operating Compute year income tix C. Mr. filed his resignation from employment in March 2019. Up to that month, his total compensation income totaled P480,000 inclusive of P80,000 benefits. Assume that his business operations for 2019 were the same as the last year. For 2019, he opted for the 8% income tax rate. What will be the total income tax due of Mr. Adrien for the year 2019?

operating Compute year income tix C. Mr. filed his resignation from employment in March 2019. Up to that month, his total compensation income totaled P480,000 inclusive of P80,000 benefits. Assume that his business operations for 2019 were the same as the last year. For 2019, he opted for the 8% income tax rate. What will be the total income tax due of Mr. Adrien for the year 2019?

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 14EA: Toren Inc. employs one person to run its solar management company. The employees gross income for...

Related questions

Question

Please help me answer number 3 only with complete solutions please thank you

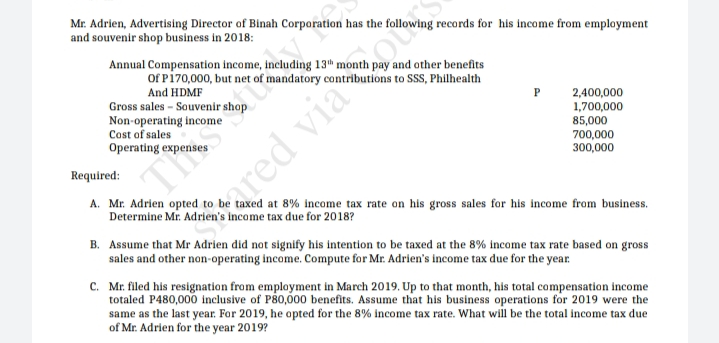

Transcribed Image Text:Mr. Adrien, Advertising Director of Binah Corporation has the following records for his income from employment

and souvenir shop business in 2018:

Annual Compensation income, Including 13" month pay and other benefits

Of Pi70,000, but net of mandatory contributions to SSS, Philhealth

And HDMF

Gross sales - Souvenir shop

Non-operating income

Cost of sales

2,400,000

1,700,000

85,000

700,000

300,000

Operating expen

Required:

A. Mr. Adrien opted to be taxed at 8% income tax rate on his gross sales for his income from business.

Determine Mr. Adrien's income tax due for 2018?

Sared viaoto

B. Assume that Mr Adrien did not signify his intention to be taxed at the 8% income tax rate based on gross

sales and other non-operating income. Compute for Mr. Adrien's income tax due for the year

C. Mr. filed his resignation from employment in March 2019. Up to that month, his total compensation income

totaled P480,000 inclusive of P80,00 benefits. Assume that his business operations for 2019 were the

same as the last year. For 2019, he opted for the 8% income tax rate. What will be the total income tax due

of Mr. Adrien for the year 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT