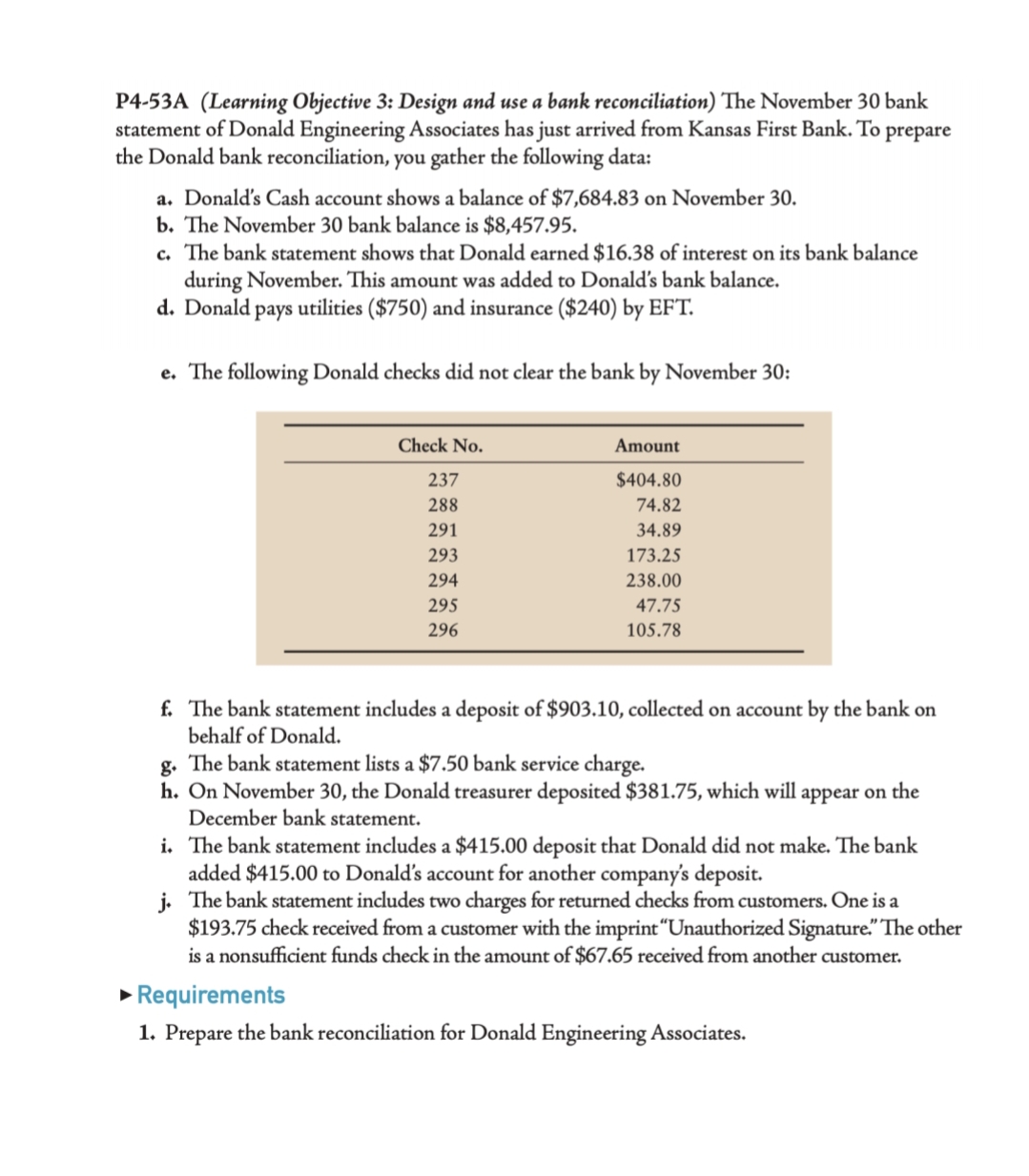

P4-53A (Learning Objective 3: Design and use a bank reconciliation) The November 30 bank statement of Donald Engineering Associates has just arrived from Kansas First Bank. To prepare the Donald bank reconciliation, you gather the following data: a. Donald's Cash account shows a balance of $7,684.83 on November 30. b. The November 30 bank balance is $8,457.95. c. The bank statement shows that Donald earned $16.38 of interest on its bank balance during November. This amount was added to Donald's bank balance. d. Donald pays utilities ($750) and insurance ($240) by EFT. e. The following Donald checks did not clear the bank by November 30: Check No. Amount 237 $404.80 288 74.82 291 34.89 293 173.25 294 238.00 295 47.75 296 105.78 f. The bank statement includes a deposit of $903.10, collected on account by the bank on behalf of Donald. g. The bank statement lists a $7.50 bank service charge. h. On November 30, the Donald treasurer deposited $381.75, which will appear on the December bank statement. i. The bank statement includes a $415.00 deposit that Donald did not make. The bank added $415.00 to Donald's account for another company's deposit. j. The bank statement includes two charges for returned checks from customers. One is a $193.75 check received from a customer with the imprint "Unauthorized Signature." The other is a nonsufficient funds check in the amount of $67.65 received from another customer. •Requirements 1. Prepare the bank reconciliation for Donald Engineering Associates.

P4-53A (Learning Objective 3: Design and use a bank reconciliation) The November 30 bank statement of Donald Engineering Associates has just arrived from Kansas First Bank. To prepare the Donald bank reconciliation, you gather the following data: a. Donald's Cash account shows a balance of $7,684.83 on November 30. b. The November 30 bank balance is $8,457.95. c. The bank statement shows that Donald earned $16.38 of interest on its bank balance during November. This amount was added to Donald's bank balance. d. Donald pays utilities ($750) and insurance ($240) by EFT. e. The following Donald checks did not clear the bank by November 30: Check No. Amount 237 $404.80 288 74.82 291 34.89 293 173.25 294 238.00 295 47.75 296 105.78 f. The bank statement includes a deposit of $903.10, collected on account by the bank on behalf of Donald. g. The bank statement lists a $7.50 bank service charge. h. On November 30, the Donald treasurer deposited $381.75, which will appear on the December bank statement. i. The bank statement includes a $415.00 deposit that Donald did not make. The bank added $415.00 to Donald's account for another company's deposit. j. The bank statement includes two charges for returned checks from customers. One is a $193.75 check received from a customer with the imprint "Unauthorized Signature." The other is a nonsufficient funds check in the amount of $67.65 received from another customer. •Requirements 1. Prepare the bank reconciliation for Donald Engineering Associates.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps