XYZ company is a manufacturing firm that uses job-order costing. On January 1, the beginning of its fiscal year, the company's inventory balances were as follows: Raw Materials WIP Php 20,000 15,000 30,000 Finished Goods The company applies overhead cost to jobs on the basis of machine- hours worked. For the current year, the company estimated that it would work 75,000 machine-hours and incur php 450,000 in manufacturing overhead cost. The following transactions were recorded for the year: a) Raw materials were purchased on account, Php 410,000. b) Raw Materials were requisitioned for use in production, Php 380,000 (Php 360,000 direct and Php 20,000 indirect). c) The following costs were incurred for emplovee services: labor

XYZ company is a manufacturing firm that uses job-order costing. On January 1, the beginning of its fiscal year, the company's inventory balances were as follows: Raw Materials WIP Php 20,000 15,000 30,000 Finished Goods The company applies overhead cost to jobs on the basis of machine- hours worked. For the current year, the company estimated that it would work 75,000 machine-hours and incur php 450,000 in manufacturing overhead cost. The following transactions were recorded for the year: a) Raw materials were purchased on account, Php 410,000. b) Raw Materials were requisitioned for use in production, Php 380,000 (Php 360,000 direct and Php 20,000 indirect). c) The following costs were incurred for emplovee services: labor

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 3CMA: Kimbeth Manufacturing uses a process cost system to manufacture dust density sensors for the mining...

Related questions

Question

100%

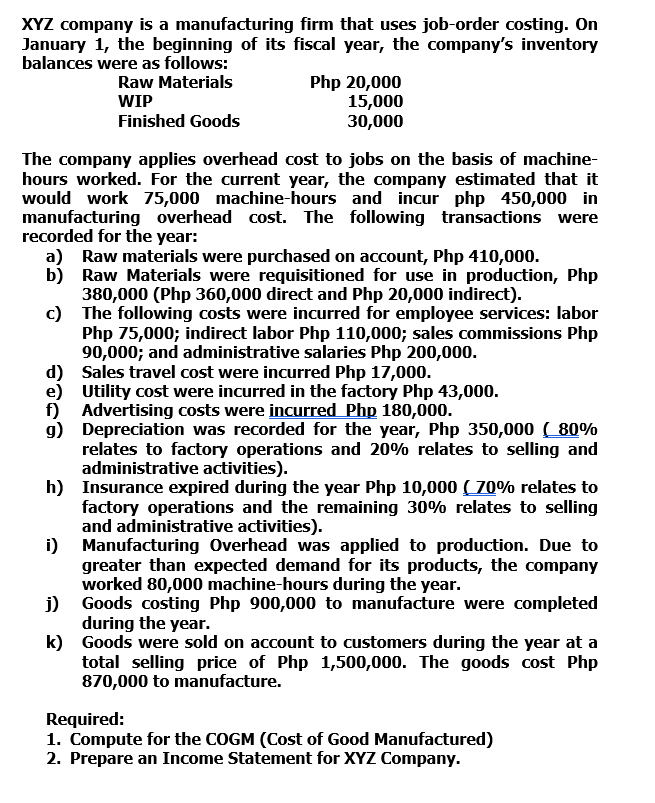

Transcribed Image Text:XYZ company is a manufacturing firm that uses job-order costing. On

January 1, the beginning of its fiscal year, the company's inventory

balances were as follows:

Raw Materials

Php 20,000

15,000

30,000

WIP

Finished Goods

The company applies overhead cost to jobs on the basis of machine-

hours worked. For the current year, the company estimated that it

would work 75,000 machine-hours and incur php 450,000 in

manufacturing overhead cost. The following transactions were

recorded for the year:

a) Raw materials were purchased on account, Php 410,000.

b) Raw Materials were requisitioned for use in production, Php

380,000 (Php 360,000 direct and Php 20,000 indirect).

c) The following costs were incurred for employee services: labor

Php 75,000; indirect labor Php 110,000; sales commissions Php

90,000; and administrative salaries Php 200,000.

d) Sales travel cost were incurred Php 17,000.

e) Utility cost were incurred in the factory Php 43,000.

f) Advertising costs were incurred Php 180,000.

g) Depreciation was recorded for the year, Php 350,000 ( 80%

relates to factory operations and 20% relates to selling and

administrative activities).

h) Insurance expired during the year Php 10,000 ( 70% relates to

factory operations and the remaining 30% relates to selling

and administrative activities).

i) Manufacturing Overhead was applied to production. Due to

greater than expected demand for its products, the company

worked 80,000 machine-hours during the year.

j) Goods costing Php 900,000 to manufacture were completed

during the year.

k) Goods were sold on account to customers during the year at a

total selling price of Php 1,500,000. The goods cost Php

870,000 to manufacture.

Required:

1. Compute for the COGM (Cost of Good Manufactured)

2. Prepare an Income Statement for XYZ Company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,