On September 30, 2021, Remus, Semus and Tuss agreed on a joint venture to sell their common stock shares of the Sagittarius Mines. Gains and losses are to be shared in proportion to the contributed shares. Gains and losses are to be shared in proportion to the contributed shares. Remus contributes 6,000 shares, which had cost him P42 a share. Semus gave 10,000 shares which had a cost of P58 each and Tuss 4,000 shares which had a cost of P62 per share. The par value of the shares was P50 and when the venture began market value was P40 per share. On October 20 he sold 4,500 shares for P44 a share and P3,000 expenses incurred. On November 1, Sagittarius Mines distributed a stock dividend of 20%. Tuss sold 5,000 shares, ex-right dividend, on November 5, for P25 a share. On November15, Sagittarius mines paid a cash dividend of P1 pershare. On November 22 he sold 6,000 shares for P28. On December 220, the remainder of the shares were sold for P35 per share. Tuss' expenses were P4,700. Tuss' loss on the disposition on his investment in Sagittarius is b. P95,140 a. P95,420 c. P105,420 d. P120,140

On September 30, 2021, Remus, Semus and Tuss agreed on a joint venture to sell their common stock shares of the Sagittarius Mines. Gains and losses are to be shared in proportion to the contributed shares. Gains and losses are to be shared in proportion to the contributed shares. Remus contributes 6,000 shares, which had cost him P42 a share. Semus gave 10,000 shares which had a cost of P58 each and Tuss 4,000 shares which had a cost of P62 per share. The par value of the shares was P50 and when the venture began market value was P40 per share. On October 20 he sold 4,500 shares for P44 a share and P3,000 expenses incurred. On November 1, Sagittarius Mines distributed a stock dividend of 20%. Tuss sold 5,000 shares, ex-right dividend, on November 5, for P25 a share. On November15, Sagittarius mines paid a cash dividend of P1 pershare. On November 22 he sold 6,000 shares for P28. On December 220, the remainder of the shares were sold for P35 per share. Tuss' expenses were P4,700. Tuss' loss on the disposition on his investment in Sagittarius is b. P95,140 a. P95,420 c. P105,420 d. P120,140

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 43P

Related questions

Question

Please help me with the solution. Thank you

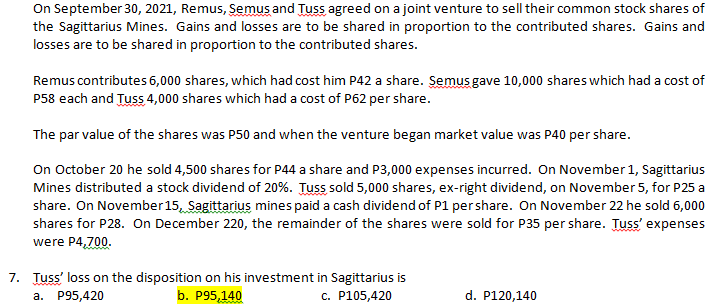

Transcribed Image Text:On September 30, 2021, Remus, Semus and Tuss agreed on a joint venture to sell their common stock shares of

the Sagittarius Mines. Gains and losses are to be shared in proportion to the contributed shares. Gains and

losses are to be shared in proportion to the contributed shares.

Remus contributes 6,000 shares, which had cost him P42 a share. Semus gave 10,000 shares which had a cost of

P58 each and Tuss 4,000 shares which had a cost of P62 per share.

The par value of the shares was P50 and when the venture began market value was P40 per share.

On October 20 he sold 4,500 shares for P44 a share and P3,000 expenses incurred. On November 1, Sagittarius

Mines distributed a stock dividend of 20%. Tuss sold 5,000 shares, ex-right dividend, on November 5, for P25 a

share. On November15, Sagittarius mines paid a cash dividend of P1 pershare. On November 22 he sold 6,000

shares for P28. On December 220, the remainder of the shares were sold for P35 per share. Tuss' expenses

were P4,700.

7. Tuss' loss on the disposition on his investment in Sagittarius is

b. P95,140

a. P95,420

c. P105,420

d. P120,140

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT