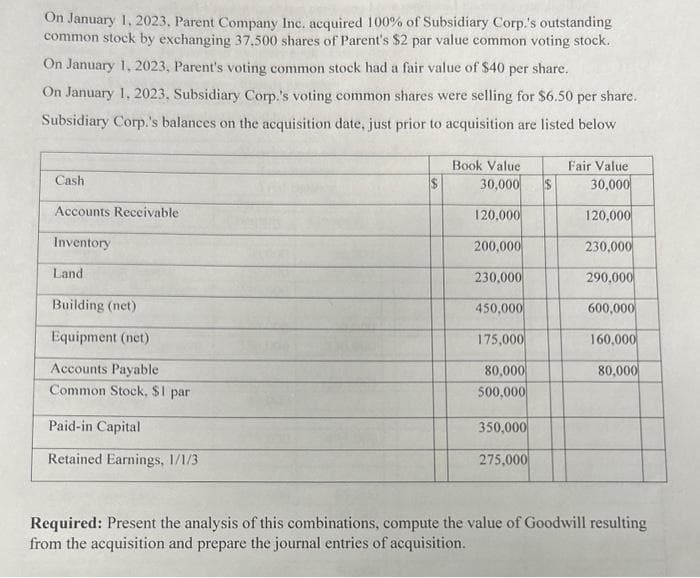

On January 1, 2023. Parent Company Inc. acquired 100% of Subsidiary Corp.'s outstanding common stock by exchanging 37,500 shares of Parent's $2 par value common voting stock. On January 1, 2023, Parent's voting common stock had a fair value of $40 per share. On January 1, 2023, Subsidiary Corp.'s voting common shares were selling for $6.50 per share. Subsidiary Corp.'s balances on the acquisition date, just prior to acquisition are listed below Cash Accounts Receivable Inventory Land Building (net) Equipment (net) Accounts Payable Common Stock, $1 par Paid-in Capital Retained Earnings, 1/1/3 Book Value 30,000 $ 120,000 200,000 230,000 450,000 175,000 80,000 500,000 350,000 275,000 Fair Value 30,000 120,000 230,000 290,000 600,000 160,000 80,000 Required: Present the analysis of this combinations, compute the value of Goodwill resulting from the acquisition and prepare the journal entries of acquisition.

On January 1, 2023. Parent Company Inc. acquired 100% of Subsidiary Corp.'s outstanding common stock by exchanging 37,500 shares of Parent's $2 par value common voting stock. On January 1, 2023, Parent's voting common stock had a fair value of $40 per share. On January 1, 2023, Subsidiary Corp.'s voting common shares were selling for $6.50 per share. Subsidiary Corp.'s balances on the acquisition date, just prior to acquisition are listed below Cash Accounts Receivable Inventory Land Building (net) Equipment (net) Accounts Payable Common Stock, $1 par Paid-in Capital Retained Earnings, 1/1/3 Book Value 30,000 $ 120,000 200,000 230,000 450,000 175,000 80,000 500,000 350,000 275,000 Fair Value 30,000 120,000 230,000 290,000 600,000 160,000 80,000 Required: Present the analysis of this combinations, compute the value of Goodwill resulting from the acquisition and prepare the journal entries of acquisition.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

Please don't give image based answer..thanku

Transcribed Image Text:On January 1, 2023, Parent Company Inc. acquired 100% of Subsidiary Corp.'s outstanding

common stock by exchanging 37,500 shares of Parent's $2 par value common voting stock.

On January 1, 2023, Parent's voting common stock had a fair value of $40 per share.

On January 1, 2023, Subsidiary Corp.'s voting common shares were selling for $6.50 per share.

Subsidiary Corp.'s balances on the acquisition date, just prior to acquisition are listed below

Cash

Accounts Receivable

Inventory

Land

Building (net)

Equipment (net)

Accounts Payable

Common Stock, $1 par

Paid-in Capital

Retained Earnings, 1/1/3

$

Book Value

30,000

120,000

200,000

230,000

450,000

175,000

80,000

500,000

350,000

275,000

Fair Value

30,000

120,000

230,000

290,000

600,000

160,000

80,000

Required: Present the analysis of this combinations, compute the value of Goodwill resulting

from the acquisition and prepare the journal entries of acquisition.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning