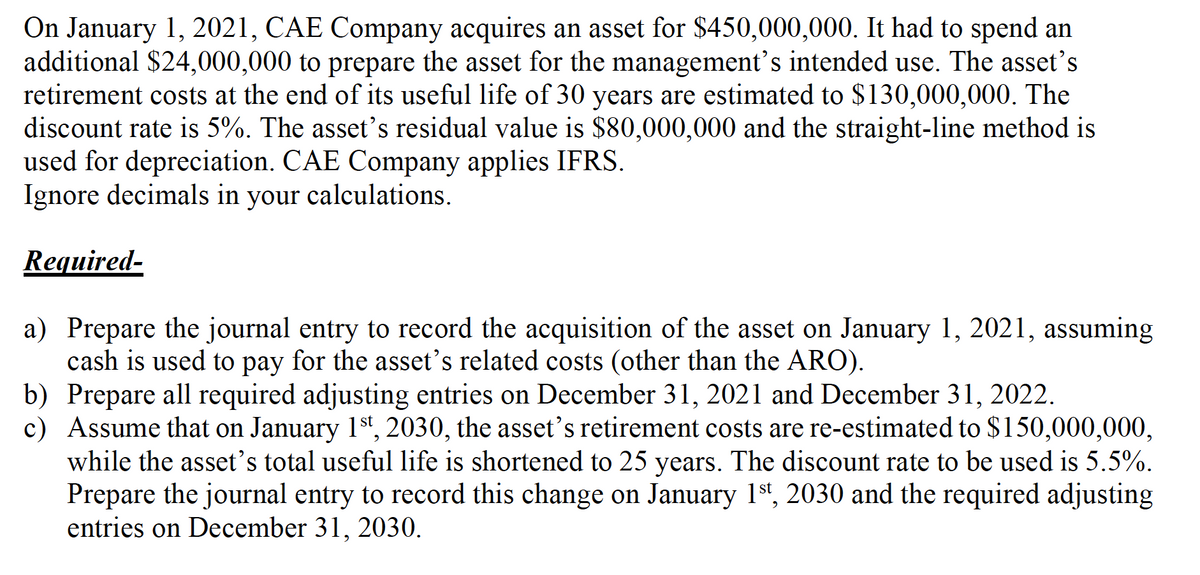

On January 1, 2021, CAE Company acquires an asset for $450,000,000. It had to spend an additional $24,000,000 to prepare the asset for the management’s intended use. The asset's retirement costs at the end of its useful life of 30 years are estimated to $130,000,000. The discount rate is 5%. The asset's residual value is $80,000,000 and the straight-line method is used for depreciation. CAE Company applies IFRS. Ignore decimals in your calculations. Required- a) Prepare the journal entry to record the acquisition of the asset on January 1, 2021, assuming cash is used to pay for the asset's related costs (other than the ARO). b) Prepare all required adjusting entries on December 31, 2021 and December 31, 2022. c) Assume that on January 1st, 2030, the asset's retirement costs are re-estimated to $150,000,000, while the asset's total useful life is shortened to 25 years. The discount rate to be used is 5.5%. Prepare the journal entry to record this change on January 1st, 2030 and the required adjusting entries on December 31, 2030.

On January 1, 2021, CAE Company acquires an asset for $450,000,000. It had to spend an additional $24,000,000 to prepare the asset for the management’s intended use. The asset's retirement costs at the end of its useful life of 30 years are estimated to $130,000,000. The discount rate is 5%. The asset's residual value is $80,000,000 and the straight-line method is used for depreciation. CAE Company applies IFRS. Ignore decimals in your calculations. Required- a) Prepare the journal entry to record the acquisition of the asset on January 1, 2021, assuming cash is used to pay for the asset's related costs (other than the ARO). b) Prepare all required adjusting entries on December 31, 2021 and December 31, 2022. c) Assume that on January 1st, 2030, the asset's retirement costs are re-estimated to $150,000,000, while the asset's total useful life is shortened to 25 years. The discount rate to be used is 5.5%. Prepare the journal entry to record this change on January 1st, 2030 and the required adjusting entries on December 31, 2030.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14P: Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used...

Related questions

Question

Transcribed Image Text:On January 1, 2021, CAE Company acquires an asset for $450,000,000. It had to spend an

additional $24,000,000 to prepare the asset for the management's intended use. The asset's

retirement costs at the end of its useful life of 30 years are estimated to $130,000,000. The

discount rate is 5%. The asset's residual value is $80,000,000 and the straight-line method is

used for depreciation. CAE Company applies IFRS.

Ignore decimals in your calculations.

Required-

a) Prepare the journal entry to record the acquisition of the asset on January 1, 2021, assuming

cash is used to pay for the asset's related costs (other than the ARO).

b) Prepare all required adjusting entries on December 31, 2021 and December 31, 2022.

c) Assume that on January 1st, 2030, the asset's retirement costs are re-estimated to $150,000,000,

while the asset's total useful life is shortened to 25 years. The discount rate to be used is 5.5%.

Prepare the journal entry to record this change on January 1st, 2030 and the required adjusting

entries on December 31, 2030.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning