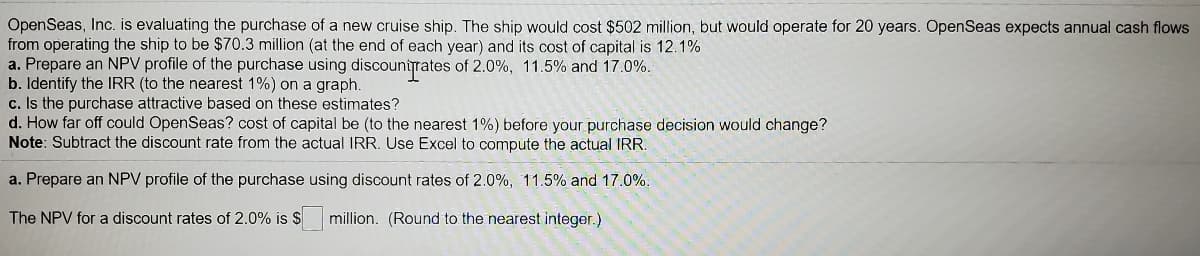

OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship would cost $502 million, but would operate for 20 years. OpenSeas expects annual cash flows rom operating the ship to be $70.3 million (at the end of each year) and its cost of capital is 12.1% 1. Prepare an NPV profile of the purchase using discountrates of 2.0%, 11.5% and 17.0%. p. Identify the IRR (to the nearest 1%) on a graph. . Is the purchase attractive based on these estimates? H. How far off could OpenSeas? cost of capital be (to the nearest 1%) before your purchase decision would change? Note: Subtract the discount rate from the actual IRR. Use Excel to compute the actual IRR. . Prepare an NPV profile of the purchase using discount rates of 2.0%, 11.5% and 17.0%: The NPV for a discount rates of 2.0% is $ million. (Round to the nearest integer.)

OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship would cost $502 million, but would operate for 20 years. OpenSeas expects annual cash flows rom operating the ship to be $70.3 million (at the end of each year) and its cost of capital is 12.1% 1. Prepare an NPV profile of the purchase using discountrates of 2.0%, 11.5% and 17.0%. p. Identify the IRR (to the nearest 1%) on a graph. . Is the purchase attractive based on these estimates? H. How far off could OpenSeas? cost of capital be (to the nearest 1%) before your purchase decision would change? Note: Subtract the discount rate from the actual IRR. Use Excel to compute the actual IRR. . Prepare an NPV profile of the purchase using discount rates of 2.0%, 11.5% and 17.0%: The NPV for a discount rates of 2.0% is $ million. (Round to the nearest integer.)

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter26: Real Options

Section: Chapter Questions

Problem 3P: Wansley Lumber is considering the purchase of a paper company, which would require an initial...

Related questions

Question

Transcribed Image Text:OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship would cost $502 million, but would operate for 20 years. OpenSeas expects annual cash flows

from operating the ship to be $70.3 million (at the end of each year) and its cost of capital is 12.1%

a. Prepare an NPV profile of the purchase using discountrates of 2.0%, 11.5% and 17.0%.

b. Identify the IRR (to the nearest 1%) on a graph.

c. Is the purchase attractive based on these estimates?

d. How far off could OpenSeas? cost of capital be (to the nearest 1%) before your purchase decision would change?

Note: Subtract the discount rate from the actual IRR. Use Excel to compute the actual IRR.

a. Prepare an NPV profile of the purchase using discount rates

2.0%, 11.5% and 17.0%.

The NPV for a discount rates of 2.0% is $

million. (Round to the nearest integer.)

Expert Solution

Step 1

Since you have asked specific question (a), we will solve the same question for you.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,