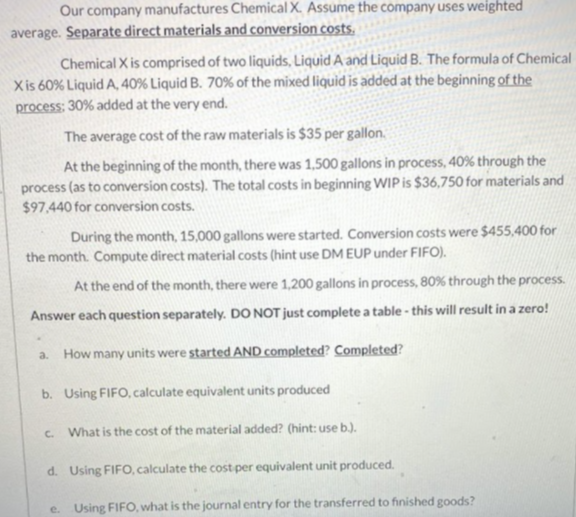

Our company manufactures Chemical X. Assume the company uses weighted average. Separate direct materials and conversion costs, Chemical X is comprised of two liquids, Liquid A and Liquid B. The formula of Chemical Xis 60% Liquid A, 40% Liquid B. 70% of the mixed liquid is added at the beginning of the process: 30% added at the very end. The average cost of the raw materials is $35 per gallon. At the beginning of the month, there was 1,500 gallons in process, 40% through the process (as to conversion costs). The total costs in beginning WIP is $36,750 for materials and $97,440 for conversion costs. During the month, 15,000 gallons were started. Conversion costs were $455,400 for the month. Compute direct material costs (hint use DM EUP under FIFO). At the end of the month, there were 1,200 gallons in process, 80% through the process. Answer each question separately. DO NOT just complete a table - this will result in a zero! How many units were started AND completed? Completed? a. b. Using FIFO, calculate equivalent units produced C. What is the cost of the material added? (hint: use b.). d. Using FIFO, calculate the cost per equivalent unit produced. e. Using FIFO, what is the journal entry for the transferred to finished goods?

Our company manufactures Chemical X. Assume the company uses weighted average. Separate direct materials and conversion costs, Chemical X is comprised of two liquids, Liquid A and Liquid B. The formula of Chemical Xis 60% Liquid A, 40% Liquid B. 70% of the mixed liquid is added at the beginning of the process: 30% added at the very end. The average cost of the raw materials is $35 per gallon. At the beginning of the month, there was 1,500 gallons in process, 40% through the process (as to conversion costs). The total costs in beginning WIP is $36,750 for materials and $97,440 for conversion costs. During the month, 15,000 gallons were started. Conversion costs were $455,400 for the month. Compute direct material costs (hint use DM EUP under FIFO). At the end of the month, there were 1,200 gallons in process, 80% through the process. Answer each question separately. DO NOT just complete a table - this will result in a zero! How many units were started AND completed? Completed? a. b. Using FIFO, calculate equivalent units produced C. What is the cost of the material added? (hint: use b.). d. Using FIFO, calculate the cost per equivalent unit produced. e. Using FIFO, what is the journal entry for the transferred to finished goods?

Chapter5: Process Costing

Section: Chapter Questions

Problem 2PB: The following product costs are available for Kellee Company on the production of eyeglass frames:...

Related questions

Question

I'm specifically having trouble figuring out what is beginning WIP for direct materials and conversion costs.

Provide step by step explanation.

Transcribed Image Text:Our company manufactures Chemical X. Assume the company uses weighted

average. Separate direct materials and conversion costs,

Chemical X is comprised of two liquids, Liquid A and Liquid B. The formula of Chemical

Xis 60% Liquid A, 40% Liquid B. 70% of the mixed liquid is added at the beginning of the

process: 30% added at the very end.

The average cost of the raw materials is $35 per gallon.

At the beginning of the month, there was 1,500 gallons in process, 40% through the

process (as to conversion costs). The total costs in beginning WIP is $36,750 for materials and

$97,440 for conversion costs.

During the month, 15,000 gallons were started. Conversion costs were $455,400 for

the month. Compute direct material costs (hint use DM EUP under FIFO).

At the end of the month, there were 1,200 gallons in process, 80% through the process.

Answer each question separately. DO NOT just complete a table - this will result in a zero!

How many units were started AND completed? Completed?

a.

b. Using FIFO, calculate equivalent units produced

C.

What is the cost of the material added? (hint: use b.).

d. Using FIFO, calculate the cost per equivalent unit produced.

e. Using FIFO, what is the journal entry for the transferred to finished goods?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning