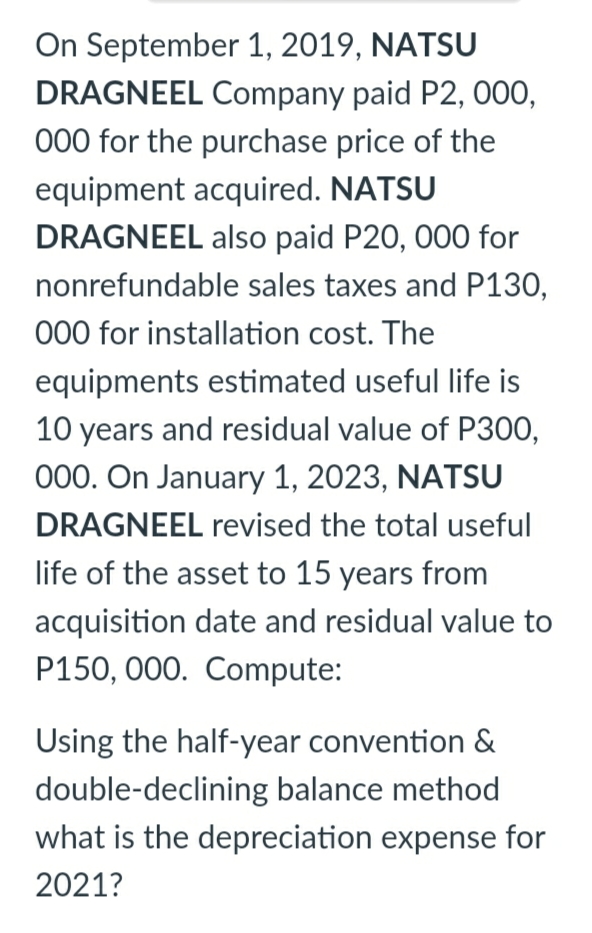

On September 1, 2019, NATSU DRAGNEEL Company paid P2, 000, 000 for the purchase price of the equipment acquired. NATSU DRAGNEEL also paid P20, 000 for nonrefundable sales taxes and P130,

Q: Lax Company at the end of 2019, its first year of operations, prepared a reconciliation between…

A: Hey, since there are multiple questions posted, we will answer first question. If you want any…

Q: 2021, Mill Corp. incurred a 100,000 net loss from disposal of a business segment. Also, on June 30,…

A: Solution: Loss from disposal of a business segment will be full included in the net income or loss…

Q: On January 1, 2020, Tom Co (A seller-lessee) sells a building to MacCo (an unrelated buyerlessor)…

A: This is a case if sale and lease back and will be covered under IFRS 15

Q: On June 30, 2021, Casio Sony Company sold a property carried in inventory at a cost of P1,894,200…

A:

Q: Discuss the implication of the transactions and state the journal entries on January 1, 2020

A:

Q: In 2019, Ulna Company borrowed P10,000,000 from Plenty Lending Company to finance the construction…

A: Here discuss about the details of the Restructure of the Notes Payable after incurred the financial…

Q: On March 1, 2021, Special Company paid P500,000 for the calendar year's property taxes. Advertising…

A: Income statement is one of the financial statement which shows all incomes and all expenses of the…

Q: On November 1, 2019, Gerakos Corporation sold software and a six-month technical support contract to…

A: Calculate the sales price of software:

Q: On October 1, 2021, Sputnik V Company leased from Gamaleya Company a set of furniture, which Sputnik…

A: Formula: Monthly rent = Total Rent / number of months

Q: PRANCER Company, at the end of 2021, its first year of operations, prepared a reconciliation between…

A: Solution: income tax payable to be presented in the statement of financial position at year end =…

Q: On March 16, 2022, BLUE Company paid property taxes of P375,000 on its building for calendar year…

A: Answer

Q: On July 1, 2020, Splish Inc. made two sales. 1. It sold land having a fair value of $909,120 in…

A: Journal Entry is the entry made to record the transactions which have occurred in the books of…

Q: On Jan 1,2020, Kim Co. supplies amounted to P2,500. During the year, thecompany purchased P1,200…

A: Office supplies means the any product used in office on regular basis. We can not say that amount of…

Q: In 2021, Crane Company accrued, for financial statement reporting, estimated losses on disposal of…

A: Deferred Tax (Asset) This type of tax occurs on the Asset side of the balance sheet due to the…

Q: On March 31, 2020, the CHICAGO BULLS Corporation issued a P3, 000, 000 12% promissory note for…

A: Interest expense from January 1 2021 to March 31 2021 = Amount payable x rate of interest x no. of…

Q: On June 30, 2021, Mill Corp. incurred a 100,000 net loss from disposal of a business segment. Also,…

A: Here we will apply the accounting rule that for an interim report all revenues and gains have to be…

Q: Discuss the implication of the transactions and state the journal entries on January 1, 2020 for…

A: Introduction: Lease: Lease can be defined as a legal agreement between the lessor and the lessee in…

Q: On June 1, 2021, Oriole & Sons sold equipment to James Landscaping Service in exchange for a…

A: Given: Fair value = $97,200 Face value of note = $112,800 Period = 12 months

Q: In 2021, a merchandise was sold on instalment basis by ONB for P80, 000 at a gross profit of 25% on…

A: The Instalment method is applied when a customer opts to make payments through instalments, rather…

Q: At the beginning of 2021, Crane Co. purchased an asset for $1750000 with an estimated useful life of…

A: SOLUTION FORMULAS- 1-DEPRECIATION AS PER STRAIGHT LINE METHOD = COST OF ASSET - SALVAGE VALUE / NO…

Q: Ascension Company has estimated that total depreciation expense for the year ending December 31,…

A: For the expenses where benefit is received through out the period should be reported proportionately…

Q: On June 30, 2021, Coco Inc. incurred a P2,000,000 net loss from disposal of a business segment. Also…

A: The question is related to Interim period is a period less than one fiscal year. Generally…

Q: PRANCER Company, at the end of 2021, its first year of operations, prepared a reconciliation between…

A: Total income tax = Taxable amount x income tax rate = 250000 x 30% = 75,000

Q: On January 1,2021, Mickey Mouse Corp sells a Furniture and Fixtures costing P1,200,000 and with…

A: Present value of the note = Present value of principal + Present value of interest payments = face…

Q: 2. On January 1, 2019, KRIS KRINGLE Company purchased a ₱600,000 machine, with a five-year useful…

A: Change in method of depreciation is not a change in accounting policy. And hence no retrospective…

Q: Discuss the implication of the transactions and state the journal entries on January 1, 2020

A: Understanding implication: According to the facts of the case, the transfer to MacCo is meeting…

Q: . On January 1, 2020, Lombard Co. sells property for which it had paid $690,000 to Sargent Company,…

A: Discount on Notes receivable = Face value of Notes receivable - Sales price of property =…

Q: On October 1, 2020, ABC Manufacturing sold a tract of land that originally cost P400,000. ABC…

A: Present value of the Note on October 1, 2020 = Present value of principal + Present value of…

Q: On October 1, 2021, Sputnik V Company leased from Gamaleya Company a set of furniture, which Sputnik…

A: Formula: Rent expense per month = Total rent / Number of months

Q: On January 1, 2019, KRIS KRINGLE Company purchased a ₱600,000 machine, with a five-year useful life…

A: Correct option is C. 36,000 Deferred tax liability as a result of change is P36,000

Q: Suri Company is a dealer of real properties. On June 30, 2020, it sold a parcel of land with a tax…

A: Installment Sales Method Under the installment sales method the recognition of revenue which are…

Q: In 2020, Lihim na Pagtingin Designs Corp. sold a layout design to Masaya Inc. and will receive…

A: Revenue - Revenue is the income for the company. This will be on an accrual basis or receipt basis.

Q: he new machinery, on the other hand, is expected to have a residual worth of $5,000. On that date,…

A: As per rule, allowed to answer first question and post the remaining in the next submission.

Q: On January 1, 2020, equipment costing $582,800 is purchased. For financial reporting purposes, the…

A: Compute the income tax expense: Amount due per tax return $132,100 Tax rate 20% Income…

Q: he income tax rate is 30% for all years. Income tax payable is?

A: Income Tax is a form of indirect tax. It is the tax payable on the amount of income earned during a…

Q: In early January 2019, Outkast Corporation applied for a trade name, incurring legal costs of…

A:

Q: On 1, 2020, Midland Company purchased a machine for P1,400,000. This machine has - year useful…

A: Income tax: It is the amount a person is liable to pay on the earned amount in an accounting year.…

Q: On January 30, 2021, XYZ Corporation, a non-VAT registered company, purchased from ABC Corporation,…

A: SOLUTION- EXPLANATION- VAT RATE = 12% SALES (A) 280000 OUTPUT VAT (B)= (280000 / 1.12 )…

Q: On December 31, 2019, Hairy Inc. Sold computer equipment to Barber Co and immediately leased it back…

A: Deferred revenue refers to the amount of money received in advance by a company before having earned…

Q: gross income in 2020 using the installment method

A: Gain on sale of parking lot = Salve value - Acquisition price Sale value P3,500,000 Acquisition…

Q: Blue Company sold a car to a customer at a price of P400,000 with a production cost of P300,000 on…

A:

Q: On October 1, 2021, Loving Company approved a formal plan to sell a businesssegment. The sale will…

A: As per IFRS 5 , Non current assets held for sale and discontinued operations An entity shall…

Q: On January 2021 Bob Company sells an item of machinery to Jaison Company for its fair value of…

A:

Q: On 1 October 2020, Maximus sold a machine to a customer for £200,000 (excluding value added tax),…

A: Given ÷ Machine sold for £200000 Transaction price allocated =£182000 Maintenance for 4 years =…

Q: On April 1, 2021, Leni Company (a calendar-year company) sold a tract of land that originally cost…

A: Interest revenue for the year ended December 31, 2021 = fair value of the note x prevailing rate of…

Q: Ven Company is a retailer. In 2019, its before-tax net income for financial reporting purposes was…

A: Taxable Income: The amount of adjusted gross income that is liable to be taxed is known as taxable…

Q: On March 1, 2021, Special Company paid P500,000 for the calendar year'sproperty taxes. Advertising…

A: Income statement is that financial statement which shows all incomes and all expenses of the…

Step by step

Solved in 4 steps with 2 images

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?

- Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.

- Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?