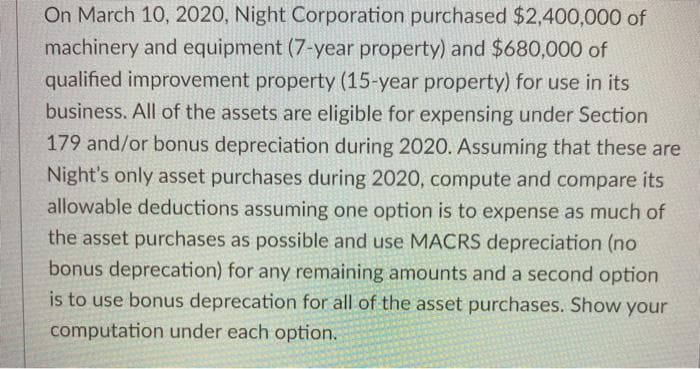

On March 10, 2020, Night Corporation purchased $2,400,000 of machinery and equipment (7-year property) and $680,000 of qualified improvement property (15-year property) for use in its business. All of the assets are eligible for expensing under Section 179 and/or bonus depreciation during 2020. Assuming that these are Night's only asset purchases during 2020, compute and compare its allowable deductions assuming one option is to expense as much of the asset purchases as possible and use MACRS depreciation (no bonus deprecation) for any remaining amounts and a second option is to use bonus deprecation for all of the asset purchases. Show your computation under each option.

On March 10, 2020, Night Corporation purchased $2,400,000 of machinery and equipment (7-year property) and $680,000 of qualified improvement property (15-year property) for use in its business. All of the assets are eligible for expensing under Section 179 and/or bonus depreciation during 2020. Assuming that these are Night's only asset purchases during 2020, compute and compare its allowable deductions assuming one option is to expense as much of the asset purchases as possible and use MACRS depreciation (no bonus deprecation) for any remaining amounts and a second option is to use bonus deprecation for all of the asset purchases. Show your computation under each option.

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 60P

Related questions

Question

If Answered within 45mins,it would be helpful!!!

Transcribed Image Text:On March 10, 2020, Night Corporation purchased $2,400,000 of

machinery and equipment (7-year property) and $680,000 of

qualified improvement property (15-year property) for use in its

business. All of the assets are eligible for expensing under Section

179 and/or bonus depreciation during 2020. Assuming that these are

Night's only asset purchases during 2020, compute and compare its

allowable deductions assuming one option is to expense as much of

the asset purchases as possible and use MACRS depreciation (no

bonus deprecation) for any remaining amounts and a second option

is to use bonus deprecation for all of the asset purchases. Show

your

computation under each option.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning