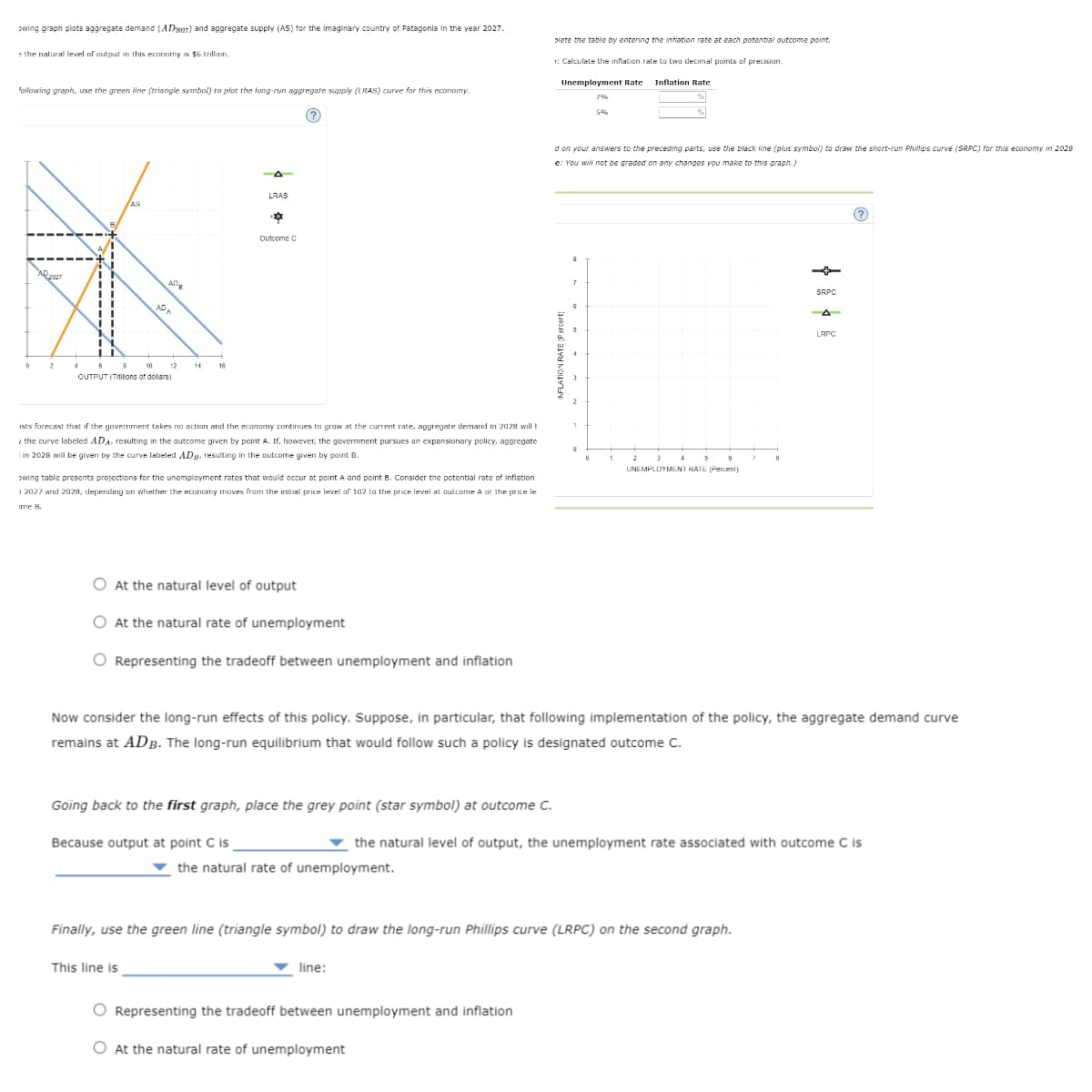

owing graph plots aggregate demand (ADar) and aggregate supply (AS) for the imaginary country of Patagonia in the year 2027. the natural level of output in this economy is $6 trillion. following graph, use the green line (triangle symbol) to plot the long-run aggregate supply (LRAS) curve for this economy. plete the table by entering the inflation rate at each potential outcome point. Calculate the inflation rate to two decimal points of precision. Unemployment Rate 3% 5% Inflation Rate LRAS AS AD ADE 12 14 16 OUTPUT (Trillions of dollars) 43 +1 Outcome C ists forecast that if the government takes no action and the economy continues to grow at the current rate, aggregate demand in 2028 will the curve labeled ADA, resulting in the outcome given by point A. If, however, the government pursues an expansionary policy, aggregate in 2028 will be given by the curve labeled ADg, resulting in the outcome given by point B. >wing table presents projections for the unemployment rates that would occur at point A and point B. Consider the potential rate of Inflation 12027 and 2028, depending on whether the economy moves from the initial price level of 102 to the price level at outcome A or the price le ime B. At the natural level of output ○ At the natural rate of unemployment Representing the tradeoff between unemployment and inflation d on your answers to the preceding parts, use the black line (plus symbol) to draw the short-run Phillips curve (SRPC) for this economy in 2028 e: You will not be graded on any changes you make to this graph.) INFLATION RATE (Percent) 7 1 0 U 1 4 8 8 UNEMPLOYMENT RATE (Percent) SRPC LRPC Now consider the long-run effects of this policy. Suppose, in particular, that following implementation of the policy, the aggregate demand curve remains at ADB. The long-run equilibrium that would follow such a policy is designated outcome C. Going back to the first graph, place the grey point (star symbol) at outcome C. the natural level of output, the unemployment rate associated with outcome C is Because output at point C is the natural rate of unemployment. Finally, use the green line (triangle symbol) to draw the long-run Phillips curve (LRPC) on the second graph. This line is line: Representing the tradeoff between unemployment and inflation At the natural rate of unemployment

owing graph plots aggregate demand (ADar) and aggregate supply (AS) for the imaginary country of Patagonia in the year 2027. the natural level of output in this economy is $6 trillion. following graph, use the green line (triangle symbol) to plot the long-run aggregate supply (LRAS) curve for this economy. plete the table by entering the inflation rate at each potential outcome point. Calculate the inflation rate to two decimal points of precision. Unemployment Rate 3% 5% Inflation Rate LRAS AS AD ADE 12 14 16 OUTPUT (Trillions of dollars) 43 +1 Outcome C ists forecast that if the government takes no action and the economy continues to grow at the current rate, aggregate demand in 2028 will the curve labeled ADA, resulting in the outcome given by point A. If, however, the government pursues an expansionary policy, aggregate in 2028 will be given by the curve labeled ADg, resulting in the outcome given by point B. >wing table presents projections for the unemployment rates that would occur at point A and point B. Consider the potential rate of Inflation 12027 and 2028, depending on whether the economy moves from the initial price level of 102 to the price level at outcome A or the price le ime B. At the natural level of output ○ At the natural rate of unemployment Representing the tradeoff between unemployment and inflation d on your answers to the preceding parts, use the black line (plus symbol) to draw the short-run Phillips curve (SRPC) for this economy in 2028 e: You will not be graded on any changes you make to this graph.) INFLATION RATE (Percent) 7 1 0 U 1 4 8 8 UNEMPLOYMENT RATE (Percent) SRPC LRPC Now consider the long-run effects of this policy. Suppose, in particular, that following implementation of the policy, the aggregate demand curve remains at ADB. The long-run equilibrium that would follow such a policy is designated outcome C. Going back to the first graph, place the grey point (star symbol) at outcome C. the natural level of output, the unemployment rate associated with outcome C is Because output at point C is the natural rate of unemployment. Finally, use the green line (triangle symbol) to draw the long-run Phillips curve (LRPC) on the second graph. This line is line: Representing the tradeoff between unemployment and inflation At the natural rate of unemployment

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter24: The Aggregate Demand/aggregate Supply Model

Section: Chapter Questions

Problem 60CTQ: The imaginary country of Harris Island has the aggregate supply and aggregate demand curves as Table...

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

Transcribed Image Text:owing graph plots aggregate demand (ADar) and aggregate supply (AS) for the imaginary country of Patagonia in the year 2027.

the natural level of output in this economy is $6 trillion.

following graph, use the green line (triangle symbol) to plot the long-run aggregate supply (LRAS) curve for this economy.

plete the table by entering the inflation rate at each potential outcome point.

Calculate the inflation rate to two decimal points of precision.

Unemployment Rate

3%

5%

Inflation Rate

LRAS

AS

AD

ADE

12

14

16

OUTPUT (Trillions of dollars)

43 +1

Outcome C

ists forecast that if the government takes no action and the economy continues to grow at the current rate, aggregate demand in 2028 will

the curve labeled ADA, resulting in the outcome given by point A. If, however, the government pursues an expansionary policy, aggregate

in 2028 will be given by the curve labeled ADg, resulting in the outcome given by point B.

>wing table presents projections for the unemployment rates that would occur at point A and point B. Consider the potential rate of Inflation

12027 and 2028, depending on whether the economy moves from the initial price level of 102 to the price level at outcome A or the price le

ime B.

At the natural level of output

○ At the natural rate of unemployment

Representing the tradeoff between unemployment and inflation

d on your answers to the preceding parts, use the black line (plus symbol) to draw the short-run Phillips curve (SRPC) for this economy in 2028

e: You will not be graded on any changes you make to this graph.)

INFLATION RATE (Percent)

7

1

0

U

1

4

8

8

UNEMPLOYMENT RATE (Percent)

SRPC

LRPC

Now consider the long-run effects of this policy. Suppose, in particular, that following implementation of the policy, the aggregate demand curve

remains at ADB. The long-run equilibrium that would follow such a policy is designated outcome C.

Going back to the first graph, place the grey point (star symbol) at outcome C.

the natural level of output, the unemployment rate associated with outcome C is

Because output at point C is

the natural rate of unemployment.

Finally, use the green line (triangle symbol) to draw the long-run Phillips curve (LRPC) on the second graph.

This line is

line:

Representing the tradeoff between unemployment and inflation

At the natural rate of unemployment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning