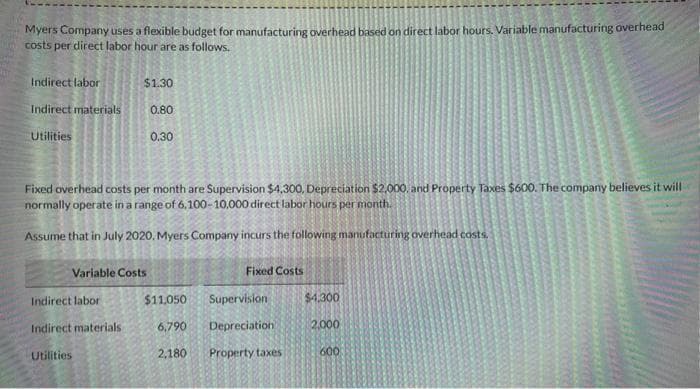

Myers Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. Indirect labor Indirect materials Utilities $1.30 Indirect labor Indirect materials Utilities Fixed overhead costs per month are Supervision $4,300, Depreciation $2,000, and Property Taxes $600. The company believes it will normally operate in a range of 6.100-10,000 direct labor hours per month. Assume that in July 2020, Myers Company incurs the following manufacturing overhead costs. Variable Costs 0.80 0.30 Fixed Costs $11,050 Supervision 6,790 Depreciation 2,180 Property taxes $4,300 2,000 600

Myers Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. Indirect labor Indirect materials Utilities $1.30 Indirect labor Indirect materials Utilities Fixed overhead costs per month are Supervision $4,300, Depreciation $2,000, and Property Taxes $600. The company believes it will normally operate in a range of 6.100-10,000 direct labor hours per month. Assume that in July 2020, Myers Company incurs the following manufacturing overhead costs. Variable Costs 0.80 0.30 Fixed Costs $11,050 Supervision 6,790 Depreciation 2,180 Property taxes $4,300 2,000 600

Chapter7: Budgeting

Section: Chapter Questions

Problem 3PB: TIB makes custom guitars and prepared the following sales budget for the second quarter It also has...

Related questions

Question

Please help me to solve this problem

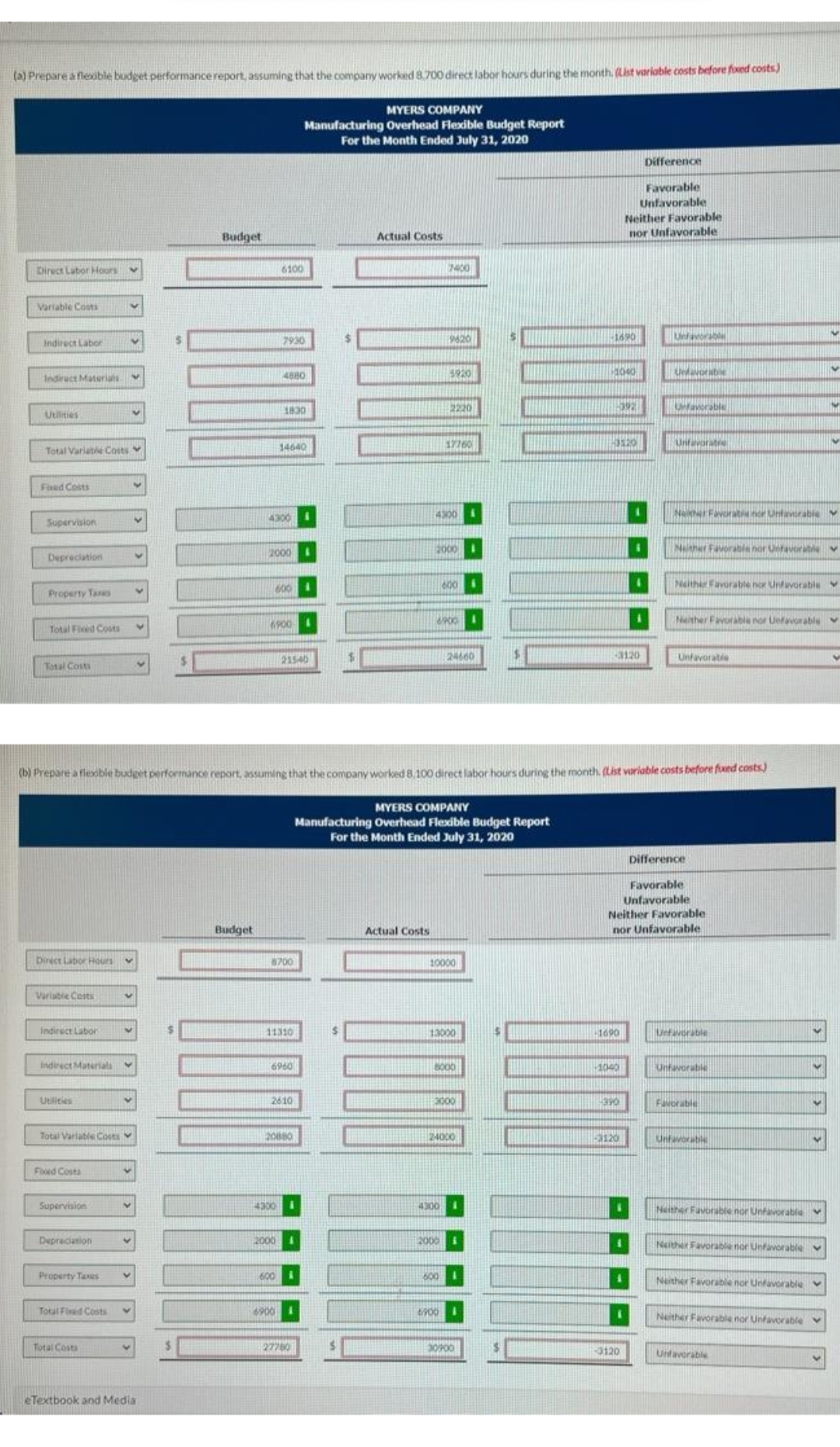

Transcribed Image Text:(a) Prepare a flexible budget performance report, assuming that the company worked 8.700 direct labor hours during the month. (List variable costs before fixed costs)

Direct Labor Hours

Variable Costs

Indirect Labor

Indiruct Materials

Utilities

Total Variable Costs

Foxed Costs

Supervision

Depreciation

Property Taxes

Total Fixed Costs

Total Costs

Direct Labor Hours

Variable Costs

Indirect Labor

Indirect Materials

Utilities

Total Variable Costs

Fixed Costa

Supervision

Depreciation

Froperty Taxas

V

Total Fixed Costs

Total Costs

V

V

eTextbook and Media

$

Budget

S

0000

Budget

6100

7930

4300

4880

2000

1830

14640

600

6900

8700

4300

2000

600

21540

11310

MYERS COMPANY

Manufacturing Overhead Flexible Budget Report

For the Month Ended July 31, 2020

6960

2610

20880

6900 1

27780

Actual Costs

$

0000

$

Actual Costs

(b) Prepare a flexible budget performance report, assuming that the company worked 8.100 direct labor hours during the month. (List variable costs before fixed costs)

7400

0000

CODO

9620

4300

5920

2000

2220

17760

49001

600

MYERS COMPANY

Manufacturing Overhead Flexible Budget Report

For the Month Ended July 31, 2020

4300

10000

2000

600

24660

13000

6900

8000

3000

24000

I

30900

$

0000

-1690

1040

392

-3120

0000

Neither Favorable

nor Unfavorable

-1690

-1040

390

Difference

Favorable

Unfavorable

-3120

1

4

3120

A

Unfavorable

Unfavorabi

Ufavorable

Unfavoratie

Neier Favoratie nor Unfavorable M

Neither Favorable

nor Unfavorable

Neither Favorable nor Unfavorable V

Neither Favorable nor Unfavorabis

Neither Favorable nor Uefavorable v

Unfavorable

Difference

Favorable

Unfavorable

Uefavorable

Unfavorable

Favorable

Unfavorable

Neither Favorable nor Unfavorable

Neither Favorable nor Unfavorable

V

Neither Favorable nor Unfavorable v

Neither Favorable nor Unfavorable

Unfavorable

Transcribed Image Text:Myers Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead

costs per direct labor hour are as follows.

Indirect labor

Indirect materials

Utilities

$1.30

Variable Costs

Indirect labor

Indirect materials

Utilities

0.80

Fixed overhead costs per month are Supervision $4,300, Depreciation $2,000, and Property Taxes $600. The company believes it will

normally operate in a range of 6,100-10,000 direct labor hours per month.

Assume that in July 2020. Myers Company incurs the following manufacturing overhead costs.

0.30

Fixed Costs

Supervision

Depreciation

$11,050

6,790

2,180 Property taxes

$4,300

2,000

600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning