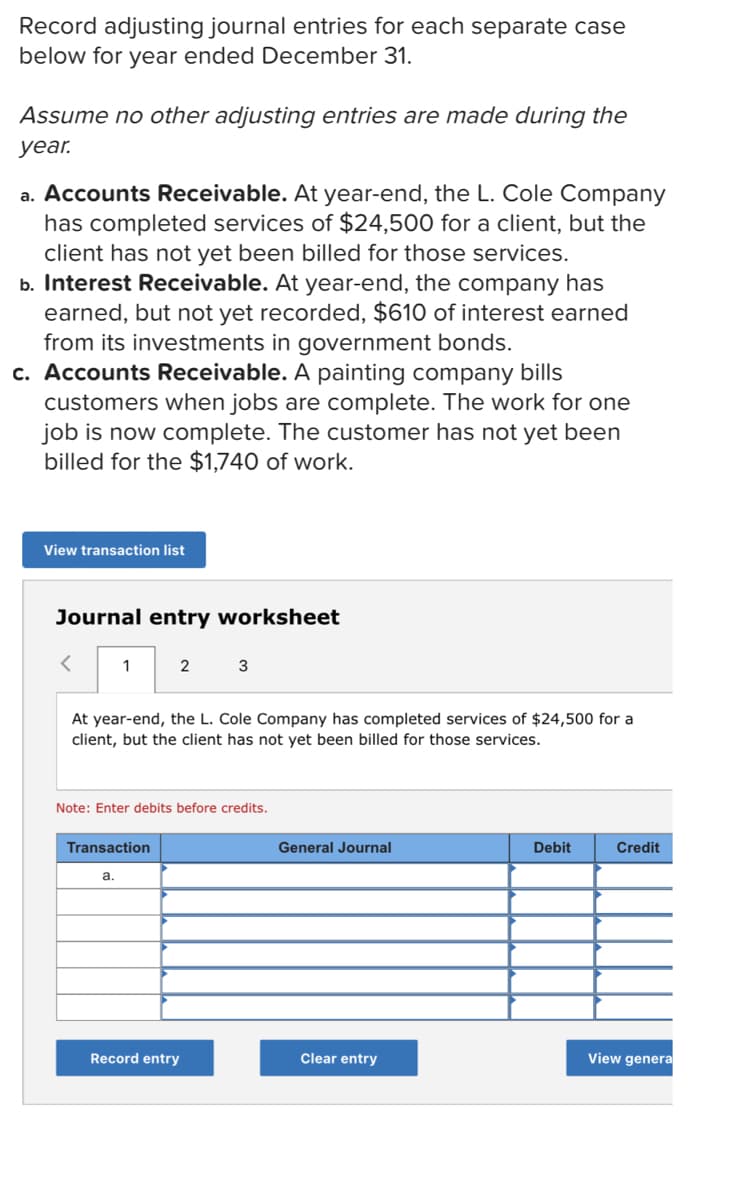

Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. a. Accounts Receivable. At year-end, the L. Cole Company has completed services of $24,500 for a client, but the client has not yet been billed for those services. b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $610 of interest earned from its investments in government bonds. c. Accounts Receivable. A painting company bills customers when jobs are complete. The work for one job is now complete. The customer has not yet been billed for the $1,740 of work.

Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. a. Accounts Receivable. At year-end, the L. Cole Company has completed services of $24,500 for a client, but the client has not yet been billed for those services. b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $610 of interest earned from its investments in government bonds. c. Accounts Receivable. A painting company bills customers when jobs are complete. The work for one job is now complete. The customer has not yet been billed for the $1,740 of work.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter21: Accounting For Accruals, Deferrals, And Reversing Entries

Section21.1: Accruals

Problem 1OYO

Related questions

Question

Do a b and c

Transcribed Image Text:Record adjusting journal entries for each separate case

below for year ended December 31.

Assume no other adjusting entries are made during the

уear.

a. Accounts Receivable. At year-end, the L. Cole Company

has completed services of $24,500 for a client, but the

client has not yet been billed for those services.

b. Interest Receivable. At year-end, the company has

earned, but not yet recorded, $610 of interest earned

from its investments in government bonds.

c. Accounts Receivable. A painting company bills

customers when jobs are complete. The work for one

job is now complete. The customer has not yet been

billed for the $1,740 of work.

View transaction list

Journal entry worksheet

1

2

3

At year-end, the L. Cole Company has completed services of $24,500 for a

client, but the client has not yet been billed for those services.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

a.

Record entry

Clear entry

View genera

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub