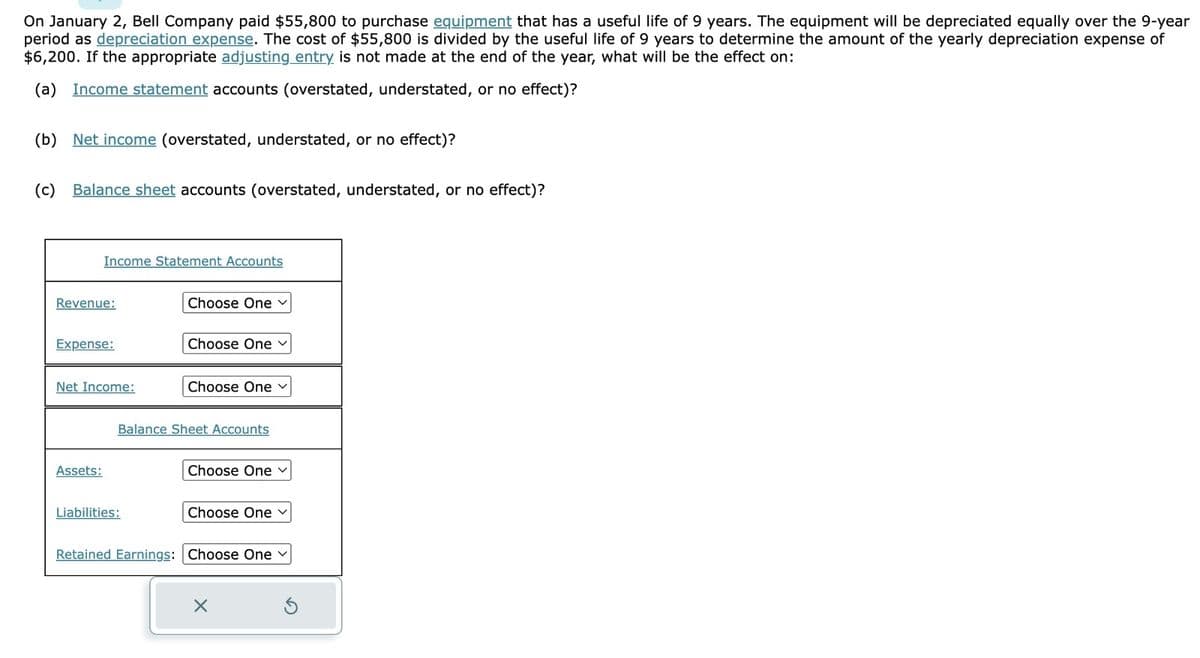

On January 2, Bell Company paid $55,800 to purchase equipment that has a useful life of 9 years. The equipment will be depreciated equally over the 9-year period as depreciation expense. The cost of $55,800 is divided by the useful life of 9 years to determine the amount of the yearly depreciation expense of $6,200. If the appropriate adjusting entry is not made at the end of the year, what will be the effect on: (a) Income statement accounts (overstated, understated, or no effect)? (b) Net income (overstated, understated, or no effect)? (c) Balance sheet accounts (overstated, understated, or no effect)?

On January 2, Bell Company paid $55,800 to purchase equipment that has a useful life of 9 years. The equipment will be depreciated equally over the 9-year period as depreciation expense. The cost of $55,800 is divided by the useful life of 9 years to determine the amount of the yearly depreciation expense of $6,200. If the appropriate adjusting entry is not made at the end of the year, what will be the effect on: (a) Income statement accounts (overstated, understated, or no effect)? (b) Net income (overstated, understated, or no effect)? (c) Balance sheet accounts (overstated, understated, or no effect)?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 5MC: During 2019, White Company determined that machinery previously depreciated over a 7-year life had a...

Related questions

Question

Owe

Subject: acounting

Transcribed Image Text:On January 2, Bell Company paid $55,800 to purchase equipment that has a useful life of 9 years. The equipment will be depreciated equally over the 9-year

period as depreciation expense. The cost of $55,800 is divided by the useful life of 9 years to determine the amount of the yearly depreciation expense of

$6,200. If the appropriate adjusting entry is not made at the end of the year, what will be the effect on:

(a) Income statement accounts (overstated, understated, or no effect)?

(b) Net income (overstated, understated, or no effect)?

(c) Balance sheet accounts (overstated, understated, or no effect)?

Income Statement Accounts

Revenue:

Expense:

Net Income:

Assets:

Choose One ✓

Liabilities:

Choose One

Choose One

Balance Sheet Accounts

Choose One

Choose One ✓

Retained Earnings: Choose One

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage