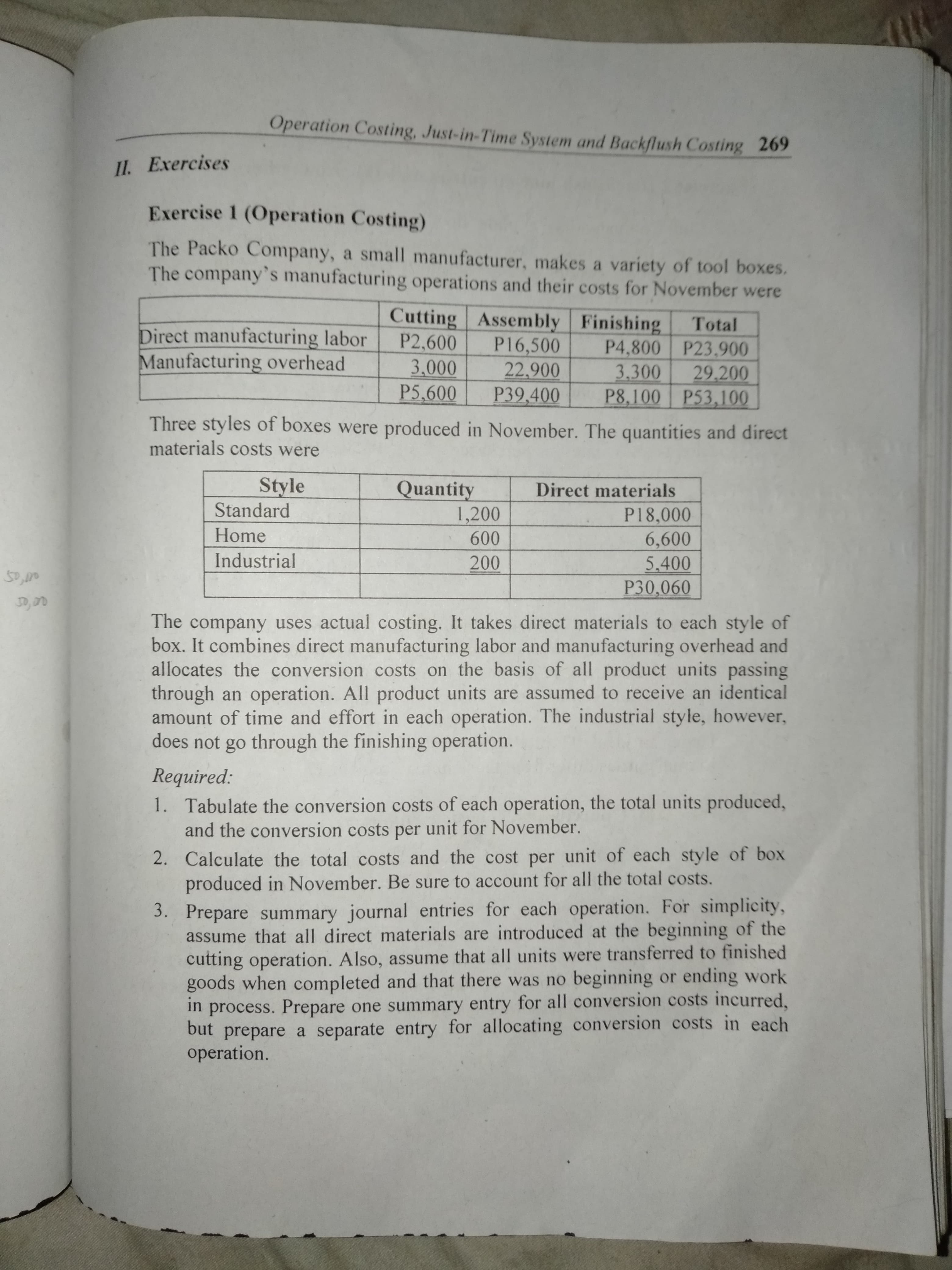

Operation Costing, Just-in-Time System and Backflush Costing 269 11. Exercises Exercise 1 (Operation Costing) The Packo Company, a small manufacturer, makes a variety of tool boxes. The company's manufacturing operations and their costs for November were Cutting Assembly Finishing P16,500 22.900 P39,400 Total Direct manufacturing labor Manufacturing overhead P2,600 3.000 P5,600 P4,800 P23.900 3.300 29,200 P8,100 P53,100 Three styles of boxes were produced in November. The quantities and direct materials costs were Style Standard Quantity 1,200 600 Direct materials P18,000 6,600 5.400 P30,060 Home Industrial 200 The company uses actual costing. It takes direct materials to each style of box. It combines direct manufacturing labor and manufacturing overhead and allocates the conversion costs on the basis of all product units passing through an operation. All product units are assumed to receive an identical amount of time and effort in each operation. The industrial style, however, does not go through the finishing operation. Required: 1. Tabulate the conversion costs of each operation, the total units produced, and the conversion costs per unit for November. 2. Calculate the total costs and the cost per unit of each style of box produced in November. Be sure to account for all the total costs. 3. Prepare summary journal entries for each operation. For simplicity, assume that all direct materials are introduced at the beginning of the cutting operation. Also, assume that all units were transferred to finished goods when completed and that there was no beginning or ending work in process. Prepare one summary entry for all conversion costs incurred, but prepare a separate entry for allocating conversion costs in each operation.

Operation Costing, Just-in-Time System and Backflush Costing 269 11. Exercises Exercise 1 (Operation Costing) The Packo Company, a small manufacturer, makes a variety of tool boxes. The company's manufacturing operations and their costs for November were Cutting Assembly Finishing P16,500 22.900 P39,400 Total Direct manufacturing labor Manufacturing overhead P2,600 3.000 P5,600 P4,800 P23.900 3.300 29,200 P8,100 P53,100 Three styles of boxes were produced in November. The quantities and direct materials costs were Style Standard Quantity 1,200 600 Direct materials P18,000 6,600 5.400 P30,060 Home Industrial 200 The company uses actual costing. It takes direct materials to each style of box. It combines direct manufacturing labor and manufacturing overhead and allocates the conversion costs on the basis of all product units passing through an operation. All product units are assumed to receive an identical amount of time and effort in each operation. The industrial style, however, does not go through the finishing operation. Required: 1. Tabulate the conversion costs of each operation, the total units produced, and the conversion costs per unit for November. 2. Calculate the total costs and the cost per unit of each style of box produced in November. Be sure to account for all the total costs. 3. Prepare summary journal entries for each operation. For simplicity, assume that all direct materials are introduced at the beginning of the cutting operation. Also, assume that all units were transferred to finished goods when completed and that there was no beginning or ending work in process. Prepare one summary entry for all conversion costs incurred, but prepare a separate entry for allocating conversion costs in each operation.

Chapter5: Process Costing

Section: Chapter Questions

Problem 2PB: The following product costs are available for Kellee Company on the production of eyeglass frames:...

Related questions

Question

Transcribed Image Text:Operation Costing, Just-in-Time System and Backflush Costing 269

11. Exercises

Exercise 1 (Operation Costing)

The Packo Company, a small manufacturer, makes a variety of tool boxes.

The company's manufacturing operations and their costs for November were

Cutting Assembly Finishing

P16,500

22.900

P39,400

Total

Direct manufacturing labor

Manufacturing overhead

P2,600

3.000

P5,600

P4,800 P23.900

3.300

29,200

P8,100 P53,100

Three styles of boxes were produced in November. The quantities and direct

materials costs were

Style

Standard

Quantity

1,200

600

Direct materials

P18,000

6,600

5.400

P30,060

Home

Industrial

200

The company uses actual costing. It takes direct materials to each style of

box. It combines direct manufacturing labor and manufacturing overhead and

allocates the conversion costs on the basis of all product units passing

through an operation. All product units are assumed to receive an identical

amount of time and effort in each operation. The industrial style, however,

does not go through the finishing operation.

Required:

1. Tabulate the conversion costs of each operation, the total units produced,

and the conversion costs per unit for November.

2. Calculate the total costs and the cost per unit of each style of box

produced in November. Be sure to account for all the total costs.

3. Prepare summary journal entries for each operation. For simplicity,

assume that all direct materials are introduced at the beginning of the

cutting operation. Also, assume that all units were transferred to finished

goods when completed and that there was no beginning or ending work

in

process. Prepare one summary entry for all conversion costs incurred,

but prepare a separate entry for allocating conversion costs in each

operation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning