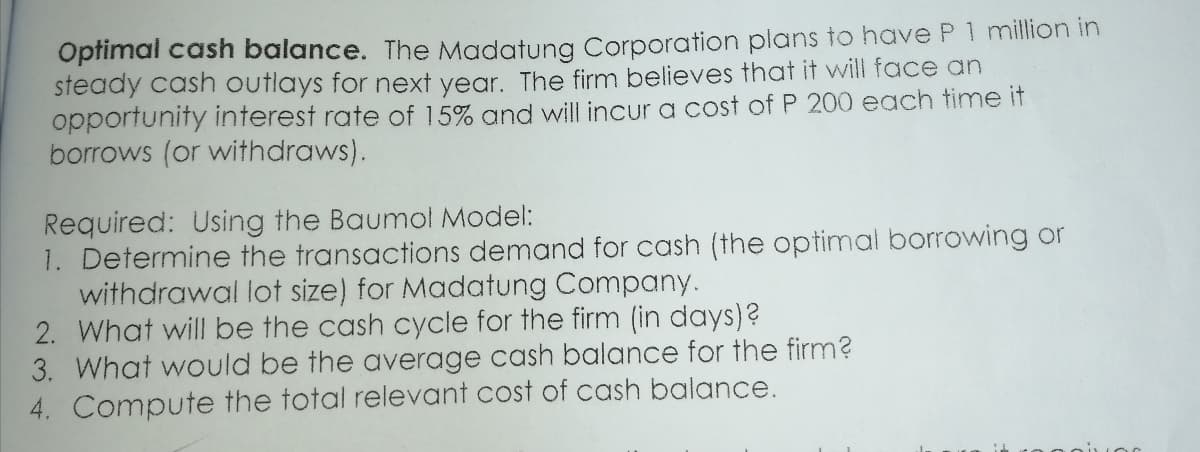

Optimal cash balance. The Madatung Corporation plans to have P1 million I steady cash outlays for next year. The firm believes that it will face an opportunity interest rate of 15% and will incur a cost of P 200 each time it borrows (or withdraws).

Optimal cash balance. The Madatung Corporation plans to have P1 million I steady cash outlays for next year. The firm believes that it will face an opportunity interest rate of 15% and will incur a cost of P 200 each time it borrows (or withdraws).

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter23: Other Topics In Working Capital Management

Section: Chapter Questions

Problem 2P: Optimal Cash Transfer Barenbaum Industries projects that cash outlays of 4.5 million will occur...

Related questions

Question

Transcribed Image Text:Optimal cash balance. The Madatung Corporation plans to have P 1 million in

steady cash outlays for next year. The firm believes that it will face an

opportunity interest rate of 15% and will incur a cost of P 200 each time it

borrows (or withdraws).

Required: Using the Baumol Model:

1. Determine the transactions demand for cash (the optimal borrowing or

withdrawal lot size) for Madatung Company.

2. What will be the cash cycle for the firm (in days)?

3. What would be the average cash balance for the firm?

4. Compute the total relevant cost of cash balance.

Jor

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT