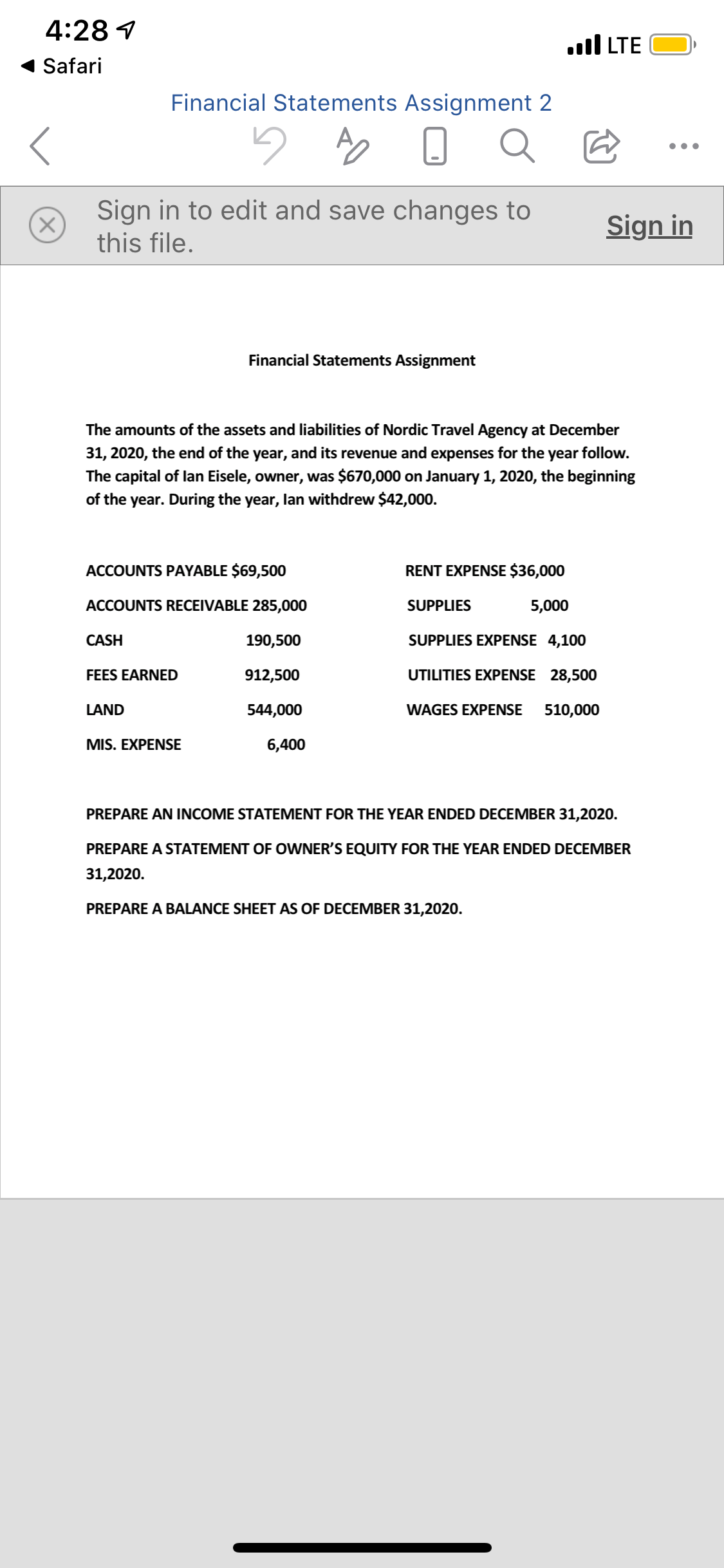

The amounts of the assets and liabilities of Nordic Travel Agency at December 31, 2020, the end of the year, and its revenue and expenses for the year follow. The capital of lan Eisele, owner, was $670,000 on January 1, 2020, the beginning of the year. During the year, lan withdrew $42,000. ACCOUNTS PAYABLE $69,500 RENT EXPENSE $36,000 ACCOUNTS RECEIVABLE 285,000 SUPPLIES 5,000 CASH 190,500 SUPPLIES EXPENSE 4,100 FEES EARNED 912,500 UTILITIES EXPENSE 28,500 LAND 544,000 WAGES EXPENSE 510,000 MIS. EXPENSE 6,400 PREPARE AN INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31,2020. PREPARE A STATEMENT OF OWNER'S EQUITY FOR THE YEAR ENDED DECEMBER 31,2020. PREPARE A BALANCE SHEET AS OF DECEMBER 31,2020.

The amounts of the assets and liabilities of Nordic Travel Agency at December 31, 2020, the end of the year, and its revenue and expenses for the year follow. The capital of lan Eisele, owner, was $670,000 on January 1, 2020, the beginning of the year. During the year, lan withdrew $42,000. ACCOUNTS PAYABLE $69,500 RENT EXPENSE $36,000 ACCOUNTS RECEIVABLE 285,000 SUPPLIES 5,000 CASH 190,500 SUPPLIES EXPENSE 4,100 FEES EARNED 912,500 UTILITIES EXPENSE 28,500 LAND 544,000 WAGES EXPENSE 510,000 MIS. EXPENSE 6,400 PREPARE AN INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31,2020. PREPARE A STATEMENT OF OWNER'S EQUITY FOR THE YEAR ENDED DECEMBER 31,2020. PREPARE A BALANCE SHEET AS OF DECEMBER 31,2020.

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 2EB: CPK ** Associates is a mid-size legal firm, specializing in closings and real estate law in the...

Related questions

Question

Please help me find solutions for the attached question.

Transcribed Image Text:The amounts of the assets and liabilities of Nordic Travel Agency at December

31, 2020, the end of the year, and its revenue and expenses for the year follow.

The capital of lan Eisele, owner, was $670,000 on January 1, 2020, the beginning

of the year. During the year, lan withdrew $42,000.

ACCOUNTS PAYABLE $69,500

RENT EXPENSE $36,000

ACCOUNTS RECEIVABLE 285,000

SUPPLIES

5,000

CASH

190,500

SUPPLIES EXPENSE 4,100

FEES EARNED

912,500

UTILITIES EXPENSE 28,500

LAND

544,000

WAGES EXPENSE

510,000

MIS. EXPENSE

6,400

PREPARE AN INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31,2020.

PREPARE A STATEMENT OF OWNER'S EQUITY FOR THE YEAR ENDED DECEMBER

31,2020.

PREPARE A BALANCE SHEET AS OF DECEMBER 31,2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub