or a certain economy, let the following data is measured in million birr Net foreign expenditure (3,000) Wage and salary of labors (8,000) Government Transfers to Individuals (3000) Rent of land and physical capitals (6.000) Government expenditure (10,000) Domestic consumption expenditure (12,000) Dividends (2,000) Interest of saving and financial capital (4,000) Profit of proprietor (sole proprietorship and partnership firms) (3.000) Undistributed corporate profit (corporate income tax + dividend +retained earning) (5,000) Indirect business tax (VAT, sales tax, excise tax) (7.000) Net Interest (public and personal) (7.000) Depreciation of fixed capital (2,000) Population number in million (9,000) Statistical discrepancy (error in measuring) (+1,000) Business Investment expenditure (11.000) Net factor income (4,000) Social Insurance Contributions (5,000) Personal Interest on Income (5,000) Personal income tax and non-tax payments (6,000) A) Calculate GDP using income approach B) Calculate GDP using expenditure approach C) Calculate GNP D) Calculate NDP J) GDP per capita E) Calculate NNP F) Calculate NI G) Calculate PI H) Calculate DPI

or a certain economy, let the following data is measured in million birr Net foreign expenditure (3,000) Wage and salary of labors (8,000) Government Transfers to Individuals (3000) Rent of land and physical capitals (6.000) Government expenditure (10,000) Domestic consumption expenditure (12,000) Dividends (2,000) Interest of saving and financial capital (4,000) Profit of proprietor (sole proprietorship and partnership firms) (3.000) Undistributed corporate profit (corporate income tax + dividend +retained earning) (5,000) Indirect business tax (VAT, sales tax, excise tax) (7.000) Net Interest (public and personal) (7.000) Depreciation of fixed capital (2,000) Population number in million (9,000) Statistical discrepancy (error in measuring) (+1,000) Business Investment expenditure (11.000) Net factor income (4,000) Social Insurance Contributions (5,000) Personal Interest on Income (5,000) Personal income tax and non-tax payments (6,000) A) Calculate GDP using income approach B) Calculate GDP using expenditure approach C) Calculate GNP D) Calculate NDP J) GDP per capita E) Calculate NNP F) Calculate NI G) Calculate PI H) Calculate DPI

Chapter6: Tracking The U.s. Economy

Section: Chapter Questions

Problem 1.3P

Related questions

Question

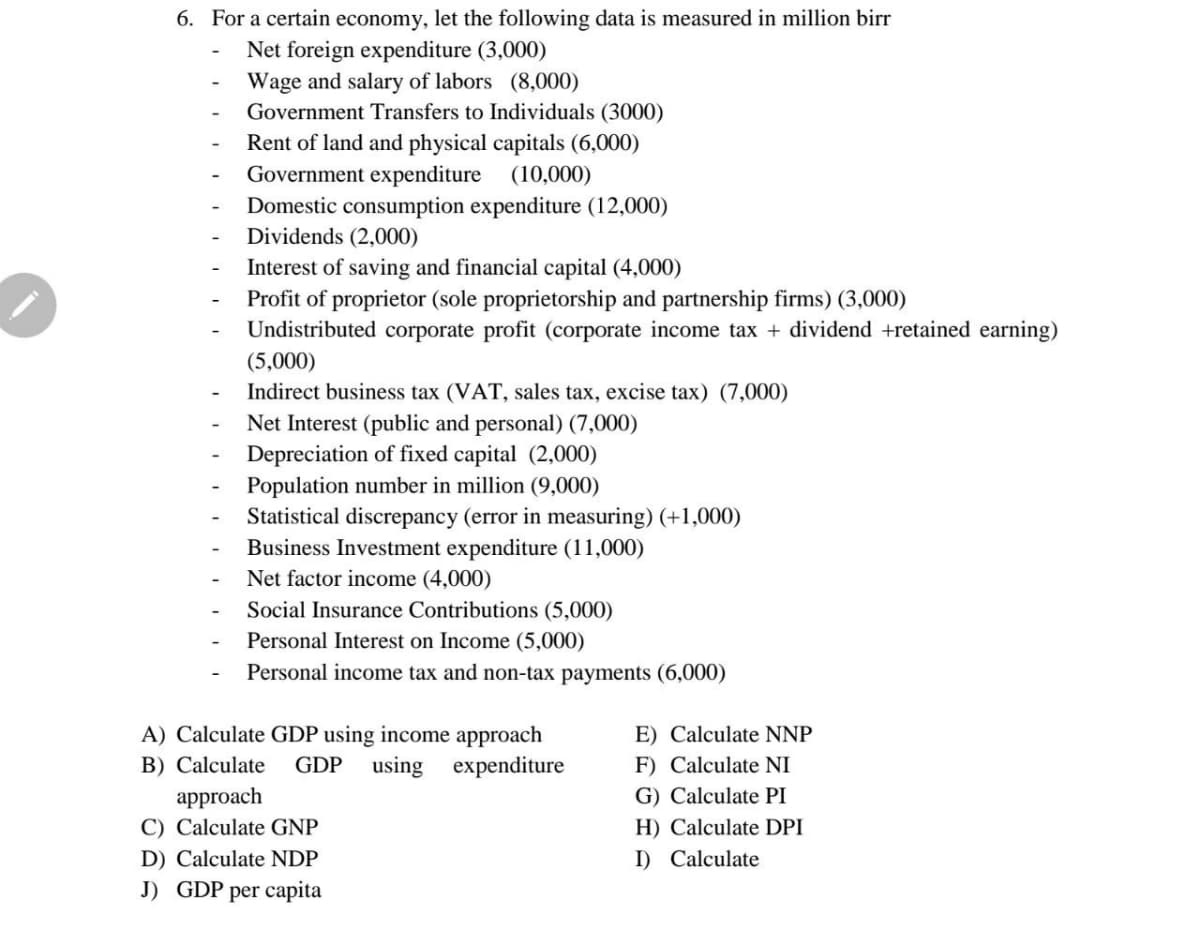

For a certain economy, let the following data is measured in million birr

Net foreign expenditure (3,000) Wage and salary of labors (8,000)

Government Transfers to Individuals (3000)

Rent of land and physical capitals (6.000) Government expenditure (10,000)

Domestic consumption expenditure (12,000)

Dividends (2,000)

Interest of saving and financial capital (4,000)

Profit of proprietor (sole proprietorship and partnership firms) (3.000) Undistributed corporate profit (corporate income tax + dividend +retained earning ) (5,000)

Indirect business tax (VAT, sales tax, excise tax) (7.000) Net Interest (public and personal) (7.000)

Depreciation of fixed capital (2,000)

Population number in million (9,000)

Statistical discrepancy (error in measuring) (+1,000) Business Investment expenditure (11.000)

Net factor income (4,000)

Social Insurance Contributions (5,000)

Personal Interest on Income (5,000)

Personal income tax and non-tax payments (6,000)

A) Calculate GDP using income approach B) Calculate GDP using expenditure

approach

C) Calculate GNP

D) Calculate NDP

J) GDP per capita

E) Calculate NNP

F) Calculate NI

G) Calculate PI

H) Calculate DPI

Transcribed Image Text:6. For a certain economy, let the following data is measured in million birr

Net foreign expenditure (3,000)

Wage and salary of labors (8,000)

Government Transfers to Individuals (3000)

Rent of land and physical capitals (6,000)

Government expenditure

(10,000)

Domestic consumption expenditure (12,000)

Dividends (2,000)

Interest of saving and financial capital (4,000)

Profit of proprietor (sole proprietorship and partnership firms) (3,000)

Undistributed corporate profit (corporate income tax + dividend +retained earning)

(5,000)

Indirect business tax (VAT, sales tax, excise tax) (7,000)

Net Interest (public and personal) (7,000)

Depreciation of fixed capital (2,000)

Population number in million (9,000)

Statistical discrepancy (error in measuring) (+1,000)

Business Investment expenditure (11,000)

Net factor income (4,000)

Social Insurance Contributions (5,000)

Personal Interest on Income (5,000)

Personal income tax and non-tax payments (6,000)

A) Calculate GDP using income approach

GDP using expenditure

E) Calculate NNP

B) Calculate

F) Calculate NI

approach

G) Calculate PI

C) Calculate GNP

H) Calculate DPI

D) Calculate NDP

I) Calculate

J) GDP per capita

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning