ow to find the values for year 2Y15. the only value i knew how to calculate was the available for sale investments at f

ow to find the values for year 2Y15. the only value i knew how to calculate was the available for sale investments at f

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.13EX

Related questions

Question

I can't figure out how to find the values for year 2Y15. the only value i knew how to calculate was the available for sale investments at fair value but not at cost.

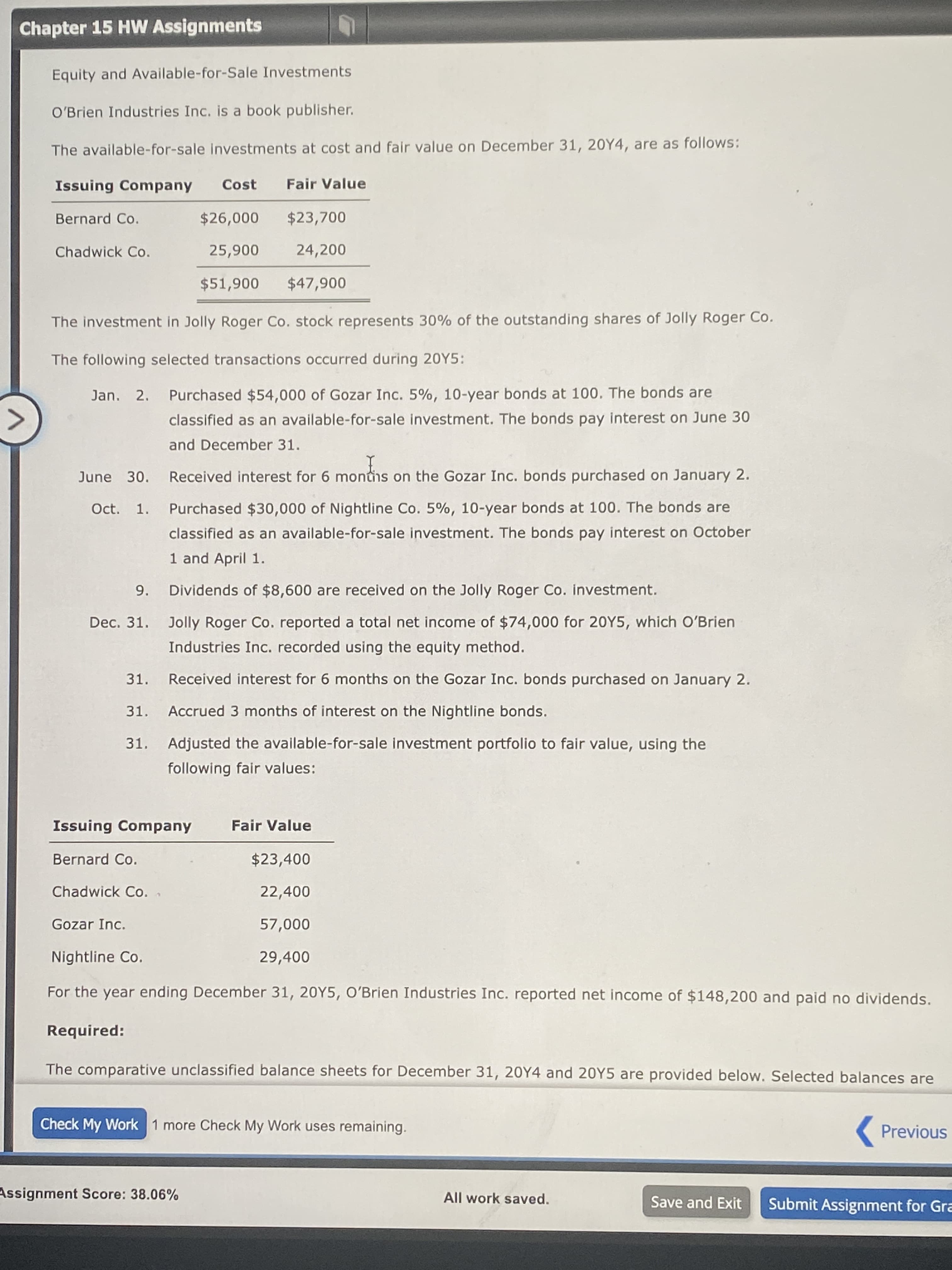

Transcribed Image Text:Chapter 15 HW Assignments

Equity and Available-for-Sale Investments

O'Brien Industries Inc. is a book publisher.

The available-for-sale investments at cost and fair value on December 31, 20Y4, are as follows:

Issuing Company

Cost

Fair Value

Bernard Co.

$26,000 $23,700

Chadwick Co.

24,200

$51,900

006

The investment in Jolly Roger Co. stock represents 30% of the outstanding shares of Jolly Roger Co.

The following selected transactions occurred during 20Y5:

Jan. 2.

Purchased $54,000 of Gozar Inc. 5%, 10-year bonds at 100. The bonds are

classified as an available-for-sale investment. The bonds pay interest on June 30

く

and December 31.

June 30. Received interest for 6 months on the Gozar Inc. bonds purchased on January 2.

Oct.

1.

Purchased $30,000 of Nightline Co. 5%, 10-year bonds at 100. The bonds are

classified as an available-for-sale investment. The bonds pay interest on October

1 and April 1.

9.

Dividends of $8,600 are received on the Jolly Roger Co. investment.

Dec. 31. Jolly Roger Co. reported a total net income of $74,000 for 20Y5, which O'Brien

Industries Inc. recorded using the equity method.

31.

Received interest for 6 months on the Gozar Inc. bonds purchased on January 2.

31.

Accrued 3 months of interest on the Nightline bonds.

31.

Adjusted the available-for-sale investment portfolio to fair value, using the

following fair values:

Issuing Company

Fair Value

Bernard Co.

$23,400

Chadwick Co.

22,400

Gozar Inc.

000'LS

Nightline Co.

29,400

For the year ending December 31, 20Y5, O'Brien Industries Inc. reported net income of $148,200 and paid no dividends.

Required:

The comparative unclassified balance sheets for December 31, 20Y4 and 20Y5 are provided below. Selected balances are

Check My Work 1 more Check My Work uses remaining.

( Previous

Assignment Score: 38.06%

All work saved.

Save and Exit

Submit Assignment for Gra

Transcribed Image Text:%24

%24

%24

Chapter 15 HW Assignments

31.

Received Interest for 6 months on the Gozar Inc. bonds purchased on January 2.

31.

Accrued 3 months of interest on the Nightline bonds.

31.

Adjusted the available-for-sale investment portfolio to fair value, using the

following fair values:

Issuing Company

Fair Value

Bernard Co.

$23,400

Chadwick Co.

22,400

Gozar Inc.

000'LS

Nightline Co.

29,400

For the year ending December 31, 20Y5, OʻBrien Industries Inc. reported net income of $148,200 and paid no dividends.

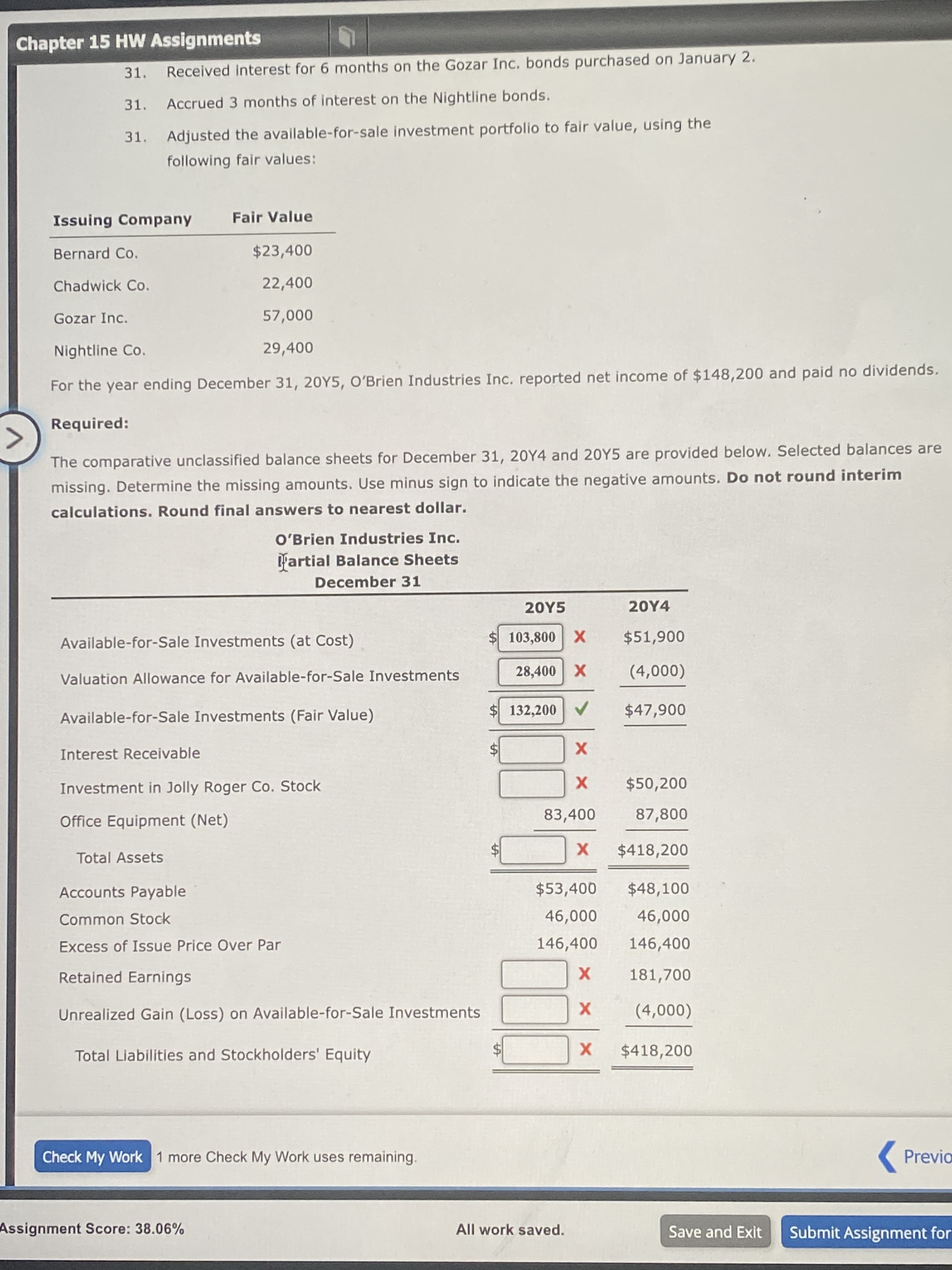

Required:

The comparative unclassified balance sheets for December 31, 20Y4 and 20Y5 are provided below. Selected balances are

missing. Determine the missing amounts. Use minus sign to indicate the negative amounts. Do not round interim

calculations. Round final answers to nearest dollar.

O'Brien Industries Inc.

B'artial Balance Sheets

December 31

20Y5

20Y4

Available-for-Sale Investments (at Cost)

$103,800 X

006'

Valuation Allowance for Available-for-Sale Investments

X 00

(000)

Available-for-Sale Investments (Fair Value)

$ 132,200 V

006

Interest Receivable

Investment in Jolly Roger Co. Stock

$50,200

Office Equipment (Net)

83,400

87,800

Total Assets

$418,200

Accounts Payable

$53,400

$48,100

0000

146,400

Common Stock

000'6

Excess of Issue Price Over Par

146,400

Retained Earnings

181,700

Unrealized Gain (Loss) on Available-for-Sale Investments

(o00't)

Total Liabilities and Stockholders' Equity

$418,200

Check My Work 1 more Check My Work uses remaining.

( Previo

Assignment Score: 38.06%

All work saved.

Submit Assignment for

Save and Exit

Expert Solution

Step 1

A balance sheet refers to the financial document which reflects the position of a company in terms of its assets and liabilities.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning