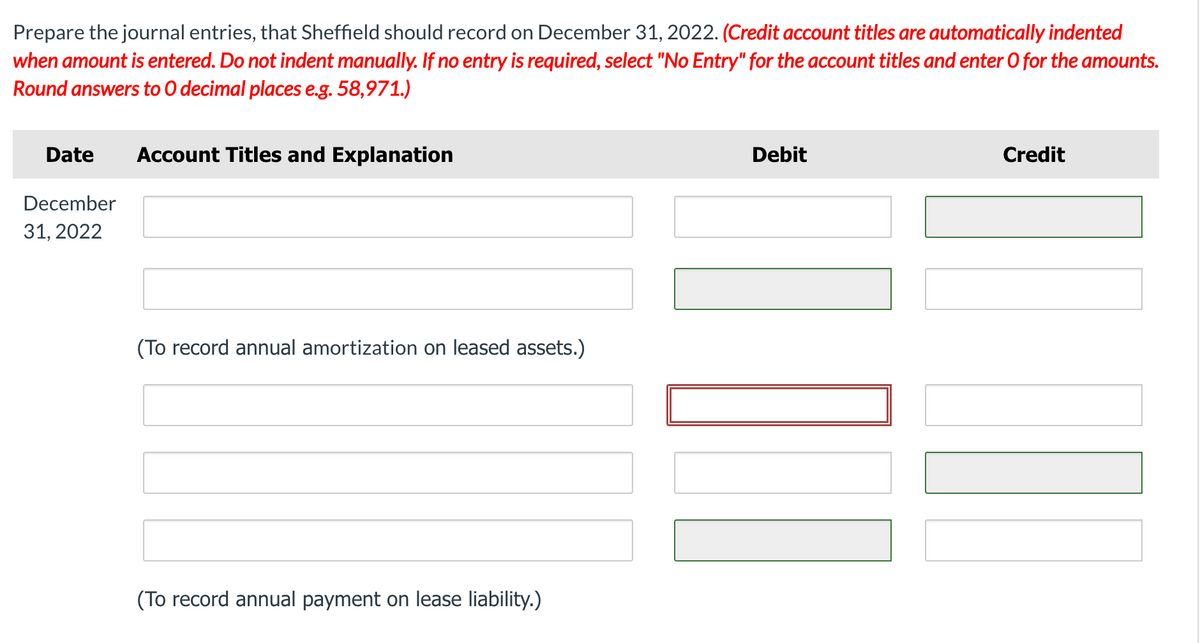

Sheffield Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $53,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 7%; Sheffield’s incremental borrowing rate is 9%. Sheffield is unaware of the rate being used by the lessor. At the end of the lease, Sheffield has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Sheffield uses the straight-line method of depreciation on similar owned equipment

Sheffield Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $53,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 7%; Sheffield’s incremental borrowing rate is 9%. Sheffield is unaware of the rate being used by the lessor. At the end of the lease, Sheffield has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Sheffield uses the straight-line method of

Trending now

This is a popular solution!

Step by step

Solved in 4 steps