[The following information applies to the questions displayed below.] Tunstall, Inc., a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December 31: Tunstall, Inc. Unadjusted Trial Balance for the Year Ended December 31 Debit Credit Cash 46,800 Accounts receivable 11,700 Supplies 550 Prepaid insurance 630 Service trucks 16,300 Accumulated depreciation 8,400 Other assets 9,860 Accounts payable 2,220 Wages payable Income taxes payable Notes payable, long-term 15,000 Common stock (4,100 shares outstanding) 1,936 Additional paid-in capital 17,424 Retained earnings 4,600 Service revenue 85,680 Wages expense 16,200 Remaining expenses (not detailed; excludes income tax) 33,220 Income tax expense Totals 135,260 135,260 Data not yet recorded at December 31 included: The supplies count on December 31 reflected $190 in remaining supplies on hand to be used in the next year. Insurance expired during the current year, $630. Depreciation expense for the current year, $4,200. Wages earned by employees not yet paid on December 31, $560. Income tax expense, $5,780. I missed few questions (pic 1) and posted them in Bartleby to assistance and got the attached (pic2) response. I still need some help with understanding the calcuation of few items.

[The following information applies to the questions displayed below.] Tunstall, Inc., a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December 31: Tunstall, Inc. Unadjusted Trial Balance for the Year Ended December 31 Debit Credit Cash 46,800 Accounts receivable 11,700 Supplies 550 Prepaid insurance 630 Service trucks 16,300 Accumulated depreciation 8,400 Other assets 9,860 Accounts payable 2,220 Wages payable Income taxes payable Notes payable, long-term 15,000 Common stock (4,100 shares outstanding) 1,936 Additional paid-in capital 17,424 Retained earnings 4,600 Service revenue 85,680 Wages expense 16,200 Remaining expenses (not detailed; excludes income tax) 33,220 Income tax expense Totals 135,260 135,260 Data not yet recorded at December 31 included: The supplies count on December 31 reflected $190 in remaining supplies on hand to be used in the next year. Insurance expired during the current year, $630. Depreciation expense for the current year, $4,200. Wages earned by employees not yet paid on December 31, $560. Income tax expense, $5,780. I missed few questions (pic 1) and posted them in Bartleby to assistance and got the attached (pic2) response. I still need some help with understanding the calcuation of few items.

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.6EX: a. (1) Current year working capital. 1,090,000 Current position analysis The following data were...

Related questions

Question

[The following information applies to the questions displayed below.]

Tunstall, Inc., a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted

| Tunstall, Inc. Unadjusted Trial Balance for the Year Ended December 31 |

|||||||

| Debit | Credit | ||||||

| Cash | 46,800 | ||||||

| Accounts receivable | 11,700 | ||||||

| Supplies | 550 | ||||||

| Prepaid insurance | 630 | ||||||

| Service trucks | 16,300 | ||||||

| 8,400 | |||||||

| Other assets | 9,860 | ||||||

| Accounts payable | 2,220 | ||||||

| Wages payable | |||||||

| Income taxes payable | |||||||

| Notes payable, long-term | 15,000 | ||||||

| Common stock (4,100 shares outstanding) | 1,936 | ||||||

| Additional paid-in capital | 17,424 | ||||||

| 4,600 | |||||||

| Service revenue | 85,680 | ||||||

| Wages expense | 16,200 | ||||||

| Remaining expenses (not detailed; excludes income tax) |

33,220 | ||||||

| Income tax expense | |||||||

| Totals | 135,260 | 135,260 | |||||

Data not yet recorded at December 31 included:

- The supplies count on December 31 reflected $190 in remaining supplies on hand to be used in the next year.

- Insurance expired during the current year, $630.

- Depreciation expense for the current year, $4,200.

- Wages earned by employees not yet paid on December 31, $560.

- Income tax expense, $5,780.

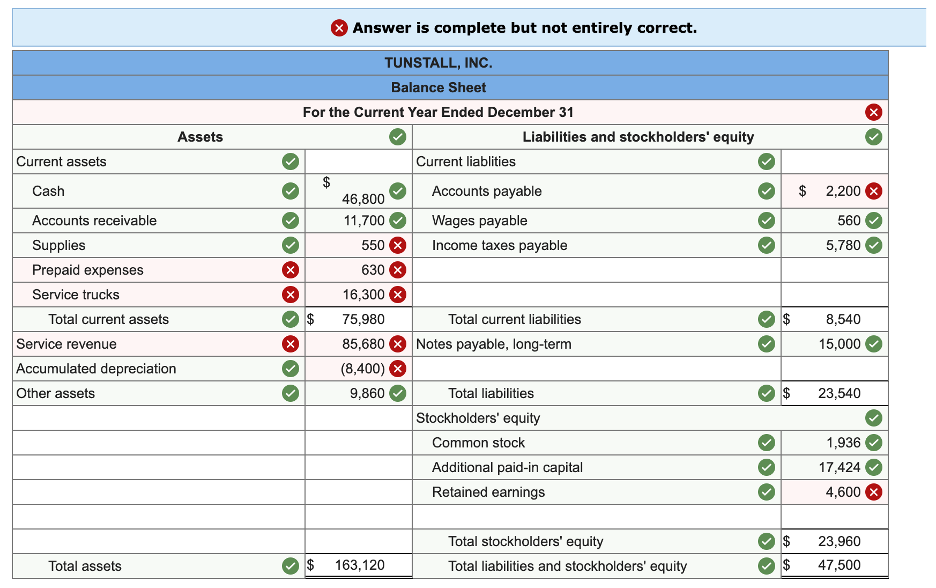

I missed few questions (pic 1) and posted them in Bartleby to assistance and got the attached (pic2) response. I still need some help with understanding the calcuation of few items.

Transcribed Image Text:Answer is complete but not entirely correct.

TUNSTALL, INC.

Balance Sheet

For the Current Year Ended December 31

Assets

Liabilities and stockholders' equity

Current assets

Current liablities

$

46,800

$ 2,200 X

Cash

Accounts payable

Accounts receivable

11,700

Wages payable

560

Supplies

550

Income taxes payable

5,780

Prepaid expenses

630

Service trucks

16,300

Total current assets

2$

75,980

Total current liabilities

$

8,540

Service revenue

Accumulated depreciation

85,680

Notes payable, long-term

15,000

(8,400) 8

Other assets

9,860

Total liabilities

$

23,540

Stockholders' equity

Common stock

1,936

Additional paid-in capital

17,424

Retained earnings

4,600

$

$

Total stockholders' equity

23,960

Total assets

163,120

Total liabilities and stockholders' equity

47,500

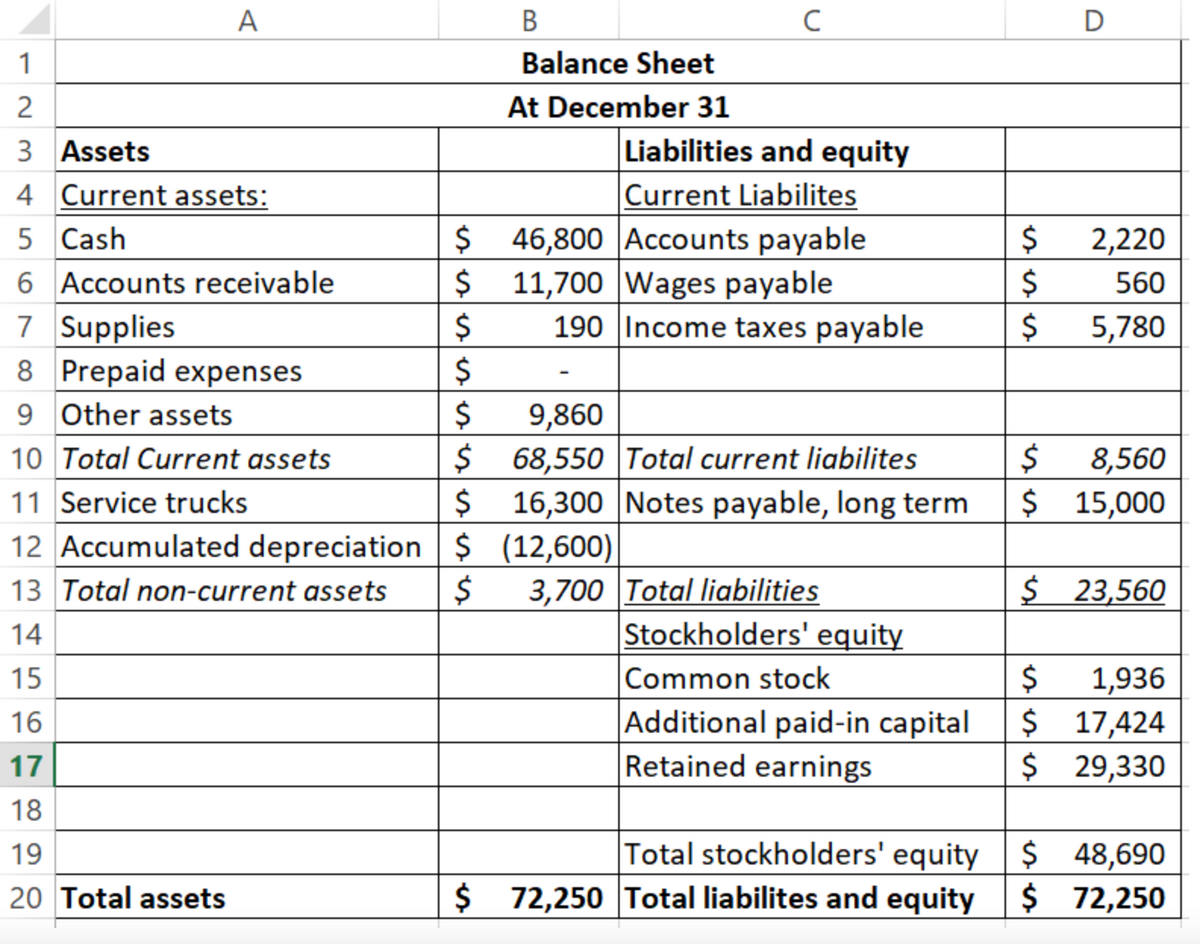

Transcribed Image Text:A

В

D

1

Balance Sheet

At December 31

3 Assets

Liabilities and equity

4 Current assets:

Current Liabilites

2$

46,800 |Accounts payable

11,700 Wages payable

190 Income taxes payable

5 Cash

2,220

6 Accounts receivable

560

7 Supplies

8 Prepaid expenses

9 Other assets

5,780

$

9,860

68,550 |Total current liabilites

$ 16,300 Notes payable, long term

10 Total Current assets

8,560

$ 15,000

11 Service trucks

12 Accumulated depreciation $ (12,600)

$ 23,560

3,700 Total liabilities

Stockholders' equity

13 Total non-current assets

14

Common stock

Additional paid-in capital

Retained earnings

$

1,936

$ 17,424

$ 29,330

15

16

17

18

Total stockholders' equity $ 48,690

$ 72,250

19

20 Total assets

$

$ 72,250 Total liabilites and equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning