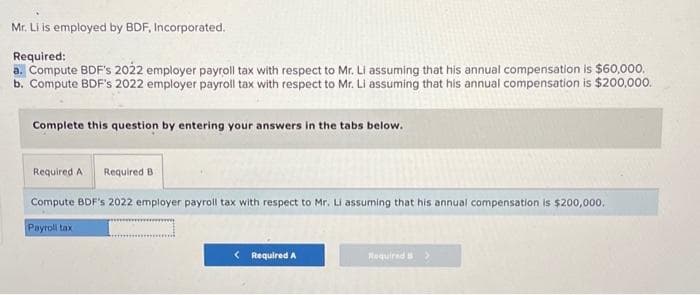

Mr. Li is employed by BDF, Incorporated

Q: 1. Use the following information about the company's adjustments to complete a 10-column work sheet.…

A: Worksheet is a 10 column calculatiion, in which we show unadjusted balances, adjusted balances and…

Q: Thornton Company sells lamps and other lighting fixtures. The purchasing department manager prepared…

A: Inventory purchase budget is used for estimating the required amount of purchases so that the…

Q: Bryant Company reports net income of $22,200. For the year, depreciation expense is $9,200 and the…

A: Cash flow statement :— It is one of the financial statement that shows change in cash and cash…

Q: Prior to revaluation to fair value at 30 June 2009 the balance in Thunder's asset revaluation…

A: The assets under IAS 16, are recognized in the books as per revaluation or cost basis. The…

Q: IC Co is a shop that sells ice-creams and cakes. The following information relates to the year 20X6:…

A: Activity-Based Costing (ABC) is a costing method used by businesses to allocate indirect costs to…

Q: An entity reported the following equity on December 31, 2023: Ordinary share capital, P25 par value,…

A: To determine the amount of ordinary share capital that should be reported on December 31, 2023, we…

Q: Required information [The following information applies to the questions displayed below.] The…

A: The balance sheet is one of the financial statement of the business. The balance sheet represents…

Q: Required: 1. What is the monthly break-even point in unit sales and in dollar sales? 2. Without…

A: The following basic information as follows under:-Break-even point point means, where no profit or…

Q: Ramos Company has the following unit costs: Variable manufacturing overhead Direct materials Direct…

A: Absorption costing considers fixed manufacturing overheadas cost of production were as variable…

Q: Russel Company is a consulting firm. The firm expects to have $34,400 in indirect costs during the…

A: Labor cost is the amount of cost incurred on the wage payment to the laborers. It could be direct or…

Q: During its first year of operations, Bridgeport Corporation had the following transactions…

A: Lets understand the basics.Journal entry is required to make to record event and transaction happens…

Q: Analyze Dollar General Dollar General Corporation (DG) is a discount retailer with more than 12,000…

A: Assets turnover = Total sales / average accounts receivable

Q: . Lita Lopez invested $70,000 cash and equipment valued at $34,000 in the company in exchange for…

A: The accounting equation is based on the principle of double-entry bookkeeping, which ensures that…

Q: a. Outstanding checks, $670. b. Deposits in transit, $1,500. C. NSF check from customer, no. 548,…

A: Bank reconciliation is the process of comparing and matching the balances in a company's bank…

Q: Leach Incorporated experienced the following events for the first two years of its operations.…

A: Financial statements are prepared at the end of an accounting period. First of all, all the…

Q: 5. Assuming that the company has made optimal use of its 94,310 direct labor-hours, what is the…

A: Highest price = Regular rate of direct labor per hour + Contribution margin per hour of mike

Q: Optimal Capital Structure with Hamada Beckman Engineering and Associates (BEA) is considering a…

A: Capital structure refers to the combination of the values of debt and equity used for financing the…

Q: Support your computations with relevant explanations.

A: Certainly! Here's a brief explanation of why certain items were included or excluded when…

Q: cash and a machine to another com

A: Journal entry refers to recording of the transactions of the business into the books of accounts and…

Q: Required information [The following information applies to the questions displayed below.] The…

A: The debt ratio indicates the rate of debt percentage in comparison to the total assets of the…

Q: If company A has a higher degree of operating leverage than company B, then which of the following…

A: Variable expenses are those costs that occur in proportionate to the units produced or revenue…

Q: On December 1, 2023, Old World Deli signed a $300,000, 6% annual interest rate, six month note…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: On July 1, 2024, Wildhorse Inc. enters into a contract with Kreighton Limited to supply $23,200 of…

A: According to the question given, we need to prepare the journal entries.Journal entries:Journal…

Q: Novak Architects incorporated as licensed architects on April 1, 2025. During the first month of the…

A: Answer:- Trail balance meaning:- An accounting document known as a "trail balance" lists the current…

Q: When using a periodic inventory system and the purchaser directly incurs the freight costs, which…

A: A periodic inventory system updates the inventory data on a regular basis, usually at the conclusion…

Q: Sante Fe Corporation's sales office and manufacturing plant are located in State A. Sante Fe also…

A: When total compensation paid in a State during the income year by the organization is divided by the…

Q: On June 1, 2023, JetCom Inventors Inc. Issued December 1, 2023. Required: a Calculate the issue…

A: The Effective Interest Method is a common approach used to amortize the discount or premium on a…

Q: When you undertook the preparation of the financial statements for Telfer Company at December 31,…

A: Ending inventory using conventional retail method is calculated by multiplying the ratio of cost to…

Q: The following information is related to Bramble Real Estate Agency. Oct. 1 Diane Lexington begins…

A: Journal entries are used by the management to record the transactions in the books of accounts.…

Q: Lois Bragg owns a small restaurant in Boston. Ms. Bragg provided her accountant with the following…

A: Loans involve an agreement between the lender and the borrower, outlining the terms and conditions…

Q: A taxpayer filing as Single has $25,600 of taxable income. Included in gross income is a 1099-INT…

A: Interest income that is subject to income tax is referred to as taxable interest. It covers the…

Q: The conceptual framework indicates the desired fundamental and enhancing qualitative characteristics…

A: No.Characteristics/ constraintsExplanation1.MaterialityAs it is a large company and the amount of…

Q: Given below are the base salaries and commions for 5 employees of your company. Identity which…

A: Commission paid to employees is generally based on Sales. It is calculated on a percentage basis,…

Q: Discussion Forum Question: As a decision- maker, what are the major differences between managerial…

A: Managerial accounting is the presenting of financial facts to management for internal use in making…

Q: Toxaway Company is a merchandiser that segments its business into two divisions-Commercial and…

A: The breakeven point is considered as that point of sales level at which the entity neither earns any…

Q: Trade creditors Returns out Provision for doubtful debts Discounts allowed Discounts received…

A: The trading and profit and loss account of the company displays all revenues and Costs, and at the…

Q: Novak Corp. is planning to replace an old asset with new equipment that will operate more…

A: Capital Budgeting decision related to the acquisition and disposal of assets used in the business…

Q: The debits to Work in Process-Roasting Department for Morning Brew Coffee Company for August,…

A: Under…

Q: Determining Market-Based and Negotiated Transfer Prices Carreker, Inc., has a number of divisions,…

A: Transfer Pricing is a price at which the organization transfer their services to other division. It…

Q: Sheridan Supply Co. has the following transactions related to notes receivable during the last 2…

A: Journal entry is used to record day to day transactions in books of accounts. Journal entry is the…

Q: A business has the following in it: - Land 750 000 - Machinery 40 000 - Cash 10 000 - Owner's…

A: Answer:- Creditor meaning:- An individual or organization that offers credit typically through a…

Q: 1. What is the change in net working capital from 2014 to 2015? 2. What is the net capital spending…

A: A net change in capital spending is determined by the company so that it can be known about the…

Q: Subject : - Accounting Rachel receives employer provided health insurance. The employer's cost of…

A: The employers provide multiple benefits and perks to the employees. These perks and benefits…

Q: Stock Y has a beta of 1.2 and an expected return of 14.5 percent. Stock Z has a beta of .7 and an…

A: In this question, we will calculate the correct answer for the reward-risk ratios for the stocks y…

Q: Assume that a company has two cost drivers-number of courses and number of students. The planned…

A: ACTIVITY BASED COSTING Activity Based Costing is a Powerful tool for measuring…

Q: What is the expected added profit from the Challenger line? Challenger Bikes Selling Price per Unit…

A: Contribution Margin is defined as what revenue is left with the firm after deduction of its Variable…

Q: Determine the amounts that should be debited to Land, to Buildings, and to Machinery and Equipment.…

A: Long term assets are those assets are those assets which is used for a long time or more than one…

Q: E9-22 Recording partial-year depreciation and sale of an asset Learning Objectives 2, 3 Depr. Exp.…

A: Depreciation is referred as the declining value of the assets such as plant, machinery, furniture…

Q: Marc Goudreau, administrator of Clearwater Hospital, was puzzled by the prior month's reports.…

A: Since you have posted a question multiple sub-parts, as per the guidelines only the first three…

Q: Waterway Out Company manufactures its product, Vitadrink, through two manufacturing processes:…

A: Journal Entry :—Journal entry consists of all the business financial transactions. They are recorded…

vd

subject-Accounting

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- How do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.During 2019, Matti Conner, president of Maggert Company, was paid a semimonthly salary of 6,000. Compute the amount of FICA taxes that should be withheld from her:During the year, employee Sean Matthews earned wages in the amount of 250,000. Discuss how the employees HI tax will differ from the employers HI tax for this employee.

- For tax purposes, assume that the maximum taxable earnings are 118,500 for Social Security and 7,000 for the unemployment tax and that all earnings are taxable for Medicare. For the payroll register for the month of November for Shelby, Inc., determine the taxable earnings for each employee.Troy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Tray is a full-time employee of the corporation and receives a salary of 60,000 per year. He also receives a bonus equal to 10% of all collections from diems he serviced during the year. Determine the tax consequences of the following events to the corporation and to Troy: a. On December 31, 2019, Troy was visiting a customer. The customer gave Troy a 10,000 check payable to the corporation for appraisal services Troy performed during 2019. Troy did not deliver the check to the corporation until January 2020. b. The facts are the same as in part (a), except that the corporation is an accrual basis taxpayer and Troy deposited the check on December 31, but the bank did not add the deposit to the corporations account until January 2020. c. The facts are the same as in part (a), except that the customer told Troy to hold the check until January 2020 when the customer could make a bank deposit that would cover the check.LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on its estimated state income tax for the year. During 2019, the company received a 4,000 refund upon filing its 2018 state income tax return. The company filed its 2019 state income tax return in August 2020 and paid the 7,000 state income tax due for 2019. In December 2019, the company received a notice from the state tax commission that an additional 6,000 of income tax was due for 2017 because of an error on the return. The company acknowledged the error in December 2019 and paid the additional 6,000 in tax in February 2020. What is Ospreys 2019 Federal income tax deduction for state income taxes?