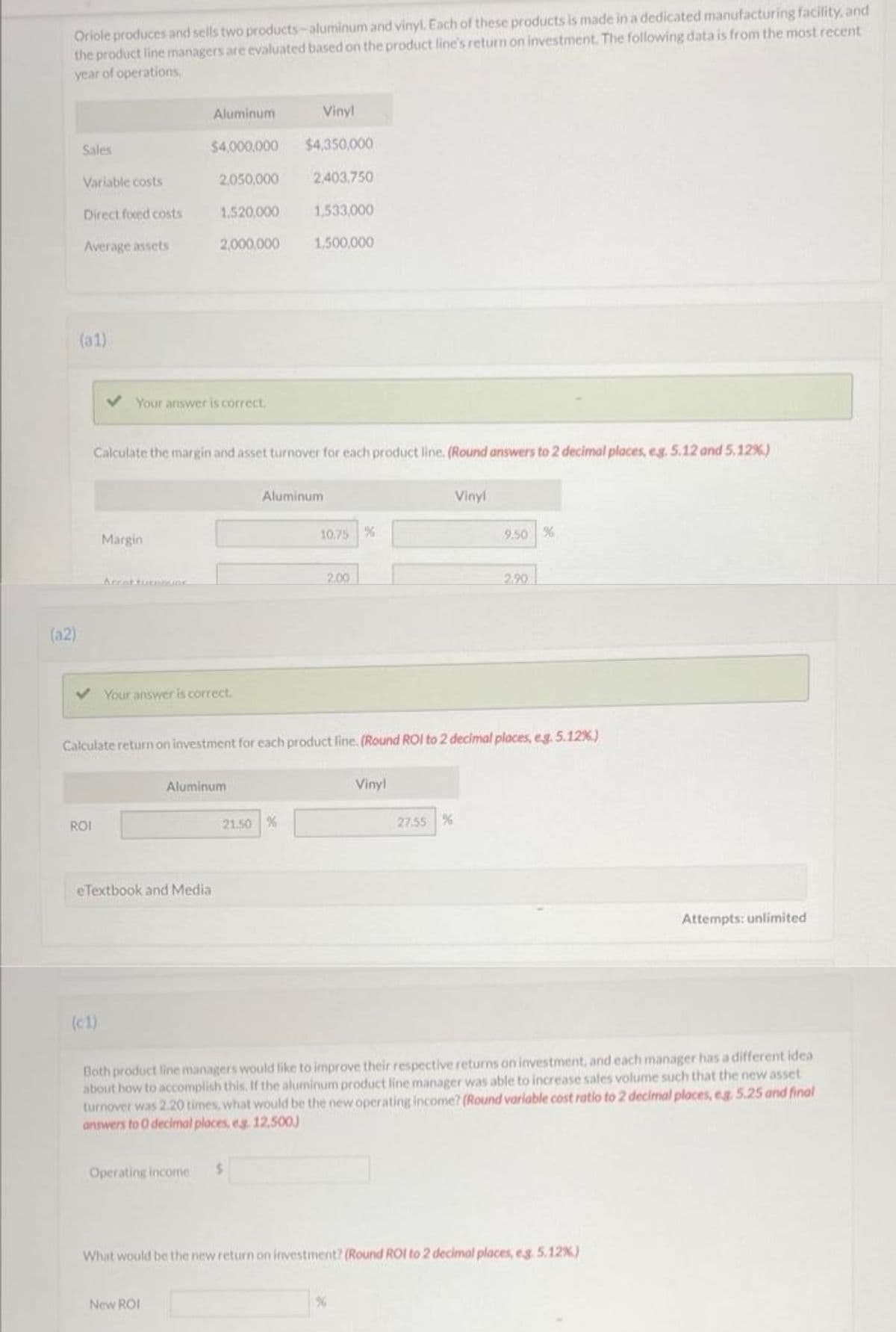

Oriole produces and sells two products-aluminum and vinyl. Each of these products is made in a dedicated manufacturing facility, al the product line managers are evaluated based on the product line's return on investment. The following data is from the most recent year of operations Aluminum Vinyl Sales $4,000,000 $4,350,000 Variable costs 2,050,000 2,403,750 Direct fixed costs 1,520,000 1,533,000 Average assets 2,000,000 1,500,000 (31) Your answer is correct. Calculate the margin and asset turnover for each product line. (Round answers to 2 decimal places, eg. 5.12 and 5,12%) Aluminum Vinyl Margin 10.75 % 9.50 % Acent turnoune 2.00 2.90

Oriole produces and sells two products-aluminum and vinyl. Each of these products is made in a dedicated manufacturing facility, al the product line managers are evaluated based on the product line's return on investment. The following data is from the most recent year of operations Aluminum Vinyl Sales $4,000,000 $4,350,000 Variable costs 2,050,000 2,403,750 Direct fixed costs 1,520,000 1,533,000 Average assets 2,000,000 1,500,000 (31) Your answer is correct. Calculate the margin and asset turnover for each product line. (Round answers to 2 decimal places, eg. 5.12 and 5,12%) Aluminum Vinyl Margin 10.75 % 9.50 % Acent turnoune 2.00 2.90

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter15: Lean Accounting And Productivity Measurement

Section: Chapter Questions

Problem 13E: Carsen Company produces handcrafted pottery that uses two inputs: materials and labor. During the...

Related questions

Question

Transcribed Image Text:Oriole produces and sells two products-aluminum and vinyl. Each of these products is made in a dedicated manufacturing facility, and

the product line managers are evaluated based on the product line's return on investment. The following data is from the most recent

year of operations,

Aluminum

Vinyl

Sales

$4,000,000

$4,350,000

Variable costs

2,050,000 2,403,750

Direct fixed costs

1,520,000

1,533,000

Average assets

2,000,000

1,500,000

(31)

Your answer is correct.

Calculate the margin and asset turnover for each product line. (Round answers to 2 decimal places, eg. 5.12 and 5,12%)

Aluminum

Vinyl

Margin

10.75 %

9.50 %

2.00

2.90

Your answer is correct.

Calculate return on investment for each product line. (Round ROI to 2 decimal places, e.g. 5.12 %)

Aluminum

Vinyl

ROI

21.50 %

27.55 %

eTextbook and Media

Attempts: unlimited

Both product line managers would like to improve their respective returns on investment, and each manager has a different idea

about how to accomplish this. If the aluminum product line manager was able to increase sales volume such that the new asset

turnover was 2.20 times, what would be the new operating income? (Round variable cost ratio to 2 decimal places, eg. 5.25 and final

answers to 0 decimal places, eg. 12,500)

Operating income $

What would be the new return on investment? (Round ROI to 2 decimal places, e.g. 5.12%)

New ROI

(a2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning