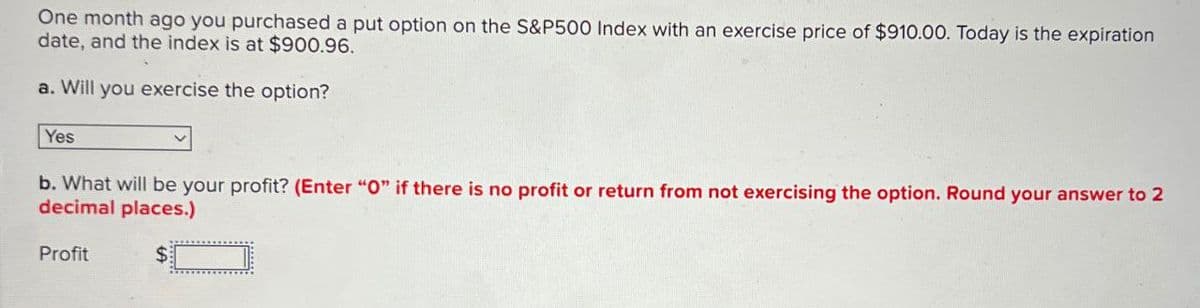

One month ago you purchased a put option on the S&P500 Index with an exercise price of $910.00. Today is the expiration date, and the index is at $900.96. a. Will you exercise the option? Yes b. What will be your profit? (Enter "O" if there is no profit or return from not exercising the option. Round your answer to 2 decimal places.) Profit $

Q: Big Toy, Inc. annually sells 115,000 units of Big Blobs. Currently, inventory is financed through…

A: ConclusionThis analysis provides clear and concise answers to the questions, demonstrating the…

Q: Dyrdek Enterprises has equity with a market value of $11.8 million and the market value of debt is…

A: Statement Showing NPVParticulars0123456TotalCost of project-2400000 Annual Cash flow…

Q: None

A: • Dividend at t0= (D0) =$1.25• Growth rate in Year 1=23%• Growth rate in Year 1=35%• Growth rate in…

Q: use excel

A: To calculate the conventional Benefit-to-Cost (B/C) ratio using Excel, you can follow these…

Q: ok nt ences Gilmore, Inc., had equity of $220,000 at the beginning of the year. At the end of the…

A: Given : Equity = $220,000Total Assets = $375,000Net Income = $46,000Dividends = $6,800 Solutions: a.…

Q: Assets, Incorporated, plans to issue $6 million of bonds with a coupon rate of 7.9 percent, a par…

A: To calculate the price of the bonds today, we need to discount the future cash flows (coupon…

Q: The venire is: a pool of potential jurors. the area in the courtroom where the jury sits. the…

A: The question is asking for the definition of the term 'venire' in the context of a courtroom or…

Q: Am. 113.

A: Certainly! Let's break down the solution step by step:1. **Maximum Allowable Debt Calculation**: -…

Q: Please Write Step by Step Answer Otherwise i give DISLIKE !!

A: Sure, I can help you with this Monte Carlo simulation problem to estimate the expected total cost of…

Q: A project has an initial cost of $75,000, expected net cash inflows of $12,000 per year for 12…

A:

Q: Please Give Step by Step Answer Otherwise i give DISLIKES !!

A: b. Yield to Maturity (YTM):YTM is the discount rate that makes the present value of all future cash…

Q: Nikulbhai

A: To estimate whether a closed-end fund is trading at a premium or discount to its net asset value…

Q: Suppose the term structure is set according to pure expectations and the maturity preference theory.…

A: Part 2: Explanation:Step 1: Calculate the expected one year rate in one year. - Given the spot rate…

Q: Problem 11-21 WACC Weights (LG11-4) BetterPie Industries has 3 million shares of common stock…

A: Step 1:We have to calculate the weights of the securities used in the calculation of…

Q: Cost of debt. Kenny Enterprises has just issued a bond with a par value of $1,000, a maturity of…

A: If you have any problem let me know here in comment box for this thankyou for your question.

Q: Orca Industries is considering the purchase of Shark Manufacturing. Shark is currently a supplier…

A: Year Previous Cash FlowGrowth Factor(1+Growth Rate)Cash flow for the year(in million) Cash flow/…

Q: TABLE 20.2 Nonforfeiture options based on $1,000 face value STRAIGHT LIFE 20-PAYMENT LIFE Years…

A: Additionally, there are calculations provided for the cash value based on the face value of $1,000.…

Q: Nikul

A: Calculating Operating Cash Flow under Best-Case ScenarioHere's how to find the operating cash flow…

Q: Chamberlain Company wants to issue new 17-year bonds for some much-needed expansion projects. The…

A: I used Excel to compute, just input the following the formula is also given. For the rate, use the…

Q: 20.2 A company's present capital structure consists of 1,000,000 shares of equity stock. It requires…

A: Let's break down the calculation and explanation for each alternative:**Alternative A: Issuing…

Q: a. Modern Medical Devices has a current ratio of 0.5. Which of thefollowing actions would improve…

A: There are two options for improving Modern Medical Devices' current ratio of 0.5. For starters,…

Q: A couple has decided to purchase a $120000 house using a down payment of $10000. They can amortize…

A: Additional considerations:This is a simplified example, and it doesn't take into account factors…

Q: Allison bought a Blu-ray DVD player from the store for $250 that came with a one-year warranty. At…

A: Should Allison buy the extended guarantee? - Analyzing CostsStep 1: Cost of the guaranteeThe…

Q: 1000322633 (1671×750)

A: 1. **Calculation of Cap Rates for Comparable Properties:** - For each comparable property, we…

Q: Kari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed…

A: To calculate Kari's closing costs, find: Down Payment:Percentage = 25%Home Price = $220,000Down…

Q: None

A: Minimum Variance Portfolio for Two Risky FundsWe can find the expected return and standard deviation…

Q: 5:41 Vo LTED 96 expert.chegg.com/qna/authorin C Time Left: 01:59:45 Student question An investor…

A: Now, let's sum up the outcomes of each trade:- Profit from buying the stock = Market price -…

Q: You have received your investment portfolio year-end statement from your broker, Rich Waldman. All…

A: 1)Calculate profit or loss for each investment:FernRod Corp.:Bought: 400 shares * $38.38 =…

Q: a. What is the primary difference between financial statementanalysis and operating indicator…

A: Approach to solving the question: Detailed explanation: Examples: Key references:

Q: You are valuing a project for Gila Corporation using the APV method. You already found the net…

A: Sure, let's break down the calculation step by step: 1. Present Value of Interest Tax Shields…

Q: The following balance sheet is to be used to answer the questions below Yields for assets &…

A: Part a: Explanation:Step 1: Identify the Assets and Liabilities Repricing within Each Interval- For…

Q: Vijay

A: Given:There are two stocks: Stock A and Stock B:There are three possible states for the economy:…

Q: Select one company of the 30 companies that make up the Dow Jones Industrial Average (DJIA). a.…

A: f. Summary and Investment DecisionFundamental Analysis: Apple has demonstrated outstanding…

Q: When Jamal graduated from college recently, his parents gave him $1,000 and told him to use it…

A: Steps

Q: Grenouille Properties. Grenouille Properties (U.S.) expects to receive cash dividends from a French…

A: the initial euro dividend of €720,000 is grown by 10.1% annually. the spot exchange rate is adjusted…

Q: Baghiben

A: Therefore, the postmerger balance sheet for Firm X will look like this:Assets AmountAssets from X $…

Q: Baghiben

A: The objective of the question is to calculate the cash flow from the mark-to-market proceeds on the…

Q: Calculating Projected Net Income. A proposed new investment has projected sales of $585,000.…

A: To prepare a pro forma income statement, we need to calculate various components based on the given…

Q: 8-30 Construct a choice table for interest rates from Of 100%. Similar alternatives will repeat…

A: Answers: AlternativesABCDInitial Cost $2500$4800$4200 $3600Annual Benefit $850$700$850$1300 Salvage…

Q: Which are valid methods for finding the cost of equity? Check all that apply: 1. The dividend…

A: 1. The dividend discount model (DDM) approach is a method used to estimate the cost of equity by…

Q: Read; Eiteman, Stonehill and Moffett, Multinational Business Finance How do you calculate these…

A: Solving the Peso Change Problem (Question 1)Calculation:Find the difference in old and new peso…

Q: Imagine as a divisional manager and currently a member of a committee which is considering two…

A: Answers: Even though the projects' predicted cash flows and risks are similar, the manager's…

Q: Question 5 0/1 pts Below is a (partial) copy of Eureka Computing's most recent income statement and…

A: To calculate Eureka Computing's free cash flows, we can use the formula:Free Cash Flows (FCF) = Net…

Q: You can come across different situations in your life where the concepts from capital budgeting will…

A: Certainly! Here's a further explanation for each term and situation:1. **Monte Carlo Simulation**:…

Q: Vijay

A: Exercise price of K = $105 and T = 1 year to expiration. The underlying stock current price = S0 = $…

Q: None

A: Step 1:It need to use a statistical software package that can perform multiple regression analyses…

Q: 2. Notable Nothings plans to issue new bonds with the same yield as its existing bonds. The existing…

A: For the purpose of calculating the cost of debt before taxes, it is necessary to ascertain the yield…

Q: Under a Personal Auto policy, an insured MUST take which of the following acts after a covered loss?…

A: A Personal Auto policy is insurance coverage for individuals' vehicles, providing financial…

Q: Refer back to Textbook Problem 17.5. Recast the financial statements for Green Valley into common…

A: Common size financial statements provide a standardized framework for analyzing and interpreting…

Q: 8. C. d. a. Firm-specific risk is measured by the residual standard deviation. Thus, stock A has…

A: Your answers for parts a, b, and c are correct! Let's discuss part d in more detail.d. The Security…

Step by step

Solved in 2 steps

- One month ago you purchased a put option on the S&P500 Index with an exercise price of $900.00. Today is the expiration date, and the index is at $896.46. a. Will you exercise the option? b. What will be your profit?An investor has a long call option on the market index at a strike price of $930.At expiration the index price is $920. Explain the profit and loss.You would like to be holding a protective put position on the stock of XYZ Company to lock in a guaranteed minimum value of $210 at year-end. XYZ currently sells for $210. Over the next year, the stock price will either increase by 10% or decrease by 10%. The T-bill rate is 4%. Unfortunately, no put options are traded on XYZ Company. Required: a. How much would it cost to purchase if the desired put option were traded? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What would be the cost of the protective put portfolio?

- Consider the following: your purchased a put option on JPM two months ago, with a strike price for the option of $138, and the option expires today. Suppose the stock price is $152. What is the exercise value?You would like to be holding a protective put position on the stock of XYZ Company to lock in a guaranteed minimum value of $105 at year-end. XYZ currently sells for $105. Over the next year, the stock price will increase by 9% or decrease by 9%. The T-bill rate is 7%. Unfortunately, no put options are traded on XYZ Company. Required: Suppose the desired put option were traded. How much would it cost to purchase? What would have been the cost of the protective put portfolio? What portfolio position in stock and T-bills will ensure you a payoff equal to the payoff that would be provided by a protective put with X = 105? Show that the payoff to this portfolio and the cost of establishing the portfolio match those of the desired protective put.Suppose that you purchased a call option on the S&P 100 Index. The option has an exercise price of 1,680, and the index is now at 1,720. What will happen when you exercise the option?

- Assume you buy a March RM1625 FBM-KLCI call option for RM25 and hold until expiry. What will be your maximum loss in ringgit? Assume you buy a March RM1625 FBM-KLCI call option for RM25 and hold until expiry. At what index level will you break-even? Assume you buy a March 1625 points FBM-KLCI call option for RM25 and hold until expiry. Draw an expiry profit diagram for this option.You have taken a long position in a call option on IBM common stock. The option has an exercise price of $176 and IBM’s stock currently trades at $180. The option premium is $5 per contract. What is your net profit on the option if IBM’s stock price increases to $190 at expiration of the option and you exercise the option? What is your net profit if IBM’s stock price decreases to $170?Consider a put option whose underlying asset is a stock index with 6 months to expiration and a strike price of $1000. Suppose the risk-free interest rate for the six months is 2% and that the option’s premium is $74.20. (a) Find the future premium value in six months. (b) What is the buyer’s profit is the index spot price is $1100? (c) What is the buyer’s profit is the index spot price is $900 Only typed answer

- You shorted a call option on Intuit stock with a strike price of $38. When you sold (wrote) the option, you received $3. The option will expire in exactly three months' time. a. If the stock is trading at $49 in three months, what will your payoff be? What will your profit be? b. If the stock is trading at $35 in three months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the payoff at expiration as a function of the stock price at expiration. d. Redo c, but instead of showing payoffs, show profits. Question content area bottom Part 1 a. The payoff of the short is $ short is $ enter your response here. enter your response here, and the profit of the. Please step by step answer.You would like to be holding a protective put position on the stock of XYZ Company to lock in a guaranteed minimum value of $240 at year-end. XYZ currently sells for $240. Over the next year, the stock price will either increase by 7% or decrease by 7%. The T-bill rate is 3%. Unfortunately, no put options are traded on XYZ Company. Required: a. How much would it cost to purchase if the desired put option were traded? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What would be the cost of the protective put portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.)One of the options is Delta Airlines. They have paid an annual divendend of $3.98 for the past 25 years and we expect them to continue this indefinetly. Assuming the market requires a(n) 12.0% return Delta, what is the value of a share of stock? (Answer with 2 decimals.) And what if we assumed they would start increasing their divendend by 2.5% per year? What would be a fair price in that scenario? (Answer with 2 decimals.)