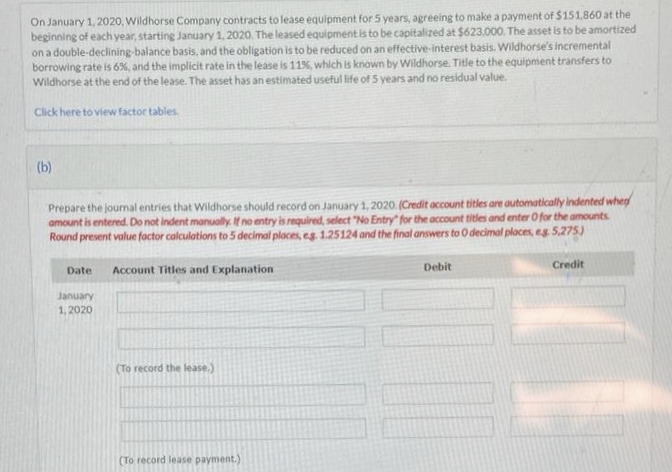

On January 1, 2020, Wildhorse Company contracts to lease equipment for 5 years, agreeing to make a payment of $151,860 at the beginning of each year, starting January 1, 2020. The leased equipment is to be capitalized at $623,000. The asset is to be amortized on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Wildhorse's incremental borrowing rate is 6%, and the implicit rate in the lease is 11%, which is known by Wildhorse. Title to the equipment transfers to Wildhorse at the end of the lease. The asset has an estimated useful life of 5 years and no residual value. Click here to view factor tables. (b) Prepare the journal entries that Wildhorse should record on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to 0 decimal places, eg. 5,275) Date January 1, 2020 Account Titles and Explanation (To record the lease.) (To record lease payment.) Debit Credit

On January 1, 2020, Wildhorse Company contracts to lease equipment for 5 years, agreeing to make a payment of $151,860 at the beginning of each year, starting January 1, 2020. The leased equipment is to be capitalized at $623,000. The asset is to be amortized on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Wildhorse's incremental borrowing rate is 6%, and the implicit rate in the lease is 11%, which is known by Wildhorse. Title to the equipment transfers to Wildhorse at the end of the lease. The asset has an estimated useful life of 5 years and no residual value. Click here to view factor tables. (b) Prepare the journal entries that Wildhorse should record on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to 0 decimal places, eg. 5,275) Date January 1, 2020 Account Titles and Explanation (To record the lease.) (To record lease payment.) Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 4P: Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides...

Related questions

Question

100%

Please help me

Transcribed Image Text:On January 1, 2020, Wildhorse Company contracts to lease equipment for 5 years, agreeing to make a payment of $151,860 at the

beginning of each year, starting January 1, 2020. The leased equipment is to be capitalized at $623,000. The asset is to be amortized

on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Wildhorse's incremental

borrowing rate is 6%, and the implicit rate in the lease is 11%, which is known by Wildhorse. Title to the equipment transfers to

Wildhorse at the end of the lease. The asset has an estimated useful life of 5 years and no residual value.

Click here to view factor tables.

(b)

Prepare the journal entries that Wildhorse should record on January 1, 2020. (Credit account titles are automatically indented when

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts

Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to 0 decimal places, e.g. 5,275)

Date

January

1,2020

Account Titles and Explanation

(To record the lease.)

(To record lease payment.)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning