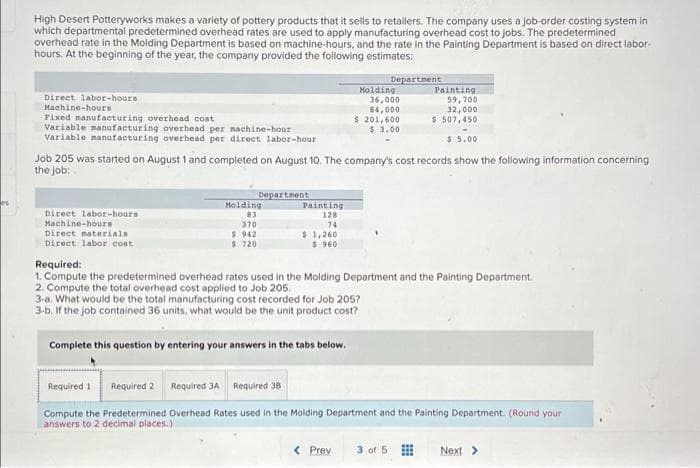

High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor- hours. At the beginning of the year, the company provided the following estimates: Department Direct labor-hours Machine-hours Molding 36,000 84,000 Painting 59,700 32,000 Fixed manufacturing overhead cost $ 507,450 $ 201,600 $ 3.00 Variable manufacturing overhead per nachine-hour Variable manufacturing overbead per direct labor-hour $ 5.00 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Department Painting Direct labor-hours Machine-hours Molding 83 370 $ 942 720 128 74 Direct materials $1,260 $ 960 Direct labor cost $ Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department. 2. Compute the total overhead cost applied to Job 205, 3-a. What would be the total manufacturing cost recorded for Job 205? 3-b. If the job contained 36 units, what would be the unit product cost? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the Predetermined Overhead Rates used in the Molding Department and the Painting Department. (Round your answers to 2 decimal places.)

High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor- hours. At the beginning of the year, the company provided the following estimates: Department Direct labor-hours Machine-hours Molding 36,000 84,000 Painting 59,700 32,000 Fixed manufacturing overhead cost $ 507,450 $ 201,600 $ 3.00 Variable manufacturing overhead per nachine-hour Variable manufacturing overbead per direct labor-hour $ 5.00 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Department Painting Direct labor-hours Machine-hours Molding 83 370 $ 942 720 128 74 Direct materials $1,260 $ 960 Direct labor cost $ Required: 1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department. 2. Compute the total overhead cost applied to Job 205, 3-a. What would be the total manufacturing cost recorded for Job 205? 3-b. If the job contained 36 units, what would be the unit product cost? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the Predetermined Overhead Rates used in the Molding Department and the Painting Department. (Round your answers to 2 decimal places.)

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter18: Activity-based Costing

Section: Chapter Questions

Problem 2PA: The management of Gwinnett County Chrome Company, described in Problem 1A, now plans to use the...

Related questions

Question

5

Transcribed Image Text:es

High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in

which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined

overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-

hours. At the beginning of the year, the company provided the following estimates:

Department

Molding

Painting.

Direct labor-hours

Machine-hours

36,000

84,000

59,700

32,000

Fixed manufacturing overhead cost

$ 507,450

$ 201,600

$ 3.00

Variable manufacturing overhead per nachine-hour

Variable manufacturing overhead per direct labor-hour

$5.00

Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning

the job:

Department

Direct labor-hours

Machine-hours

Molding

83

370

$ 942

$ 720

Painting

128

74

Direct materials

Direct labor cost

$1,260

$ 960

Required:

1. Compute the predetermined overhead rates used in the Molding Department and the Painting Department.

2. Compute the total overhead cost applied to Job 205.

3-a. What would be the total manufacturing cost recorded for Job 205?

3-b. If the job contained 36 units, what would be the unit product cost?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3A Required 38

Compute the Predetermined Overhead Rates used in the Molding Department and the Painting Department. (Round your

answers to 2 decimal places.)

< Prev

3 of 5 ⠀⠀⠀

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning