osting Johnson Inc. is a job-order manufacturing company that uses a predetermined overhead rate based on direct labor ours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 95,000 and estimated factory overhead s $617,500. The following information is for September of the current year. Job A was completed during September, and Job B was tarted but not finished. September 1, Inventories Materials Inventory $ 7,500 Work-in-Process Inventory (All Job A) 31,200 Finished Goods Inventory 67,000 Material purchases 104,000 Direct materials requisitioned Job A 65,000 Job B 33,500 Direct labor hours Job A 4,200 Job B 3,500 Labor costs incurred Direct labor ($8.50/hour) $65,450 Indirect labor 13,500 Supervisory salaries 6,000 Rental costs Factory 7,000 Administrative offices 1,800 Total equipment depreciation costs Factory 7,500 Administrative offices 1,600

osting Johnson Inc. is a job-order manufacturing company that uses a predetermined overhead rate based on direct labor ours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 95,000 and estimated factory overhead s $617,500. The following information is for September of the current year. Job A was completed during September, and Job B was tarted but not finished. September 1, Inventories Materials Inventory $ 7,500 Work-in-Process Inventory (All Job A) 31,200 Finished Goods Inventory 67,000 Material purchases 104,000 Direct materials requisitioned Job A 65,000 Job B 33,500 Direct labor hours Job A 4,200 Job B 3,500 Labor costs incurred Direct labor ($8.50/hour) $65,450 Indirect labor 13,500 Supervisory salaries 6,000 Rental costs Factory 7,000 Administrative offices 1,800 Total equipment depreciation costs Factory 7,500 Administrative offices 1,600

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 4BE: Applying factory overhead Bergan Company estimates that total factory overhead costs will be 620,000...

Related questions

Question

Transcribed Image Text:4-33

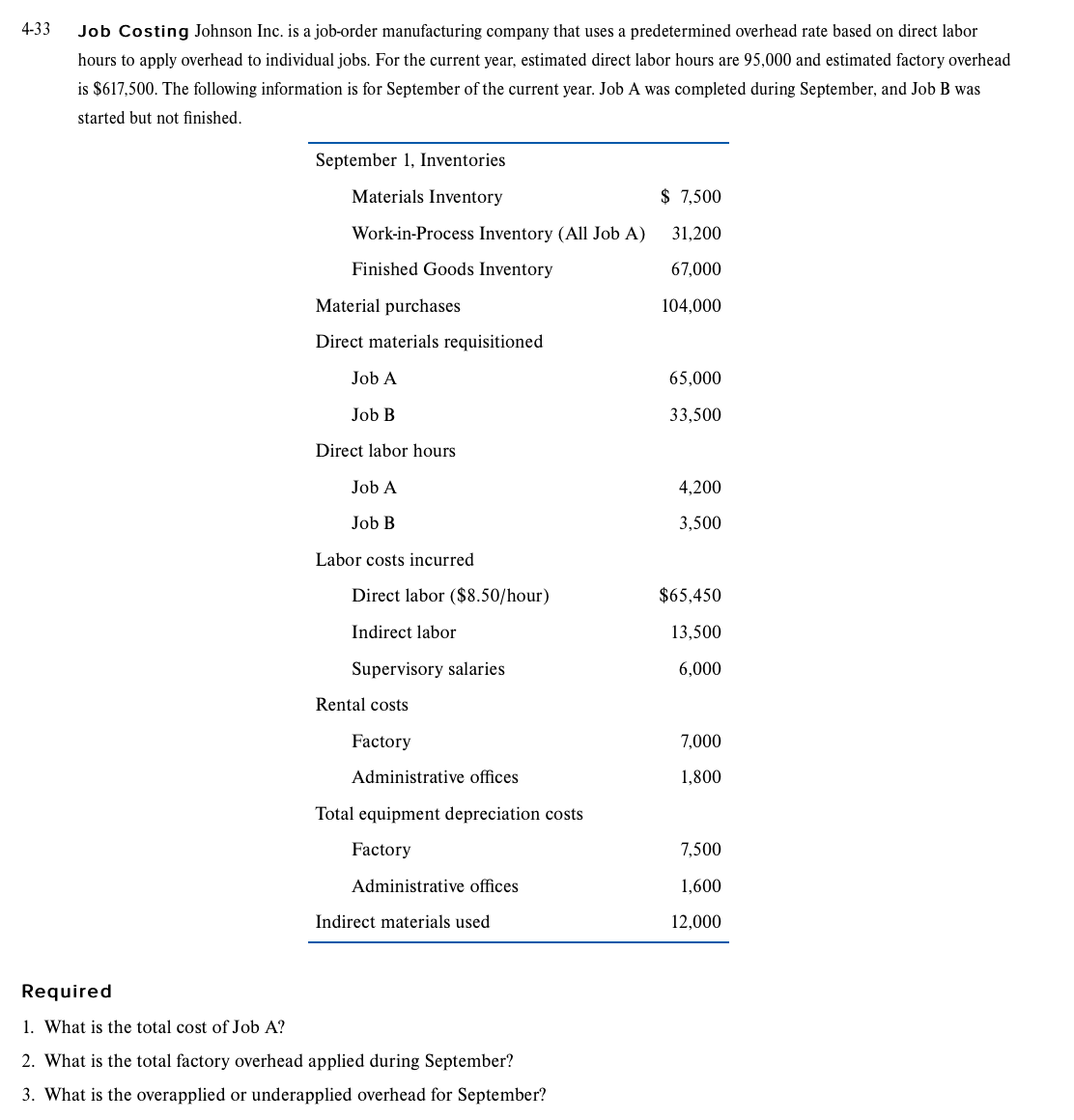

Job Costing Johnson Inc. is a job-order manufacturing company that uses a predetermined overhead rate based on direct labor

hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 95,000 and estimated factory overhead

is $617,500. The following information is for September of the current year. Job A was completed during September, and Job B was

started but not finished.

September 1, Inventories

Materials Inventory

$ 7,500

Work-in-Process Inventory (All Job A)

31,200

Finished Goods Inventory

67,000

Material purchases

104,000

Direct materials requisitioned

Job A

65,000

Job B

33,500

Direct labor hours

Job A

4,200

Job B

3,500

Labor costs incurred

Direct labor ($8.50/hour)

$65,450

Indirect labor

13,500

Supervisory salaries

6,000

Rental costs

Factory

7,000

Administrative offices

1,800

Total equipment depreciation costs

Factory

7,500

Administrative offices

1,600

Indirect materials used

12,000

Required

1. What is the total cost of Job A?

2. What is the total factory overhead applied during September?

3. What is the overapplied or underapplied overhead for September?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning