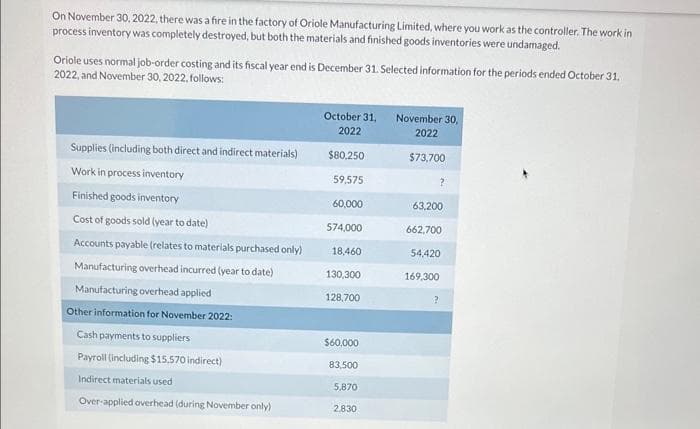

On November 30, 2022, there was a fire in the factory of Oriole Manufacturing Limited, where you work as the controller. The work in process inventory was completely destroyed, but both the materials and finished goods inventories were undamaged. Oriole uses normal job-order costing and its fiscal year end is December 31. Selected information for the periods ended October 31, 2022, and November 30, 2022, follows: Supplies (including both direct and indirect materials) Work in process inventory Finished goods inventory Cost of goods sold (year to date) Accounts payable (relates to materials purchased only) Manufacturing overhead incurred (year to date) October 31, 2022 $80,250 59,575 60,000 574,000 18,460 130,300 November 30, 2022 $73,700 ? 63,200 662,700 54,420 169,300

On November 30, 2022, there was a fire in the factory of Oriole Manufacturing Limited, where you work as the controller. The work in process inventory was completely destroyed, but both the materials and finished goods inventories were undamaged. Oriole uses normal job-order costing and its fiscal year end is December 31. Selected information for the periods ended October 31, 2022, and November 30, 2022, follows: Supplies (including both direct and indirect materials) Work in process inventory Finished goods inventory Cost of goods sold (year to date) Accounts payable (relates to materials purchased only) Manufacturing overhead incurred (year to date) October 31, 2022 $80,250 59,575 60,000 574,000 18,460 130,300 November 30, 2022 $73,700 ? 63,200 662,700 54,420 169,300

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

Problem 17E: Nelson Fabrication Inc. had a remaining credit balance of $20,000 in its under- and overapplied...

Related questions

Question

Transcribed Image Text:On November 30, 2022, there was a fire in the factory of Oriole Manufacturing Limited, where you work as the controller. The work in

process inventory was completely destroyed, but both the materials and finished goods inventories were undamaged.

Oriole uses normal job-order costing and its fiscal year end is December 31. Selected information for the periods ended October 31,

2022, and November 30, 2022, follows:

Supplies (including both direct and indirect materials)

Work in process inventory

Finished goods inventory

Cost of goods sold (year to date)

Accounts payable (relates to materials purchased only)

Manufacturing overhead incurred (year to date)

Manufacturing overhead applied

Other information for November 2022:

Cash payments to suppliers

Payroll (including $15.570 indirect)

Indirect materials used

Over-applied overhead (during November only)

October 31,

2022

$80,250

59,575

60,000

574,000

18,460

130,300

128,700

$60,000

83,500

5,870

2.830

November 30,

2022

$73,700

?

63,200

662,700

54,420

169,300

2

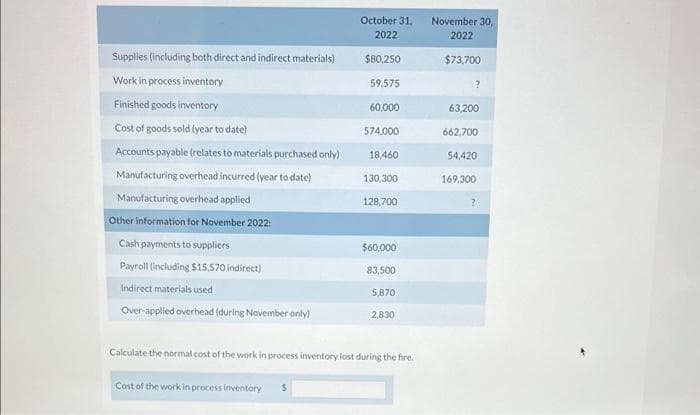

Transcribed Image Text:Supplies (including both direct and indirect materials)

Work in process inventory

Finished goods inventory

Cost of goods sold (year to date)

Accounts payable (relates to materials purchased only)

Manufacturing overhead incurred (year to date)

Manufacturing overhead applied

Other information for November 2022:

Cash payments to suppliers

Payroll (including $15,570 indirect)

Indirect materials used

Over-applied overhead (during November only)

October 31.

2022

$80,250

59,575

Cost of the work in process inventory S

60,000

574,000

18,460

130,300

128,700

$60,000

83,500

5,870

2,830

Calculate the normal cost of the work in process inventory lost during the fire.

November 30,

2022

$73,700

?

63,200

662,700

54,420

169,300

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning