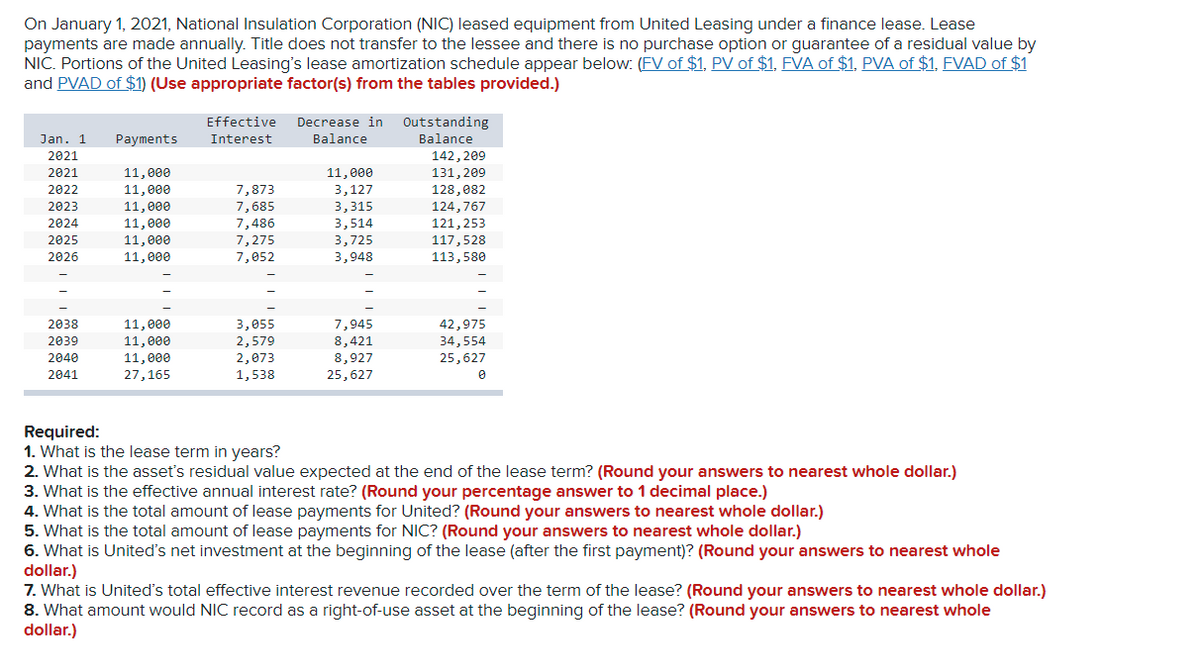

On January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing's lease amortization schedule appear below: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Effective Decrease in Outstanding Intonoct Ralanc. Palanco

On January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by NIC. Portions of the United Leasing's lease amortization schedule appear below: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Effective Decrease in Outstanding Intonoct Ralanc. Palanco

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 8RE: Use the following information to decide whether this equipment lease qualifies as an operating,...

Related questions

Question

ONLY NEED ASSISTANCE WITH NUMBER 8, What amount would NIC record as a right-of-use asset at the beginning of the lease?

Transcribed Image Text:On January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease

payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by

NIC. Portions of the United Leasing's lease amortization schedule appear below: (FV of $1, PV of $1, FVA of $1, PVA of $1. FVAD of $1

and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Effective

Decrease in

Outstanding

Jan. 1

Payments

Interest

Balance

Balance

2021

142,209

2021

11,000

11,000

131,209

2022

11,000

7,873

3,127

128,082

3,315

3,514

3,725

2023

11,000

7,685

124,767

7,486

7,275

121,253

117,528

113,580

2024

11,000

2025

11,000

2026

11,000

7,052

3,948

11,000

11,000

11,000

27,165

3,055

2,579

2,073

42,975

34,554

2038

7,945

2039

2040

8,421

8,927

25,627

2041

1,538

25,627

Required:

1. What is the lease term in years?

2. What is the asset's residual value expected at the end of the lease term? (Round your answers to nearest whole dollar.)

3. What is the effective annual interest rate? (Round your percentage answer to 1 decimal place.)

4. What is the total amount of lease payments for United? (Round your answers to nearest whole dollar.)

5. What is the total amount of lease payments for NIC? (Round your answers to nearest whole dollar.)

6. What is United's net investment at the beginning of the lease (after the first payment)? (Round your answers to nearest whole

dollar.)

7. What is United's total effective interest revenue recorded over the term of the lease? (Round your answers to nearest whole dollar.)

8. What amount would NIC record as a right-of-use asset at the beginning of the lease? (Round your answers to nearest whole

dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning