Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter8: Cost Analysis

Section: Chapter Questions

Problem 2.2CE

Related questions

Question

Just wanting answer to question 5 a, Thank you :)

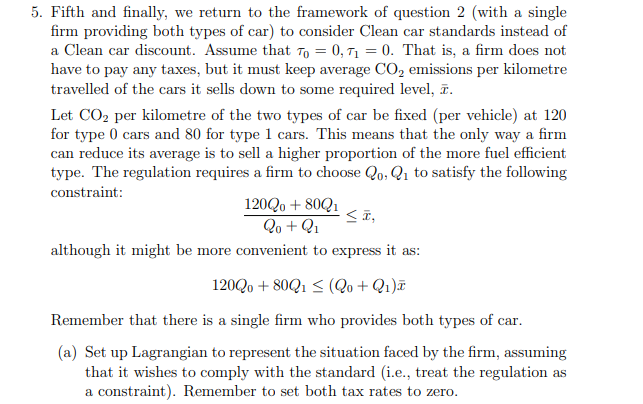

Transcribed Image Text:5. Fifth and finally, we return to the framework of question 2 (with a single

firm providing both types of car) to consider Clean car standards instead of

a Clean car discount. Assume that To = 0, T1 = 0. That is, a firm does not

have to pay any taxes, but it must keep average CO, emissions per kilometre

travelled of the cars it sells down to some required level, ĩ.

Let CO2 per kilometre of the two types of car be fixed (per vehicle) at 120

for type 0 cars and 80 for type 1 cars. This means that the only way a firm

can reduce its average is to sell a higher proportion of the more fuel efficient

type. The regulation requires a firm to choose Qo, Q1 to satisfy the following

constraint:

120Q0 + 80Q1

Qo + Q1

although it might be more convenient to express it as:

120Qo + 80Q1 < (Qo + Q1)¤

Remember that there is a single firm who provides both types of car.

(a) Set up Lagrangian to represent the situation faced by the firm, assuming

that it wishes to comply with the standard (i.e., treat the regulation as

a constraint). Remember to set both tax rates to zero.

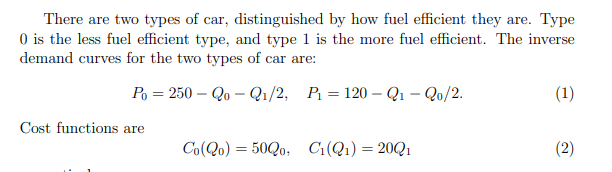

Transcribed Image Text:There are two types of car, distinguished by how fuel eficient they are. Type

O is the less fuel efficient type, and type 1 is the more fuel efficient. The inverse

demand curves for the two types of car are:

Po = 250 – Qo – Qı/2, P = 120 – Q1 – Qo/2.

(1)

Cost functions are

Co(Qo) = 50Q0, C:(Q1) = 20Q1

(2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 15 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning