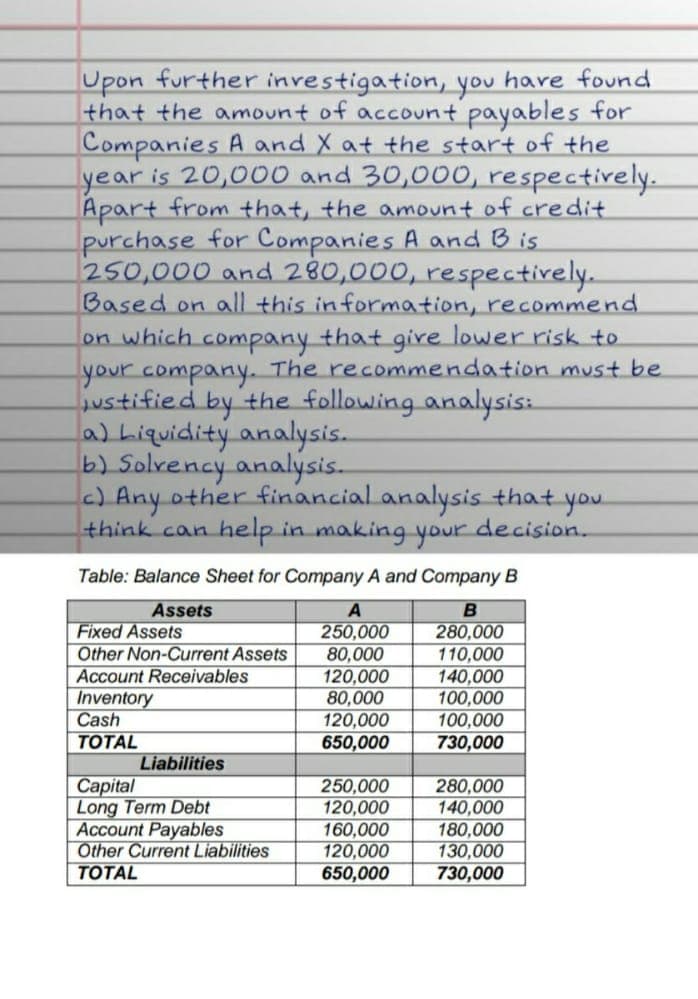

on which company that gire lower risk to your company. The recommendation must be ustified by the following analysis: a) hiquidity analysis. b) Solvency analysis. c) Any other financial analysis that think can help in making your you. decision.

Q: Record adjusting journal entries for each separate case below for year ended December 31. Assume no ...

A: Increase in assets should be debited and decrease in assets should be credited. Increase in revenues...

Q: Entity A had the following instruments outstanding all throughout 20x1:12% convertible bonds payable...

A: Earning per share The purpose of calculating earning per share in the business entity which can know...

Q: Allan has a gross income of P400,000 in 2020. His employer deducted P5,000 SSS, P4,000 PHIC, P3,000 ...

A: Answer: The final tax due is calculated on the net income of the person. The deductions is allowed f...

Q: Statement of Earnings and Statement of Financial Position Relationships Each column presents financ...

A: Relationship: Net Income/(loss)= Total revenue - Total expense Total Assets= Total liabilities + Tot...

Q: By how much did Declan's Designs' Gross PPE decrease during 2022? Please do not provide the net chan...

A: The fixed asset such as Property, plant and equipment get decreased by sale of assets during the per...

Q: Design a salary slip for the month of December 2021

A: Salary slip is the slip which is given to the employee in which it is clearly stated about how much ...

Q: In the Invoice Lookup, when view

A: Answer: SAGE 50 is the accounting software that is used by many business to record their day to day ...

Q: * Subscribe You are a merchandising company. Please make a random list of accounts with their balanc...

A: Introduction:- Merchandising is that the show and promotion of things purchasable at each wholesale ...

Q: c. Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has incu...

A: adjusting entry is passed when transactions occurs at the end of accounting period to record any inc...

Q: Required information Problem 6-9B Record transactions and prepare a partial income statement using a...

A: The journal keeps the record for day to day transactions of the business. Under periodic inventory s...

Q: Hi-Tek Manufacturing, Incorporated, makes two types of industrial component parts-the B300 and the T...

A: >There are various methods to allocate the overhead support costs that are not directly related t...

Q: Choy, after recelving her degree in Hotel and Restaurant Management began her own business called Ch...

A: Acccounting equation is the basic principle of accounting which states that Asset = Liability + Capi...

Q: ACCOUNT NAME NORMAL BALANCE Cash in Bank ............................................$46,540 Accou...

A: Normal balance of all the assets, expenses and drawings account will be debit balance. Normal balanc...

Q: Adams, Inc., acquires Clay Corporation on January 1, 2020, in exchange for $713,300 cash. Immediatel...

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question...

Q: e adjusted trial balance is prepared a.to determine the net income or loss. b.to verify the equali...

A: Solution: Trial balance is a supporting statement to financial statements which summarizes the balan...

Q: roofing company collects payment when jobs are complete. The work fo ne customer, whose job was bid ...

A: Solution: When work has been completed but customers have not billed yet, that gives rise to account...

Q: On October 1, Goodwell Company rented warehouse space to a tenant for $1,600 per month and received ...

A: Adjusting Entry – Adjusting entries do not include cash. This also ensures that the transactions inc...

Q: Prepare BALANCE SHEET

A: Balance sheet is a statement on financial position of an business enterprises. It is called a balanc...

Q: How does Depreciation Expense impact Declan's Designs' 2022 Statement of Cash Flows?

A: The cash flow statement is prepared to record the cash flow from various activities during the perio...

Q: In 2015, Byron was granted 1,000 stock options by his employer, Buxton Corporation. The options vest...

A: Taxable income is the portion of an individual's or a company's income that is used to determine how...

Q: What is Declan's Design's 2022 Cash Flows from Operating Activities? Question 23 options: Incr...

A: The cash flow statement is prepared to record the cash flow from various activities during the perio...

Q: 2. Suppose by the end of November that the remaining inventory is estimated to have a net realizable...

A: Adjustment entries are those journal entries which are recorded in order to correct the account bala...

Q: Tara Westmont, the proprietor of Tiptoe Shoes, had annual revenues of $187,000, expenses of $104,700...

A: >Owner’s capital balance is the part of Equity.>It contains the amount of amount invested by t...

Q: If you become aware of a breach or violation, you should

A: Breach or violation of the terms and conditions by the employee is a commit of fraud or revealing th...

Q: an auditor finds any misstatements or deviations in planned procedures: a. the auditor should not re...

A: When an auditor finds any misstatements or deviations in the financial statements then the auditor h...

Q: The substance of annual report are a) the management analysis b ) the charts and tables C ) the au...

A: Annual reports represent the financial statement of the company that has been audited by the auditor...

Q: Mielé Appliances estima warranty payablé of Duri 2017, Miele made sales of $100000 and expects produ...

A:

Q: How much is the patient services revenue? How much is the operating revenue? How much is the total n...

A: Patient revenue services includes charges for direct patient care such as doctor's fees,room charges...

Q: Statement of Earnings, Statement of Retained Earnings, and Statement of Financial Position McDonald...

A: The income statement, along with the balance sheet and the statement of cash flows, is one of three ...

Q: How does the Loss on Sale of PPE impact Declan's Designs' 2022 Statement of Cash Flows? Questi...

A: Cash Flow Statement - The Cash Flow Statement is the statement that shows the cash inflow and outflo...

Q: On January 1, 2021, ABC Co. acquired all of the identifiable assets and assumed all of the liabiliti...

A: SOLUTION GOODWILL = PURCHASE PRICE OF TARGET COMPANY -(FAIR MARKET VALUE OF ASSETS - FAIR MARKET VAL...

Q: We have set up the new production facility in an old warehouse that we stopped using a year ago. Pri...

A: GIVEN we had considered selling the building and it had been valued at E$100,000 on 30 June 2021....

Q: Preparation of Closing Entries and a Statement of Earnings Clayoquot Boat Repair Ltd. has entered a...

A: A journal entry is a form of accounting entry that is used to report a business transaction in a com...

Q: n January 1, 2021, ABC Co. acquired all of the identifiable assets and assumed all of the liabilitie...

A: solution given Number of ABC co’s share 60000 Par value per share 40 Fair value of i...

Q: Johnstone Controls had the following situations on December 2021. On March 31, 2021, the company le...

A: Journal entries are being used to record financial transactions. You create a journal entry by enter...

Q: Record adjusting journal entries for each separate case below for year ended December 31. Assume no ...

A: The adjustment entries are prepared at end of accounting period to adjust the revenue and expenses o...

Q: Consider the unadjusted trial balance of RiverdaleCompany at June 30, 2016, and the related month-en...

A: To begin, keeping accurate records of your transactions aids in the organization of your business's ...

Q: Failure to provide any level of care in fulfilling a duty owed to another party, including reckless ...

A: Constructive fraud occurs when you falsify or omit vital facts when speaking with somebody who belie...

Q: ABC Corporation issued 15%, 1,000-par value preference shares. Interest is payable monthly. It will ...

A: Let the current market price of preference share be P Interest = 1,000 x 15% = 150 FV = Face value...

Q: Mr. E is a business process outsourcing (BPO) employee in IT Park, Lahug, Cebu City. Prepare a very ...

A: Introduction:- A tax is a governmental organization's mandatory financial charge or other type of le...

Q: A company that was to be liquidated had the following liabilities: Income Taxes $ 15,000 Notes Payab...

A: Total Assets = Current assets + Land + Building Land is secured for notes payable. The question requ...

Q: Accounting Prepare and submit journal entries for the following transactions. Follow the correct for...

A: Journal entry is used to record all the transactions we have done in the business. It helps in maint...

Q: How does Accounts Payable impact Declan's Designs' 2022 Statement of Cash Flows?

A: Accounts payable form part of working capital of a company. Therefore, a change (increase or decreas...

Q: Required information Problem 6-9B Record transactions and prepare a partial income statement using a...

A: Solution Concept Journal entry is a book where the business transactions are recorded It is recorde...

Q: If you receive your full bonus at the end of the year, what is your total (gross or before tax) pay ...

A: Taxable income refers to the amount to which tax is imposed. It is arrived at after allowing certain...

Q: Entity A had 200,000 ordinary shares outstanding all throughout 20x1. In 20x2, share issuances occur...

A: Earning per Share: It indicates a company's profitability and is calculated by dividing a company's ...

Q: The following items are reported on a company's balance sheet: Cash $550,800 Marketable securities 4...

A: Ratio analysis helps to analyze the financial statements of the company. The management can take dec...

Q: The vice president of marketing and the director of human resources have developed a proposal whereb...

A: Gross profit is the ratio of gross profit over net sales. It is required to measure the gross profi...

Q: rue or False: Effectiveness is doing the right things of completing activities so that the organiza...

A: The basic meaning of effectiveness in Management is that the concerned person/team has a capability ...

Q: The West Indies School Book Shop sells T Shirts emblazoned with the school's name and logo. The shir...

A: Introduction:- Job relationships are contractual in nature, consisting of an agreement between the p...

Step by step

Solved in 2 steps

- An employee at Azai Bank seeks to evaluate a transaction using the risk-adjusted return on capital (RAROC) model. The transaction entails extending a loan to an agro-based entity with the following details:- The risk-free rate of return is 7%- Loss given default (LGD) = 51%- Exposure at default (EAD) = ZMW 2.5 million- Probability of default (PD) = 40 basis points The bank's economic capital (EC) model assesses an EC charge for the firm, equivalent to 5% of EAD, amounting to ZMW 100,000. Assuming a RAROC hurdle rate of 15%, the transaction yields a net profit of ZMW 14,000 before other adjustments. Tasks:A. Calculate the bank’s risk-adjusted rate of return on the loan to the agricultural company. B. Additionally, consider the scenario where the bank could have extended a loan of the same amount, generating an identical net profit of ZMW 14,000 before adjustments to a pharmaceutical products manufacturing firm, with an EC of 2.5%. C. Determine which loan the bank should prioritize…Shimmer Products is considering which bad debt estimation method works best for its company. It is deciding between the income statement method, balance sheet method of receivables, and balance sheet aging of receivables method. If it uses the income statement method, bad debt would be estimated at 5.6% of credit sales. If it were to use the balance sheet method, it would estimate bad debt at 13.7% percent of accounts receivable. If it were to use the balance sheet aging of receivables method, it would split its receivables into three categories: 0–30 days past due at 5%, 31–90 days past due at 21%, and over 90 days past due at 30%. There is currently a zero balance, transferred from the prior years Allowance for Doubtful Accounts. The following information is available from the year-end income statement and balance sheet. There is also additional information regarding the distribution of accounts receivable by age. Prepare the year-end adjusting entry for bad debt, using A. Income statement method B. Balance sheet method of receivables C. Balance sheet aging of receivables method D. Which method should the company choose, and why?Organics Plus is considering which bad debt estimation method works best for its company. It is deciding between the income statement method, balance sheet method of receivables, and balance sheet aging of receivables method. If it uses the income statement method, bad debt would be estimated at 4% of credit sales. If it were to use the balance sheet method, it would estimate bad debt at 12% of accounts receivable. If it were to use the balance sheet aging of receivables method, it would split its receivables into three categories: 0–30 days past due at 6%, 31–90 days past due at 19%, and over 90 days past due at 26%. There is currently a zero balance, transferred from the prior years Allowance for Doubtful Accounts. The following information is available from the year-end income statement and balance sheet. There is also additional information regarding the distribution of accounts receivable by age. Prepare the year-end adjusting entry for bad debt, using A. Income statement method B. Balance sheet method of receivables C. Balance sheet aging of receivables method. D. Which method should the company choose, and why?

- please help me answeer the following given Debt analysis Springfield Bank is evaluating Creek Enterprises, which has requested a $3,780,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industr, averages and Creek's recent financial statements, evaluate and recommend appropriate action on the loan request. Industry averages Creek Enterprises Income Statement: Debt ratio 0 50 Times interest earned ratio 7.42 Fixed-payment coverage ratio 2.03 Creek Enterprises Balance Sheet: Creek Enterprises's debt ratio is _____ (Round to two decimal places.) Creek Enterprises's times interest earned ratio is ______ (Round to two decimal places.) Creek Enterprises's fixed-payment coverage ratio is. ______ (Round to two decimal places.) Complete the following summary of ratios and compare Creek Enterprises's ratios vs. the industry average: (Round to two decimal places.) Creek Debt ratio Industry 0.50 Times…A bank is considering adding secuirtt underwriting services to the services it offers. It has estimated that the expected return and standard deviation of its traditional service are 8% and 10% respectively. It has estimated that the expected return and standard deviation of its new securities underwriting services are 16% and 20% respectively. The correlation between these services has been estimated to be -.3 and the bank estimates that 80% of its business will be from traditional services and 20% from the new services. What is the standard deviation of the new combined firm? A) 7.8% B) 10% C) 12% D) 15.5% E) 20%Consider a bank with the following balance sheet (Shown in image):a) Calculate the equity (total asset – total liability) to asset ratio of the bank(Hint: equity to asset ratio = total equity/total asset) b) Calculate the duration and convexity of the both asset and liability sides; c) If the interest rates go up by 1%, using the duration and convexity rule to determine the networth of the bank and the equity to asset ratio; d) In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation,the bank decides to raise cash (zero duration and zero convexity) from the equity holders.How much cash does the bank need to raise? e) Do you agree with the following statement? Explain why. “The information about a bond’s duration and convexity adjustment is sufficient to quantifyinterest rate risk exposure.”

- When firms enter into loan agreements with their bank, it is very common for the agreement to have a restriction on the minimum current ratio the firm has to maintain. So, it is important that the firm be aware of the effects of their decisions on the current ratio. Consider the situation of Advanced Autoparts (AAP) in 2009. The firm has total current assets of $1,780,195,300 and current liabilities of $1,369,381,000. What is the firm’s current ratio? If the firm were to expand its investment in inventory and finance the expansion by increasing accounts payable, how much could it increase its inventory without reducing the current ratio below 1.2? If the company needed to raise its current ratio to 1.5 by reducing its investment in current assets and simultaneously reducing accounts payable and short-term debt, how much would it have to reduce current assets to accomplish this goal?Please help with the below minicase. Directions: The best way to do this case is to use relevant credit information and calculate some financial ratios: ROA, debt ratio, liquidity ratios, ROE, profit margin, Inventory and Asset turnover. Then look at breakeven point probability, and finally the possibility of a repeat order. What can you say about Miami Spice’s creditworthiness? What is the break-even probability of default? How is it affected by the delay before MS pays its bills? How should George Stamper’s decision be affected by the possibility of repeat orders? MiniCase: George Stamper a credit analyst with Micro-Encapsulators Corp. (MEC) needs to respond to an urgent email request from the southeast sales office. The local sales manager reported that she had an opportunity to clinch an order from Miami Spice (MS) for 50 encapulators at $10,000 each She added that she was particularly keen to secure this order since MS was likely to have a continuing need for 50 encapulators a…Please help with the below minicase. Directions: The best way to do this case is to use relevant credit information and calculate some financial ratios: ROA, debt ratio, liquidity ratios, ROE, profit margin, Inventory and Asset turnover. Then look at breakeven point probability, and finally the possibility of a repeat order. What can you say about Miami Spice’s creditworthiness? What is the break-even probability of default? How is it affected by the delay before MS pays its bills? How should George Stamper’s decision be affected by the possibility of repeat orders? MiniCase: George Stamper a credit analyst with Micro-Encapsulators Corp. (MEC) needs to respond to an urgent email request from the southeast sales office. The local sales manager reported that she had an opportunity to clinch an order from Miami Spice (MS) for 50 encapulators at $10,000 each She added that she was particularly keen to secure this order since MS was likely to have a continuing need for 50 encapulators a…

- A lending officer at C Bank has insisted that your firm improve the current ratio of 0.8 before the bank will consider a loan. Which of the following actions would INCREASE the ratio? Group of answer choices: Selling some of the existing inventory at cost Using cash to pay off current liabilities Borrowing long-term debt to pay off short-term bank loan Paying off long-term debt. Collecting some of the current accounts receivableYou are an investor looking to contribute financially to either company A or Company B. The following, select financial information as follows. Company A and company B, respectively: Beginning Account Receivable $ 50,000, 60,000; Ending Account Receivable $ 80,000, 90,000; Net credit sales $ 550,000, $460,000. Based on the information provided: compute the account receivable turnover ratio. Compute the number of days sales in receivables ratio for both companies A and company B ( round all answers to two decimals places) Interpret the outcomes stating which company you would invest in and why.When firms enter into loan agreements with their bank, it is very common for the agreement to have a restriction on the minimum current ratio the firm has to maintain. So, it is important that the firm be aware of the effects of their decisions on the current ratio. Consider the situation of Advanced Autoparts (AAP) in 2009. The firm had total current assets of $1,907,570,000 and current liabilities of $1,362,550,000. a. What is the firm's current ratio? b. If the firm were to expand its investment in inventory and finance the expansion by increasing accounts payable, how much could it increase its inventory without reducing the current ratio below 1.2? c. If the company needed to raise its current ratio to 1.5 by reducing its investment in current assets and simultaneously reducing accounts payable and short-term debt, how much would it have to reduce current assets to accomplish this goal? Question content area bottom Part 1 a. What is the firm's…