Palantir Corp. sells specialized equipment to the healthcare industry. Palantir pays its sales agents a salary plus a 5% commission on sales. Sales agents employed by the company sold 10 Osgilith MRI machines that were delivered and installed in January 2017. The MRI machine sells for $45,600 due at the end of 12 months. Alternatively, customers may elect to pay $40,000 at delivery and installation. All customers purchasing machines during January elected to pay at the end of the 12-month period. Required: 1. Determine the transaction price of the Osgilith MRI machines, and discuss how Palantir would account for the sales commission. 2. Discuss whether the delayed payment contract contains a significant financing component. 3. Prepare the journal entries for 2017 for the Osgilith MRI machines sold by Palantir to customers who elect the delayed payment option. 4. Prepare the 2017 journal entries that Palantir would make for the 10 Osgilith MRI machines that are sold if customers elect to pay at delivery.

Palantir Corp. sells specialized equipment to the healthcare industry. Palantir pays its sales agents a salary plus a 5% commission on sales. Sales agents employed by the company sold 10 Osgilith MRI machines that were delivered and installed in January 2017. The MRI machine sells for $45,600 due at the end of 12 months. Alternatively, customers may elect to pay $40,000 at delivery and installation. All customers purchasing machines during January elected to pay at the end of the 12-month period. Required: 1. Determine the transaction price of the Osgilith MRI machines, and discuss how Palantir would account for the sales commission. 2. Discuss whether the delayed payment contract contains a significant financing component. 3. Prepare the journal entries for 2017 for the Osgilith MRI machines sold by Palantir to customers who elect the delayed payment option. 4. Prepare the 2017 journal entries that Palantir would make for the 10 Osgilith MRI machines that are sold if customers elect to pay at delivery.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 5P

Related questions

Question

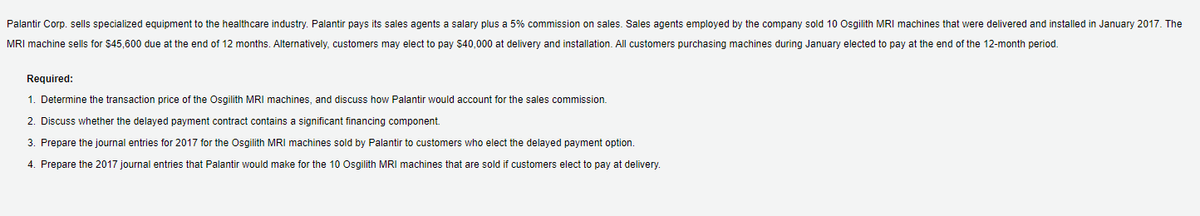

Transcribed Image Text:Palantir Corp. sells specialized equipment to the healthcare industry. Palantir pays its sales agents a salary plus a 5% commission on sales. Sales agents employed by the company sold 10 Osgilith MRI machines that were delivered and installed in January 2017. The

MRI machine sells for $45,600 due at the end of 12 months. Alternatively, customers may elect to pay S40,000 at delivery and installation. All customers purchasing machines during January elected to pay at the end of the 12-month period.

Required:

1. Determine the transaction price of the Osgilith MRI machines, and discuss how Palantir would account for the sales commission.

2. Discuss whether the delayed payment contract contains

significant financing component.

3. Prepare the journal entries for 2017 for the Osgilith MRI machines sold by Palantir to customers who elect the delayed payment option.

4. Prepare the 2017 journal entries that Palantir would make for the 10 Osgilith MRI machines that are sold if customers elect to pay at delivery.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College