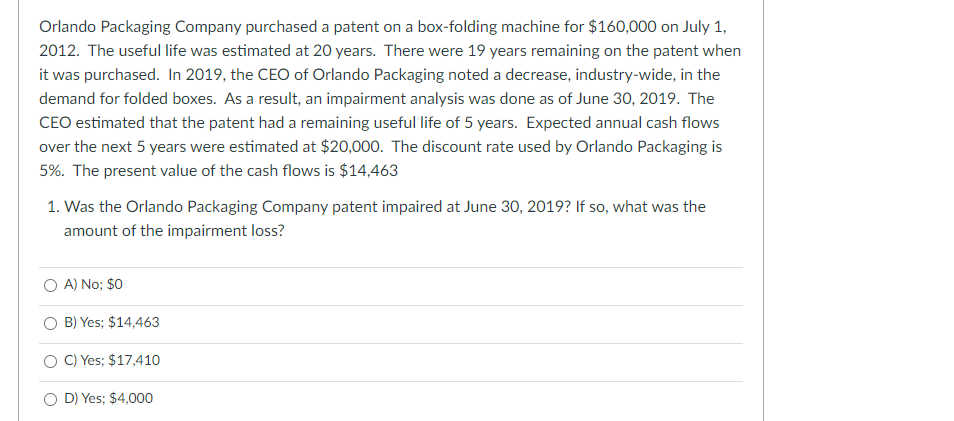

Orlando Packaging Company purchased a patent on a box-folding machine for $160,000 on July 1, 2012. The useful life was estimated at 20 years. There were 19 years remaining on the patent when it was purchased. In 2019, the CEO of Orlando Packaging noted a decrease, industry-wide, in the demand for folded boxes. As a result, an impairment analysis was done as of June 30, 2019. The CEO estimated that the patent had a remaining useful life of 5 years. Expected annual cash flows over the next 5 years were estimated at $20,000. The discount rate used by Orlando Packaging is 5%. The present value of the cash flows is $14,463 1. Was the Orlando Packaging Company patent impaired at June 30, 2019? If so, what was the amount of the impairment loss? O A) No; $0 O B) Yes; $14,463 O C) Yes; $17,410 O D) Yes; $4,000

Orlando Packaging Company purchased a patent on a box-folding machine for $160,000 on July 1, 2012. The useful life was estimated at 20 years. There were 19 years remaining on the patent when it was purchased. In 2019, the CEO of Orlando Packaging noted a decrease, industry-wide, in the demand for folded boxes. As a result, an impairment analysis was done as of June 30, 2019. The CEO estimated that the patent had a remaining useful life of 5 years. Expected annual cash flows over the next 5 years were estimated at $20,000. The discount rate used by Orlando Packaging is 5%. The present value of the cash flows is $14,463 1. Was the Orlando Packaging Company patent impaired at June 30, 2019? If so, what was the amount of the impairment loss? O A) No; $0 O B) Yes; $14,463 O C) Yes; $17,410 O D) Yes; $4,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 10PB: For each of the following unrelated situations, calculate the annual amortization expense and...

Related questions

Question

Transcribed Image Text:Orlando Packaging Company purchased a patent on a box-folding machine for $160,000 on July 1,

2012. The useful life was estimated at 20 years. There were 19 years remaining on the patent when

it was purchased. In 2019, the CEO of Orlando Packaging noted a decrease, industry-wide, in the

demand for folded boxes. As a result, an impairment analysis was done as of June 30, 2019. The

CEO estimated that the patent had a remaining useful life of 5 years. Expected annual cash flows

over the next 5 years were estimated at $20,000. The discount rate used by Orlando Packaging is

5%. The present value of the cash flows is $14,463

1. Was the Orlando Packaging Company patent impaired at June 30, 2019? If so, what was the

amount of the impairment loss?

O A) No; $0

O B) Yes; $14,463

C) Yes; $17,410

O D) Yes; $4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT