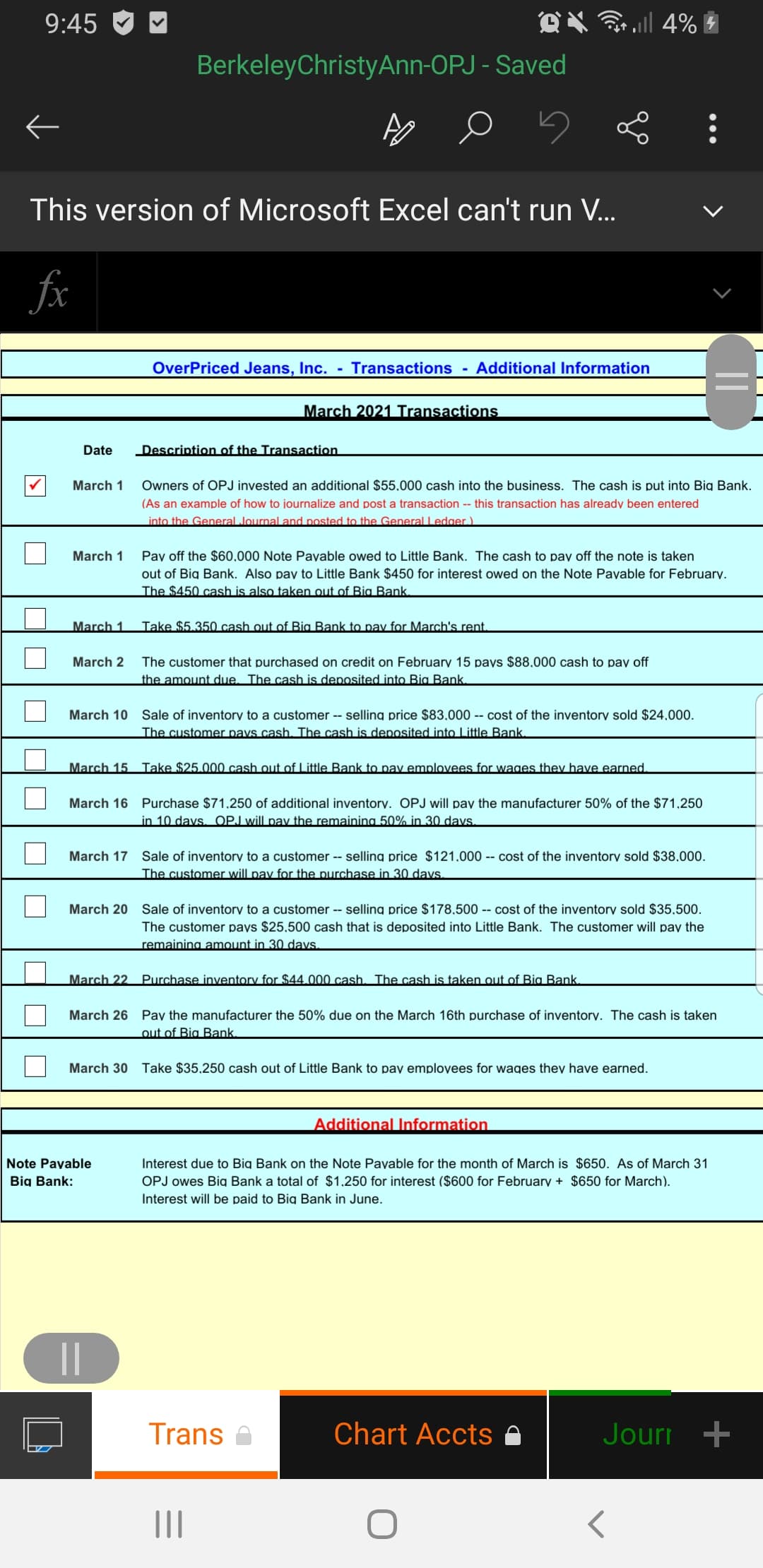

OverPriced Jeans, Inc. Transactions Additional Information March 2021 Transactions Date Description of the Transaction Owners of OPJ invested an additional $55.000 cash into the business. The cash is put into Big Bank. (As an example of how to journalize and post a transaction -- this transaction has already been entered into the General Journal and posted to the General Ledger) March 1 March 1 Pay off the $60.000 Note Payable owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Pavable for February. The $450 cash is also taken out of Big Bank. March 1 Take $5.350 cash out of Bia Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88.000 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer - selling price $83.000 -- cost of the inventory sold $24.000. The customer pavs cash. The cash is denosited into Little Bank. March 15 Take $25.000 cash out of Little Bank to pay emplovees for wages they have earned March 16 Purchase $71.250 of additional inventory. OPJ will pay the manufacturer 50% of the $71,250 in 10 davs. OPJ will pay the remaining 50% in 30 davs. March 17 Sale of inventory to a customer - selling price $121.000 -- cost of the inventory sold $38,000. The customer will pay for the purchase in 30 davs March 20 Sale of inventory to a customer - selling price $178.500 -- cost of the inventory sold $35.500. The customer pays $25.500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 davs. March 22 Purchase inventory for $44.000 cash. The cash is taken out of Big Bank March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank March 30 Take $35.250 cash out of Little Bank to pay employees for wages thev have earned. Additional Information Note Payable Interest due to Big Bank on the Note Payvable for the month of March is $650. As of March 31 Big Bank: OPJ owes Big Bank a total of $1.250 for interest ($600 for February + $650 for March). Interest will be paid to Big Bank in June.

OverPriced Jeans, Inc. Transactions Additional Information March 2021 Transactions Date Description of the Transaction Owners of OPJ invested an additional $55.000 cash into the business. The cash is put into Big Bank. (As an example of how to journalize and post a transaction -- this transaction has already been entered into the General Journal and posted to the General Ledger) March 1 March 1 Pay off the $60.000 Note Payable owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Pavable for February. The $450 cash is also taken out of Big Bank. March 1 Take $5.350 cash out of Bia Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88.000 cash to pay off the amount due. The cash is deposited into Big Bank. March 10 Sale of inventory to a customer - selling price $83.000 -- cost of the inventory sold $24.000. The customer pavs cash. The cash is denosited into Little Bank. March 15 Take $25.000 cash out of Little Bank to pay emplovees for wages they have earned March 16 Purchase $71.250 of additional inventory. OPJ will pay the manufacturer 50% of the $71,250 in 10 davs. OPJ will pay the remaining 50% in 30 davs. March 17 Sale of inventory to a customer - selling price $121.000 -- cost of the inventory sold $38,000. The customer will pay for the purchase in 30 davs March 20 Sale of inventory to a customer - selling price $178.500 -- cost of the inventory sold $35.500. The customer pays $25.500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 davs. March 22 Purchase inventory for $44.000 cash. The cash is taken out of Big Bank March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank March 30 Take $35.250 cash out of Little Bank to pay employees for wages thev have earned. Additional Information Note Payable Interest due to Big Bank on the Note Payvable for the month of March is $650. As of March 31 Big Bank: OPJ owes Big Bank a total of $1.250 for interest ($600 for February + $650 for March). Interest will be paid to Big Bank in June.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 47E

Related questions

Question

1.Complete a Journel

2.Complete a General Ledger

3. Complete a Trail Balance

Transcribed Image Text:9:45

BerkeleyChristyAnn-OPJ - Saved

This version of Microsoft Excel can't run V..

fx

OverPriced Jeans, Inc.

Transactions

Additional Information

March 2021 Transactions

Date

Description of the Transaction.

Owners of OPJ invested an additional $55,000 cash into the business. The cash is put into Big Bank.

(As an example of how to journalize and post a transaction -- this transaction has already been entered

into the General Journal and posted to the General Ledger.)

March 1

March 1

Pay off the $60.000 Note Payable owed to Little Bank. The cash to pay off the note is taken

out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Payable for February.

The $450 cash is also taken out of Big Bank.

March 1

Take $5.350 cash out of Bia Bank to pay for March's rent.

The customer that purchased on credit on February 15 pays $88.000 cash to pay off

the amount due. The cash is deposited into Big Bank.

March 2

March 10 Sale of inventory to a customer -- selling price $83.000 -- cost of the inventory sold $24.000.

The customer pavs cash. The cash is deposited into Little Bank.

March 15 Take $25.000 cash out of Litle Bank to pav emplovees for wages they have earned

March 16 Purchase $71.250 of additional inventory. OPJ will pay the manufacturer 50% of the $71,250

in 10 davs. OPJ will pay the remaining 50% in 30 das.

March 17 Sale of inventory to a customer -- selling price $121.000 -- cost of the inventory sold $38,000.

The customer will pay for the purchase in 30 days.

rch 20 Sale of inventory to a customer -- selling price $178,500 -- cost of the inventory sold $35,500.

The customer pays $25,500 cash that is deposited into Little Bank. The customer will pay the

remaining amount in 30 davs.

March 22 Purchase inventory for $44.000 cash. The cash is taken out of Big Bank

March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken

out of Big Bank.

March 30

Take $35.250 cash out of Little Bank to pay employees for wages they have earned.

Additional Information

Note Payable

Interest due to Big Bank on the Note Pavable for the month of March is $650. As of March 31

Big Bank:

OPJ owes Big Bank a total of $1,250 for interest ($600 for February + $650 for March).

Interest will be paid to Big Bank in June.

||

Trans

Chart Accts A

Jouri +

II

||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,