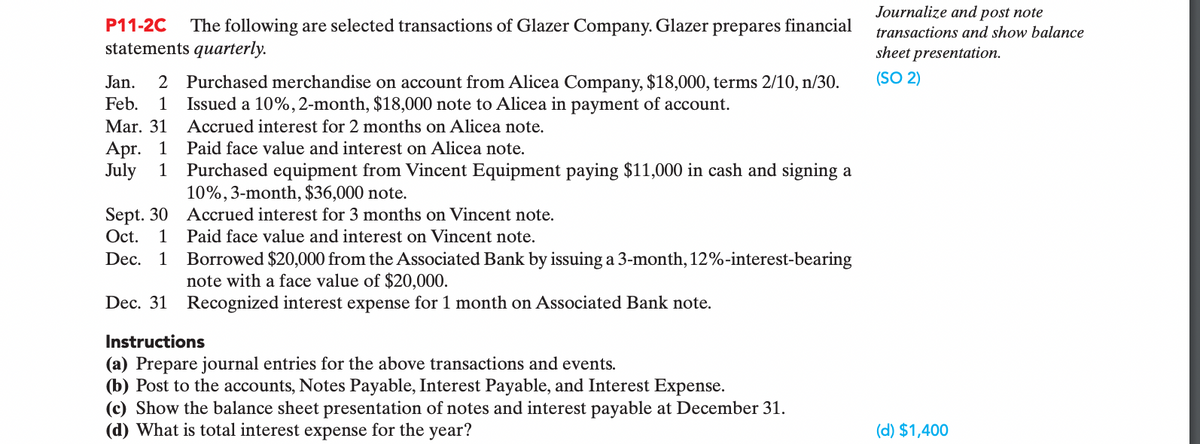

P11-2C The following are selected transactions of Glazer Company. Glazer prepares financial statements quarterly. Jan. 2 Purchased merchandise on account from Alicea Company, $18,000, terms 2/10, n/30. Feb. 1 Issued a 10%,2-month, $18,000 note to Alicea in payment of account. Mar. 31 Accrued interest for 2 months on Alicea note. Apr. 1 Paid face value and interest on Alicea note. July Purchased equipment from Vincent Equipment paying $11,000 in cash and signing a 10%,3-month, $36,000 note. Sept. 30 Accrued interest for 3 months on Vincent note. Oct. 1 Paid face value and interest on Vincent note. Dec. 1 Borrowed $20,000 from the Associated Bank by issuing a 3-month, 12%-interest-bearing note with a face value of $20,000. Dec. 31 Recognized interest expense for 1 month on Associated Bank note. Instructions (a) Prepare journal entries for the above transactions and events. (b) Post to the accounts, Notes Payable, Interest Payable, and Interest Expense. (c) Show the balance sheet presentation of notes and interest payable at December 31. (d) What is total interest expense for the year?

P11-2C The following are selected transactions of Glazer Company. Glazer prepares financial statements quarterly. Jan. 2 Purchased merchandise on account from Alicea Company, $18,000, terms 2/10, n/30. Feb. 1 Issued a 10%,2-month, $18,000 note to Alicea in payment of account. Mar. 31 Accrued interest for 2 months on Alicea note. Apr. 1 Paid face value and interest on Alicea note. July Purchased equipment from Vincent Equipment paying $11,000 in cash and signing a 10%,3-month, $36,000 note. Sept. 30 Accrued interest for 3 months on Vincent note. Oct. 1 Paid face value and interest on Vincent note. Dec. 1 Borrowed $20,000 from the Associated Bank by issuing a 3-month, 12%-interest-bearing note with a face value of $20,000. Dec. 31 Recognized interest expense for 1 month on Associated Bank note. Instructions (a) Prepare journal entries for the above transactions and events. (b) Post to the accounts, Notes Payable, Interest Payable, and Interest Expense. (c) Show the balance sheet presentation of notes and interest payable at December 31. (d) What is total interest expense for the year?

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 8PA: Serene Company purchases fountains for its inventory from Kirkland Inc. The following transactions...

Related questions

Question

Transcribed Image Text:Journalize and post note

P11-2C

The following are selected transactions of Glazer Company. Glazer prepares financial

transactions and show balance

statements quarterly.

sheet presentation.

(SO 2)

2 Purchased merchandise on account from Alicea Company, $18,000, terms 2/10, n/30.

Issued a 10%,2-month, $18,000 note to Alicea in payment of account.

Jan.

Feb.

1

Mar. 31

Accrued interest for 2 months on Alicea note.

Apг. 1

July

Paid face value and interest on Alicea note.

Purchased equipment from Vincent Equipment paying $11,000 in cash and signing a

10%, 3-month, $36,000 note.

1

Sept. 30

Oct.

Accrued interest for 3 months on Vincent note.

1 Paid face value and interest on Vincent note.

Borrowed $20,000 from the Associated Bank by issuing a 3-month, 12%-interest-bearing

note with a face value of $20,000.

Dec.

1

Dec. 31 Recognized interest expense for 1 month on Associated Bank note.

Instructions

(a) Prepare journal entries for the above transactions and events.

(b) Post to the accounts, Notes Payable, Interest Payable, and Interest Expense.

(c) Show the balance sheet presentation of notes and interest payable at December 31.

(d) What is total interest expense for the year?

(d) $1,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,