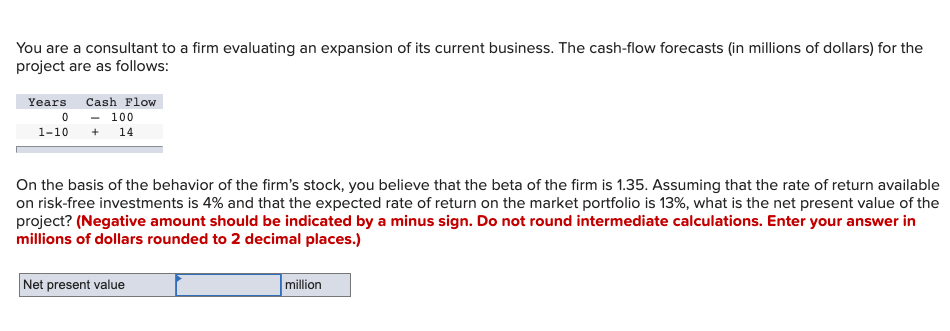

'ou are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecast project are as follows: Years Cash Flow - 100 1-10 + 14 On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.35. Assuming on risk-free investments is 4% and that the expected rate of return on the market portfolio is 13%, wha project? (Negative amount should be indicated by a minus sign. Do not round intermediate calcula nillions of dollars rounded to 2 decimal places.)

'ou are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecast project are as follows: Years Cash Flow - 100 1-10 + 14 On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.35. Assuming on risk-free investments is 4% and that the expected rate of return on the market portfolio is 13%, wha project? (Negative amount should be indicated by a minus sign. Do not round intermediate calcula nillions of dollars rounded to 2 decimal places.)

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 14P

Related questions

Question

Need help calculating NPV, thank you!

Transcribed Image Text:You are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the

project are as follows:

Years

Cash Flow

100

1-10

14

On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.35. Assuming that the rate of return available

on risk-free investments is 4% and that the expected rate of return on the market portfolio is 13%, what is the net present value of the

project? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in

millions of dollars rounded to 2 decimal places.)

Net present value

million

Expert Solution

Step 1

Net present value is difference between present value cash flow and initial investment.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning