120,000

Cost of goods sold

(72,000)

Gross profit

135,000

48,000

Depreciation expense

(40,000)

(10,000)

Distribution costs

(32,000)

(3,000)

(18,000)

Interest expense

- |

Dividend income

4,800

Profit for the year

64,800

20,000

How much is the profit attributable to

Owners of the parent

NCI

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning