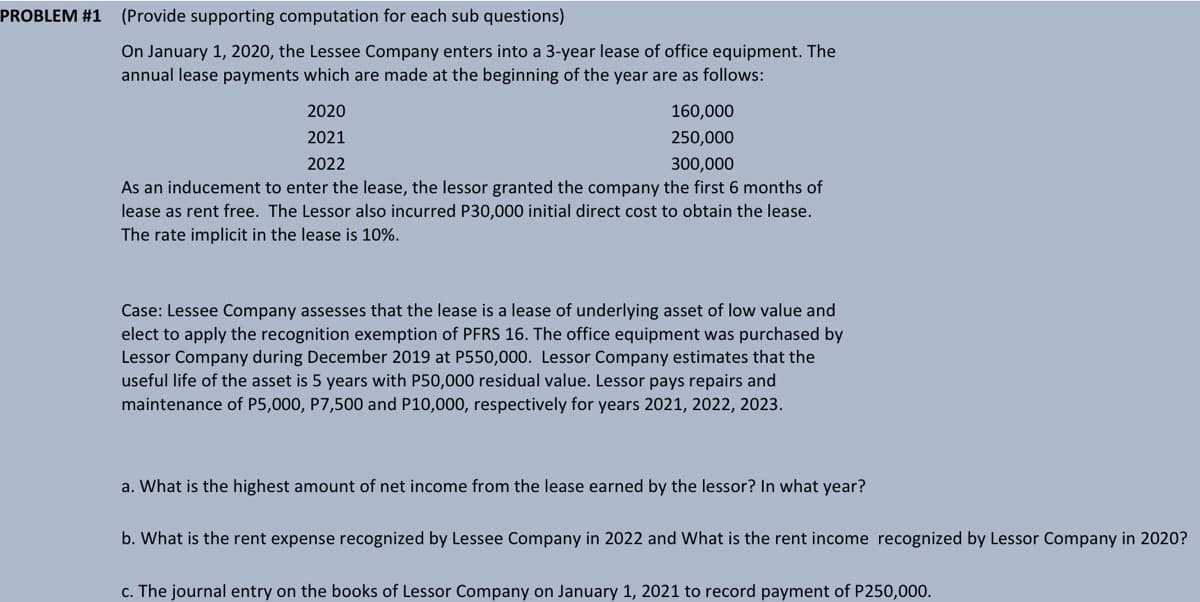

On January 1, 2020, the Lessee Company enters into a 3-year lease of office equipment. The annual lease payments which are made at the beginning of the year are as follows: 2020 160,000 2021 250,000 2022 300,000 As an inducement to enter the lease, the lessor granted the company the first 6 months of lease as rent free. The Lessor also incurred P30,000 initial direct cost to obtain the lease. The rate implicit in the lease is 10%. Case: Lessee Company assesses that the lease is a lease of underlying asset of low value and elect to apply the recognition exemption of PFRS 16. The office equipment was purchased by Lessor Company during December 2019 at P550,000. Lessor Company estimates that the useful life of the asset is 5 years with P50,000 residual value. Lessor pays repairs and maintenance of P5,000, P7,500 and P10,000, respectively for years 2021, 2022, 2023. a. What is the highest amount of net income from the lease earned by the lessor? In what year? b. What is the rent expense recognized by Lessee Company in 2022 and What is the rent income recognized by Lessor Company in 2020? c. The journal entry on the books of Lessor Company on January 1, 2021 to record payment of P250,000.

On January 1, 2020, the Lessee Company enters into a 3-year lease of office equipment. The annual lease payments which are made at the beginning of the year are as follows: 2020 160,000 2021 250,000 2022 300,000 As an inducement to enter the lease, the lessor granted the company the first 6 months of lease as rent free. The Lessor also incurred P30,000 initial direct cost to obtain the lease. The rate implicit in the lease is 10%. Case: Lessee Company assesses that the lease is a lease of underlying asset of low value and elect to apply the recognition exemption of PFRS 16. The office equipment was purchased by Lessor Company during December 2019 at P550,000. Lessor Company estimates that the useful life of the asset is 5 years with P50,000 residual value. Lessor pays repairs and maintenance of P5,000, P7,500 and P10,000, respectively for years 2021, 2022, 2023. a. What is the highest amount of net income from the lease earned by the lessor? In what year? b. What is the rent expense recognized by Lessee Company in 2022 and What is the rent income recognized by Lessor Company in 2020? c. The journal entry on the books of Lessor Company on January 1, 2021 to record payment of P250,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6E: Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on...

Related questions

Question

100%

Transcribed Image Text:PROBLEM #1

(Provide supporting computation for each sub questions)

On January 1, 2020, the Lessee Company enters into a 3-year lease of office equipment. The

annual lease payments which are made at the beginning of the year are as follows:

2020

160,000

2021

250,000

2022

300,000

As an inducement to enter the lease, the lessor granted the company the first 6 months of

lease as rent free. The Lessor also incurred P30,000 initial direct cost to obtain the lease.

The rate implicit in the lease is 10%.

Case: Lessee Company assesses that the lease is a lease of underlying asset of low value and

elect to apply the recognition exemption of PFRS 16. The office equipment was purchased by

Lessor Company during December 2019 at P550,000. Lessor Company estimates that the

useful life of the asset is 5 years with P50,000 residual value. Lessor pays repairs and

maintenance of P5,000, P7,500 and P10,000, respectively for years 2021, 2022, 2023.

a. What is the highest amount of net income from the lease earned by the lessor? In what year?

b. What is the rent expense recognized by Lessee Company in 2022 and What is the rent income recognized by Lessor Company in 2020?

c. The journal entry on the books of Lessor Company on January 1, 2021 to record payment of P250,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning