P6-4B The management of Weigel Inc. asks your help in determıning the compal tive effects of the FIFO and LIFO inventory cost flow methods. For 2014 the accounting records show these data. $ 16,000 470,500 Inventory, January 1 (4,000 units) Cost of 105,000 units purchased Selling price of 100,000 units sold Operating expenses 900,000 185,000 Units purchased consisted of 35,000 units at $4.21 on March 20; 65,000 units at $4.60 on July 24; and 5,000 units at $4.83 on December 12. Income taxes are 30%. Instructions (a) Prepare compårative condensed income statements for 2014 under FIFO and LIFO. (Show computations of ending inventory.) (b) - (1) Which inventory cost flow method produces the most meaningful inventory amount for the balance sheet? Why? (2) Which inventory cost flow method produces the most meaningful net income? Why? (3) Which inventory cost flow method is most likely to approximate the actual physical flow of the goods? Why? (4) How much more cash will be available under LIFO than under FIFO? Why? (5) How much of the gross profit under FIFO is illusionary in comparison with the gross profit under LIFO? Answer the following questions for management in the form of a business letter.

P6-4B The management of Weigel Inc. asks your help in determıning the compal tive effects of the FIFO and LIFO inventory cost flow methods. For 2014 the accounting records show these data. $ 16,000 470,500 Inventory, January 1 (4,000 units) Cost of 105,000 units purchased Selling price of 100,000 units sold Operating expenses 900,000 185,000 Units purchased consisted of 35,000 units at $4.21 on March 20; 65,000 units at $4.60 on July 24; and 5,000 units at $4.83 on December 12. Income taxes are 30%. Instructions (a) Prepare compårative condensed income statements for 2014 under FIFO and LIFO. (Show computations of ending inventory.) (b) - (1) Which inventory cost flow method produces the most meaningful inventory amount for the balance sheet? Why? (2) Which inventory cost flow method produces the most meaningful net income? Why? (3) Which inventory cost flow method is most likely to approximate the actual physical flow of the goods? Why? (4) How much more cash will be available under LIFO than under FIFO? Why? (5) How much of the gross profit under FIFO is illusionary in comparison with the gross profit under LIFO? Answer the following questions for management in the form of a business letter.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

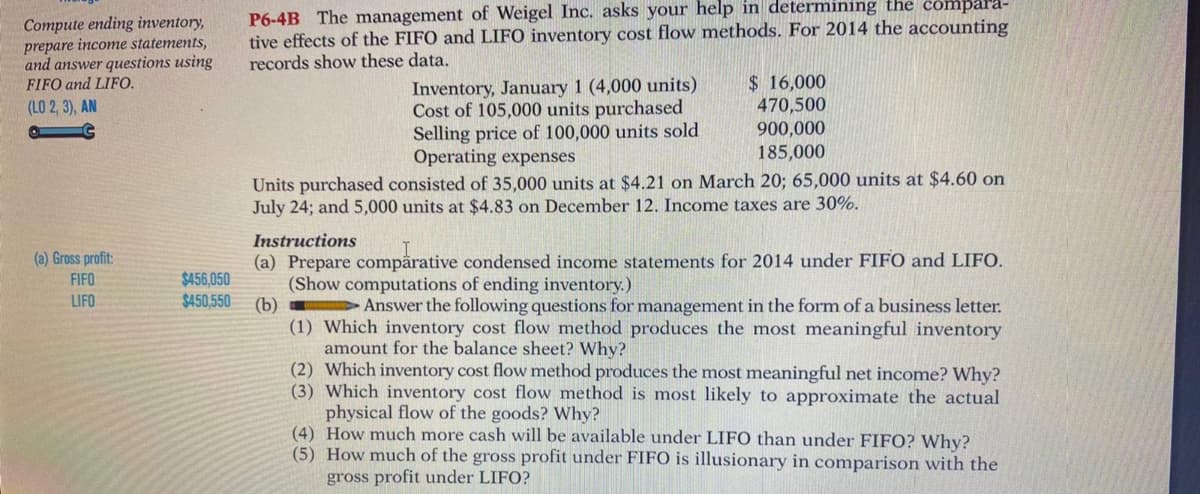

Transcribed Image Text:Compute ending inventory,

prepare income statements,

and answer questions using

FIFO and LIFO.

P6-4B The management of Weigel Inc. asks your help in determining the compara-

tive effects of the FIFO and LIFO inventory cost flow methods. For 2014 the accounting

records show these data.

Inventory, January 1 (4,000 units)

Cost of 105,000 units purchased

Selling price of 100,000 units sold

Operating expenses

$ 16,000

470,500

900,000

185,000

(LO 2, 3), AN

Units purchased consisted of 35,000 units at $4.21 on March 20; 65,000 units at $4.60 on

July 24; and 5,000 units at $4.83 on December 12. Income taxes are 30%.

Instructions

(a) Prepare compårative condensed income statements for 2014 under FIFO and LIFO.

(Show computations of ending inventory.)

(b)

(1) Which inventory cost flow method produces the most meaningful inventory

amount for the balance sheet? Why?

(2) Which inventory cost flow method produces the most meaningful net income? Why?

(3) Which inventory cost flow method is most likely to approximate the actual

physical flow of the goods? Why?

(4) How much more cash will be available under LIFO than under FIFO? Why?

(5) How much of the gross profit under FIFO is illusionary in comparison with the

gross profit under LIFO?

(a) Gross profit:

FIFO

$456,050

$450,550

LIFO

Answer the following questions for management in the form of a business letter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning