our mining company is considering an expansion of operations into iron ore. Your engineers surveyed a particular piece of land three weeks ago (the survey cost $25,000) You can extract 1,000 tons of iron ore per year. There are 4,000 tons of iron ore underneath this land. Once all the ore has been extracted, the project will cease to produce any revenues. The price of ore will remain constant for the next 4 years. Currently ore sells for $100 per ton. The operating cost to extract the ore will be $60 per ton for the next 4 years. We will need to invest in the equipment for this project right now for $100,000. -The equipment will be depreciated over a period of four years using the straight-line method, with an assumed salvage value of zero for tax purposes. At the end of year 4, we can sell the equipment involved in the project for $20,000 The expansion requires additional working capital (NWC) of $10,000 from the start (at time t=0) until the end of year 4. At time t-4, working capital decreases to $0. The tax rate is assumed to be 40%. Your cost of capital is 12%. (please round all answers to the nearest dollar) T=0 Cash Flow S T=1 Cash Flow S T=2 Cash Flow S T-3 Cash Flow: $ T=4 Cash Flow S The Net Present Value (NPV) of this project is: $ Based on this analysis, should you pursue this project OA. Yes H

our mining company is considering an expansion of operations into iron ore. Your engineers surveyed a particular piece of land three weeks ago (the survey cost $25,000) You can extract 1,000 tons of iron ore per year. There are 4,000 tons of iron ore underneath this land. Once all the ore has been extracted, the project will cease to produce any revenues. The price of ore will remain constant for the next 4 years. Currently ore sells for $100 per ton. The operating cost to extract the ore will be $60 per ton for the next 4 years. We will need to invest in the equipment for this project right now for $100,000. -The equipment will be depreciated over a period of four years using the straight-line method, with an assumed salvage value of zero for tax purposes. At the end of year 4, we can sell the equipment involved in the project for $20,000 The expansion requires additional working capital (NWC) of $10,000 from the start (at time t=0) until the end of year 4. At time t-4, working capital decreases to $0. The tax rate is assumed to be 40%. Your cost of capital is 12%. (please round all answers to the nearest dollar) T=0 Cash Flow S T=1 Cash Flow S T=2 Cash Flow S T-3 Cash Flow: $ T=4 Cash Flow S The Net Present Value (NPV) of this project is: $ Based on this analysis, should you pursue this project OA. Yes H

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 14P

Related questions

Question

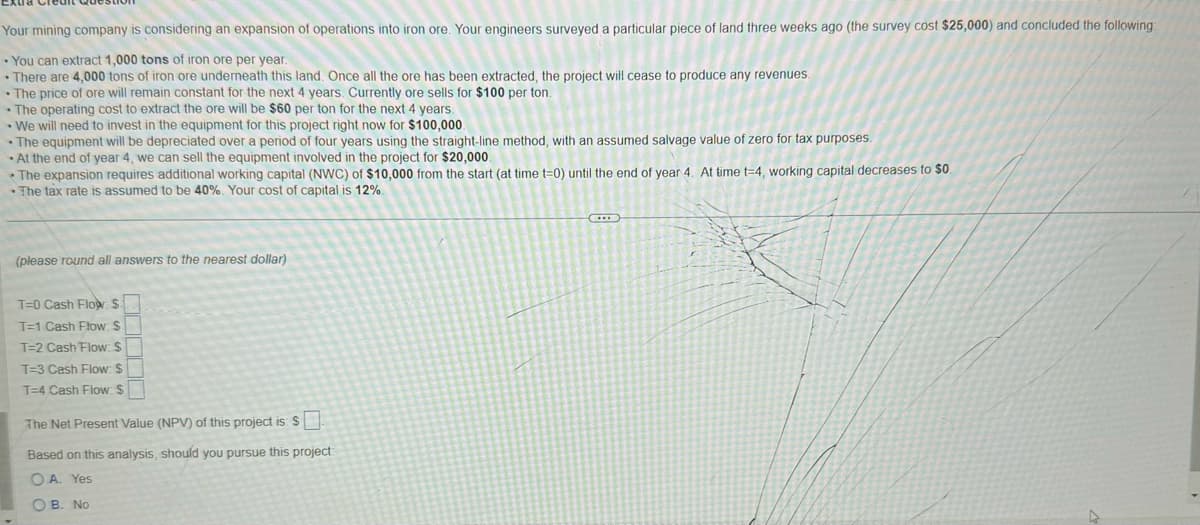

Transcribed Image Text:Your mining company is considering an expansion of operations into iron ore. Your engineers surveyed a particular piece of land three weeks ago (the survey cost $25,000) and concluded the following:

• You can extract 1,000 tons of iron ore per year.

• There are 4,000 tons of iron ore underneath this land. Once all the ore has been extracted, the project will cease to produce any revenues.

• The price of ore will remain constant for the next 4 years. Currently ore sells for $100 per ton.

• The operating cost to extract the ore will be $60 per ton for the next 4 years.

.

• We will need to invest in the equipment for this project right now for $100,000.

.

mention

The equipment will be depreciated over a period of four years using the straight-line method, with an assumed salvage value of zero for tax purposes.

At the end of year 4, we can sell the equipment involved in the project for $20,000.

The expansion requires additional working capital (NWC) of $10,000 from the start (at time t=0) until the end of year 4. At time t-4, working capital decreases to $0.

• The tax rate is assumed to be 40%. Your cost of capital is 12%.

(please round all answers to the nearest dollar)

T=0 Cash Flow S

T=1 Cash Flow: S

T-2 Cash Flow: S

T=3 Cash Flow: $

T=4 Cash Flow: S

The Net Present Value (NPV) of this project is: $

Based on this analysis, should you pursue this project:

OA. Yes

OB. No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning