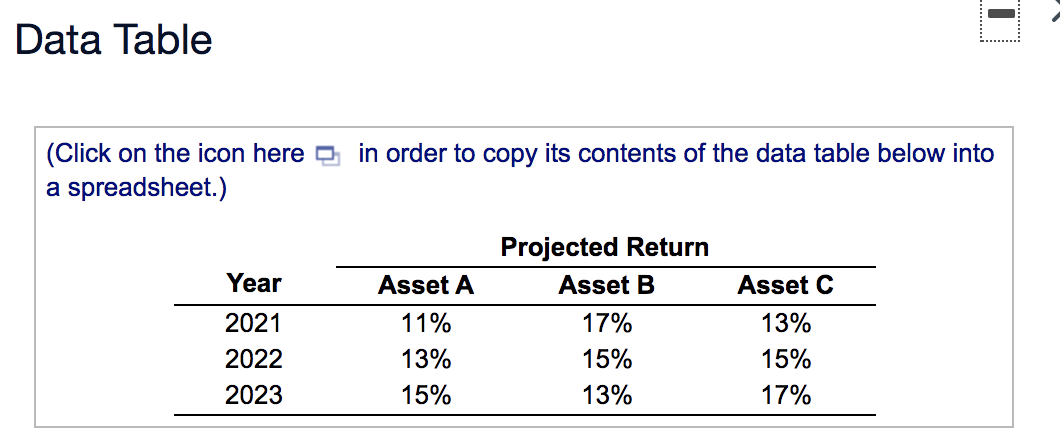

a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, rp, for each of the portfolios?

Q: Ayayai Industries is considering the purchase of new equipment costing $1,500,000 to replace…

A: NPV represents the value generated by an investment or a project expressed in absolute profitability…

Q: 1. Determine the internal rate of return of Investment X and Investment Y. Should X and Y be…

A: We can determine the IRR of each investment using the formula below. IRR = FVInitial…

Q: Sub : Finance Pls answer very fast.I ll upvote CORRECT ANSWER . Thank You( Dnt use CHATGPT ) If a…

A: The Economic Value Added (EVA), often known as Economic Profit, is a metric based on the Residual…

Q: Which of the following is generally excluded in estimating the weighted average cost of capital? a.…

A: Weighted Average Cost of Capital is a weighted average of the components costs of long-term debt,…

Q: TSLA stock price is currently at $600. The $700-strike European TSLA call option expiring on March…

A: To compute the Black-Scholes delta of a put option, we can use the put-call parity relationship and…

Q: Use the data in the tables below to answer the following questions: Average rates of return on…

A: Businesses examine possible significant projects or expenditures using the capital budgeting…

Q: Consider the following table, which gives a security analyst's expected return on two stocks in two…

A: The beta of the stock refers to the measurement of the stock movement in the overall market. The…

Q: Explain the graph using examples.

A: A long position in call option provides its holder the right to purchase the option at the…

Q: Flowers by Irene Inc. is also considering financing the project with 50% equity and 50% debt. The…

A: Businesses utilize the capital budgeting process to assess possible big projects or investments.…

Q: Suppose today is January 1, 2024 and you are given two options: a. an annuity that pays you 1000…

A: Annuity is fixed amount being paid at each year for the fixed period of time Perpetuity is fixed…

Q: The following information is given about an Option on a stock: S(0)=$31, X-$34, rf-9%, variance…

A: Please note that under the answering guidelines only up to 3 subparts can be answered. Kindly repost…

Q: a) What is the price of a European put option on the same stock that expires in 8months and has a…

A: Using Put Call Parity formula, we can determine the price of the put option. The formula is as…

Q: How long will it take $2400 to grow into $5760 if it's insested at 6% interest compounded…

A: Present Value = pv = $2400 Future Value = fv = $5760 Interest Rate = r = 6% Time = t = ?

Q: Denali Inc. is acquiring Whitney Corp. at an exchange ratio of 2:1. After the deal is announced,…

A: Merger arbitrage refers to the opportunity of earning profits from the disparity of the stock prices…

Q: Your company currently has $1,000 par, 5.25% coupon bonds with 10 years to maturity and a price of…

A: Bonds are the company's liabilities issued to raise the funds required to finance the company's…

Q: Chik's Chickens has accounts receivable of $5,533. Sales for the year were $9,000. What is its…

A: Average collection period = Accounts receivable * 365 / Net sales

Q: Jacob is a member of his employers defined contribution pension plan. He has pensionable earnings of…

A: As per Bartleby guidelines, only one question can be solved at a time. Please reupload other…

Q: Lucky Larry wins $6,000,000 in a state lottery. The standard way in which the state pays such…

A: Payment = p = $240,000 Time = t = 25 years Interest rate = r = 5%

Q: You are considering investing in a project with an initial outlay of $50,000 and the following year…

A: Internal Rate of Return better known as IRR is a discounting capital budgeting technique. IRR is the…

Q: Suppose a ten-year, $1,000 bond with an 8.4% coupon rate and semiannual coupons is trading for…

A: Bonds refer to the financial instrument issued for providing funds to the borrower by the…

Q: You would like to have $550,000 when you retire in 35 years. How much should you invest each quarter…

A: The amount that a present investment will gain in value over time when kept in a compound interest…

Q: A 5-year floating-rate security was issued on 1 January 2015. The coupon rate formula was 1-year…

A: LIBOR stands for the London Interbank Offered Rate. It is a benchmark interest rate that indicates…

Q: Country Bank has $350,000 of 6% debenture bonds outstanding. The bonds were issued at 106 in 2021…

A: Debenture issued at premium of 106 Total amount = $350000 Interest rate = 6% Maturity = 20 years

Q: Calculate the cost of capital of a bond selling to yeild 13% for the purchaser of the bond. The…

A: Yield to purchaser = r = 13% Tax rate = t = 34%

Q: You have decided to purchase a house. The house has a current price of $300,000 and you plan on…

A: A mortgage refers to a loan borrowed for purchasing a property where the property itself is the…

Q: You have a 25-year $400,000 mortgage with a 3.5% rate of interest (compounded monthly) that you make…

A: As per instructions, the solution will be provided on TI BA II Plus calculator. First, we need to…

Q: You have been asked by the president of your company to evaluate the proposed acquisition of a new…

A: NPV net present value is the difference between the present value of cash flow and initial…

Q: An investor purchased a fixed-coupon bond at a time when the bond's yield to maturity was 6.9%. The…

A: Yield-to-maturity (YTM) refers to the annualized return that is provided by the bond if an investor…

Q: 6. Below is a list of daily Treasury note and bond listings from Wall Street Journal. Treasury bonds…

A: A treasury bond is a kind of debt security issued by the government and private companies for…

Q: 16. What is the total variance of the following portfolio including 2 assets invested in the ratio…

A: Formula to be used: Portfolio variance=(WA2 x σ2A)+(WB2 x σ2B)+ (2 x WA x σA x WB x σB x r) Data…

Q: ( a contractor want to invest his money in on of project A or B if you know that the interest rate…

A: Net present worth represents the value generated by a project or an investment in absolute…

Q: TikTok is considering a project that will cost $ 800,000 and is expected to last for 10 years and…

A: The internal rate of return the rate of return which generated by project and it is calculated on…

Q: Assume the spot Swiss franc is $0.7045 and the six-month forward rate is $0.7040. What is the Value…

A: An option is a type of financial instrument that is based on the value of underlying securities,…

Q: Bramble Corporation had net credit sales of $14100000 and cost of goods sold of $9370000 for the…

A: Here, Net Credit Sales is $14100000 Cost of Goods Sold is $9370000 Average Inventory is $1171250

Q: Old Economy Traders opened an account to short-sell 1,000 shares of Internet Dreams at $40 per…

A: According to bartleby guidelines , if question involves multiple sub parts , then 1 st sub 3 parts…

Q: Returns of a Single Asset. Suppose you have invested in 2 assets whose annual returns are shown in…

A: Data given: Asset A Asset B Year Annual Return Year Annual Return 1 -6.01% 1 -9.98% 2…

Q: nvestors choose deri tives

A: derivatives are financial instruments whose value is derived from an underlying asset such as bonds…

Q: For this assignment, discuss how the finance function is interrelated and connected to the other…

A: A company's finance department is in charge of overseeing the organization's finances and making…

Q: Beryl's Iced Tea currently rents a bottling machine for $52 000 per year, including all maintenance…

A: As per the given information: Rent of a bottling machine - $52,000a. Purchase price - $155,000 ;…

Q: Finance what is cost of equity as an effective annual rate given that they pay semi annually,…

A: Cost of equity is also known as KE. It is that cost which is incurred by the company for financing…

Q: Required information A potential investment has a cost of $425,000 and a useful life of 5 years.…

A: Annual cash inflows are the cash inflows incurred during the year for the purpose of calculating the…

Q: Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The…

A: NPV is also known as Net present value. It is a capital budgeting techniques which help in decision…

Q: XYZ Co is considering to purchase equipment that has 4 years of life and requires an initial capital…

A: Npv is a capital budgeting techniques. Which help in decision making on the basis of future cash…

Q: The face value of a bond is $78,000, its stated rate is 7%, and the term of the bond is five years.…

A: Face value of Bond=$78,000 Interest rate=7%=7%/2=3.5% Market rate-8%=8%/2=4% Term=5 years=5*2=10…

Q: 3. Company WACC is 20%. Debt interest rate is 4% and D/ E ratio is 1,6. What is the cost of equity?…

A: Weighted Average Cost of Capital = WACC = 20% Cost of debt = 4% Debt equity Ratio = 1.6

Q: 37) You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P,…

A: To solve the question we first need to determine the expected return of the risky portfolio and then…

Q: The S&P 500 declined 38.49 percent during 2008, its third-worse performance in history. (The largest…

A: Calculate the remaining value after the decline. To determine the remaining value after a decline of…

Q: Duo Corporation is evaluating a project with the following cash flows. The company uses a discount…

A: Here, Year Cash flows 0 $-15,400.00 1 $ 6,500.00 2 $ 7,700.00 3 $ 7,300.00…

Q: Sheffield Company has hired a consultant to propose a way to increase the company's revenues. The…

A: Net Present Value:— It is the difference between the present value of cash flows and initial capital…

Q: The following financial data for a firm is provided to you. Calculate the Operating Cash Flow and…

A: Operating cash flow (OCF) the cash flow a firm generates from its normal operations calculated as…

Step by step

Solved in 3 steps with 3 images

- A particular firm’s portfolio is composed of two assets, which we will call" A" and "B." Let X denote the annual rate of return from asset A, and let Y denote the annual rate of return from asset B. Suppose that E(X) = 0.15, E(Y) = 0.20, SD (X) = 0.05, SD (Y) = 0.06, and CORR (X, Y) = 0.30. Use a spreadsheet to perform the following analysis. (a) What is the expected return of investing 50% of the portfolio in asset A and 50% of the portfolio in asset B? What is the variance of this return? (b) Replace CORR (X, Y) = 0.30 by CORR (X, Y) = 0.60, 0, -0.30, and -0.60 and answer the questions in part (a). What is the impact of correlation on the expected returns and its variance? Explain why this is so. (c) Suppose that the fraction of the portfolio that is invested in asset B is f, and so the fraction of the portfolio that is invested in asset A is (1 – f). Let f vary from f = 0.0 to f = 1.0 in increments of 5% (that is, f = 0.0, 0.05, 0.10, 0.15, ...), and compute the mean and the…Leon has in his investment a portfolio that paid him the rate of returns of 14 %, -13%, 15.6%, 17% and 19.5% over the past five years. Required: a)Calculate the arithmetic average return (AAR) and geometric average return (GAR) of the portfolio? If someone asks you what is the actual compounding rate of return of Leon’s portfolio over the past five year, which one (AAR or GAR) will be a better answer? b)Following is forecast for economic situation and Leon’s portfolio returns next year, calculate the expected return, variance and standard deviation of the portfolio. State of economy Probability Rate of returns Mild Recession 0.25 -2.5% Normal 0.45 13.5% Growth 0.30 20% c) Assume that expected return of the stock A in Leon’s portfolio is 13.2%. Beta of this stock is 1.2, risk free rate is 3.5%. Calculate market portfolio rate of return, which is used to compute the expected return of this stock by Capital Asset Pricing Model (CAPM)?Leon has in his investment a portfolio that paid him the rate of returns of 14 %, -13%, 15.6%, 17% and 19.5% over the past five years. Required: Calculate the arithmetic average return (AAR) and geometric average return (GAR) of the portfolio? If someone asks you what is the actual compounding rate of return of Leon’s portfolio over the past five year, which one (AAR or GAR) will be a better answer? (2 marks) Following is forecast for economic situation and Leon’s portfolio returns next year, calculate the expected return, variance and standard deviation of the portfolio. (4 marks) State of economy Probability Rate of returns Mild Recession 0.25 -2.5% Normal 0.45 13.5% Growth 0.30 20% c) Assume that expected return of the stock A in Leon’s portfolio is 13.2%. Beta of this stock is 1.2, risk free rate is 3.5%. Calculate market portfolio rate of return, which is used to compute the expected return of this stock by Capital Asset Pricing Model…

- Suppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below (Attached image). Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?You are going to invest $50,000 in a portfolio consisting of assets X, Y, and Z, as follows; What is the expected return of this portfolio? Calculate the beta coefficient of the portfolioTalal can pick one of two investment portfolios - A and B. Each requires an initial outlay of $100,000 and each has a most likely annualrate of return of 18%. Estimated the returns associated with each investment. Past estimates indicate that the probabilities of thepessimistic, most likely, and optimistic outcomes are 30%, 50%, and 20%, respectively. Note that the sum of these probabilities mustequal 100%; that is, they must be based on all the alternatives considered.Question:1. Explain him about risk aversion, risk neutrality and risk seeking on the bases of standard deviation and coefficient of variation.DetailsAsset AAsset B1.Initial Investment$100.000$100,000Rate of Return - Pessimistic16%10%Rate of Return - Most likely18%18%Rate of Return - Optimistic20%26%

- You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviations for five different well-diversified portfolios of risky assets:Portfolio Expected Return Standard DeviationQ 7.8% 10.5%R 10.0 14.0S 4.6 5.0T 11.7 18.5U 6.2 7.5a. For each portfolio, calculate the risk premium per unit of risk that you expect to receive ([E(R) − RFR]/σ). Assume that the risk-free rate is 3.0 percent.b. Using your computations in Part a, explain which of these five portfolios is most likely tobe the market portfolio. Use your calculations to draw the capital market line (CML).c. If you are only willing to make an investment with σ = 7.0%, is it possible for you toearn a return of 7.0 percent?d. What is the minimum level of risk that would be necessary for an investment to earn7.0 percent? What is the composition of the portfolio along the CML that will generatethat expected return?e. Suppose you are now willing to make an investment…David established an investment portfolio of two blue chips four years ago: Gold share and Silver Bond. Gold share accounts for 65% of his investment portfolio. Required: If David’s portfolio has provided the returns of 9.5%, 11.3%, - 12.5% and 15.6% over the past four years, respectively. Calculate geometric average return of the portfolio for this period? Assume that the below data is available for David’s portfolio performance, calculate the expected return, variance and standard deviation of the portfolio. Assume that expected return of the Gold share in David’s portfolio is 14.5%. The share’s beta coefficient is 1.5. Market risk premium is 7.5. Calculate the risk-free rate using Capital Asset Pricing Model Assume that David bought 2000 of Gold shares in his portfolio for a price of $75 each, the dividend paid for this stock is $7/stock each year. The current market price of this share is $135. Calculate the capital gain yield of this investment after four yearsYou are going to invest $20,000 in a portfolio consisting of assets X, Y, and Z, as follows: Asset Annual Return Probability Beta Proportion X 10% 0.50 1.2 0.333 Y 8% 0.25 1.6 0.333 Z 16% 0.25 2.0 0.333 Given the information in Table 5.2, The beta of the portfolio in Table 8.2, containing assets X, Y, and Z is ________. Select one: a. 1.6 b. 2.0 c. 1.5 d. 2.4

- Suppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below. A B C Probabilities return 0.05 0.50% -3.60% 3.60% 0.35 0.60% 2.75% 0.15% 0.45 3.66% 1.45% 0.45% 0.15 -4.80% -0.60% 6.30% Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?You have a portfolio of three assets at the beginning of the year: Asset 1 is 30% of the portfolio, Asset 2 is 40% of the portfolio, and Asset 3 is 30% of the portfolio. During the year, Asset 1 has a return of 4%, Asset 2 has a return of 12%, and Asset 3 has a return of -20%. What was the return on your portfolio for the year?Assume you are considering a portfolio containing Asset 1 and Asset 2. Asset 1 will represent 37% of the dollar value of the portfolio, and asset 2 will account for the other 63%. Assume that the portfolio is rebalanced at the end of each year. The expected returns over the next 6 years, 2021–2026, for each of these assets are summarized in the following table: Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Projected Return Year Asset L Asset M 2021 −9% 33% 2022 15% 5% 2023 26% −9% 2024 4% 18% 2025 −9% 33% 2026 33% −18% . a. Calculate the expected portfolio return, rp, for each of the 6 years. b. Calculate the average expected portfolio return, rp, over the 6-year period. c. Calculate the standard deviation of expected portfolio returns, sp, over…