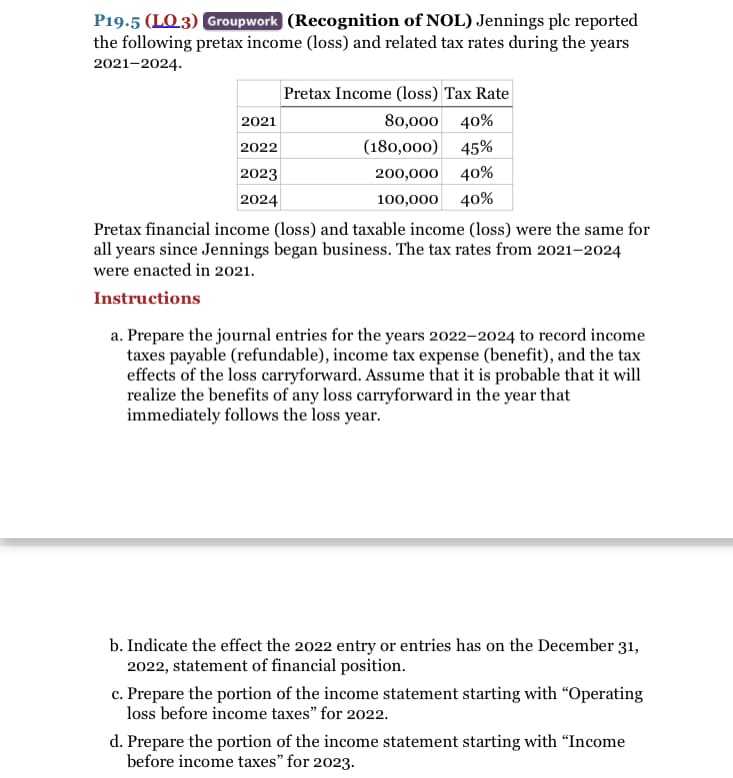

P19.5 (LO.3) Groupwork (Recognition of NOL) Jennings plc reported the following pretax income (loss) and related tax rates during the years 2021-2024. 2021 2022 2023 2024 Pretax Income (loss) Tax Rate 80,000 40% (180,000) 45% 200,000 40% 100,000 40% Pretax financial income (loss) and taxable income (loss) were the same for all years since Jennings began business. The tax rates from 2021-2024 were enacted in 2021. Instructions a. Prepare the journal entries for the years 2022-2024 to record income taxes payable (refundable), income tax expense (benefit), and the tax effects of the loss carryforward. Assume that it is probable that it will realize the benefits of any loss carryforward in the year that immediately follows the loss year. b. Indicate the effect the 2022 entry or entries has on the December 31, 2022, statement of financial position. c. Prepare the portion of the income statement starting with "Operating loss before income taxes" for 2022. d. Prepare the portion of the income statement starting with "Income before income taxes" for 2023.

P19.5 (LO.3) Groupwork (Recognition of NOL) Jennings plc reported the following pretax income (loss) and related tax rates during the years 2021-2024. 2021 2022 2023 2024 Pretax Income (loss) Tax Rate 80,000 40% (180,000) 45% 200,000 40% 100,000 40% Pretax financial income (loss) and taxable income (loss) were the same for all years since Jennings began business. The tax rates from 2021-2024 were enacted in 2021. Instructions a. Prepare the journal entries for the years 2022-2024 to record income taxes payable (refundable), income tax expense (benefit), and the tax effects of the loss carryforward. Assume that it is probable that it will realize the benefits of any loss carryforward in the year that immediately follows the loss year. b. Indicate the effect the 2022 entry or entries has on the December 31, 2022, statement of financial position. c. Prepare the portion of the income statement starting with "Operating loss before income taxes" for 2022. d. Prepare the portion of the income statement starting with "Income before income taxes" for 2023.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

Transcribed Image Text:P19.5 (LO.3) Groupwork (Recognition of NOL) Jennings ple reported

the following pretax income (loss) and related tax rates during the years

2021-2024.

Pretax Income (loss) Tax Rate

2021

80,000 40%

2022

(180,000) 45%

2023

200,000

40%

2024

100,000 40%

Pretax financial income (loss) and taxable income (loss) were the same for

all years since Jennings began business. The tax rates from 2021-2024

were enacted in 2021.

Instructions

a. Prepare the journal entries for the years 2022-2024 to record income

taxes payable (refundable), income tax expense (benefit), and the tax

effects of the loss carryforward. Assume that it is probable that it will

realize the benefits of any loss carryforward in the year that

immediately follows the loss year.

b. Indicate the effect the 2022 entry or entries has on the December 31,

2022, statement of financial position.

c. Prepare the portion of the income statement starting with “Operating

loss before income taxes" for 2022.

d. Prepare the portion of the income statement starting with "Income

before income taxes" for 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT