Part I To recap, W.T.'s planning on the following: Newspaper ad Social media manager Payment collection Gas $120 per month $100 per month; $1 per job scheduled $0.75 per job $4.00 per job Considering his analysis of similar services and to keep things simple, W.T. plans to price all jobs the same and charge $15 per job. Because of this flat rate, he anticipates he'll likely need to create different types of "jobs". For example, purchasirg a list of items at the grocery store would be one job, while a bundle of 2-3 small errands such as picking up dry cleaning and prescriptions, might be considered one job. We'll deal with those details later. For now, assume that all jobs are priced at $15 each and all have the associated variable expenses listed above. Because this will be a new business, W.T. knows business will likely be slow at the beginning. Complete the following table assSuming W.T. completes 10 jobs in a single month. Item Per Job Total Computations (10 jobs) Sales Less: Variable Cost Contribution Margin Less: Fixed Cost $4 Gross Margin $4 %24 %24 %24 %24 %24 %24

Part I To recap, W.T.'s planning on the following: Newspaper ad Social media manager Payment collection Gas $120 per month $100 per month; $1 per job scheduled $0.75 per job $4.00 per job Considering his analysis of similar services and to keep things simple, W.T. plans to price all jobs the same and charge $15 per job. Because of this flat rate, he anticipates he'll likely need to create different types of "jobs". For example, purchasirg a list of items at the grocery store would be one job, while a bundle of 2-3 small errands such as picking up dry cleaning and prescriptions, might be considered one job. We'll deal with those details later. For now, assume that all jobs are priced at $15 each and all have the associated variable expenses listed above. Because this will be a new business, W.T. knows business will likely be slow at the beginning. Complete the following table assSuming W.T. completes 10 jobs in a single month. Item Per Job Total Computations (10 jobs) Sales Less: Variable Cost Contribution Margin Less: Fixed Cost $4 Gross Margin $4 %24 %24 %24 %24 %24 %24

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 5PB: Blake Cohen Painting Service specializes in small paint jobs. His normal charge is $350/day plus...

Related questions

Question

Transcribed Image Text:Part I.

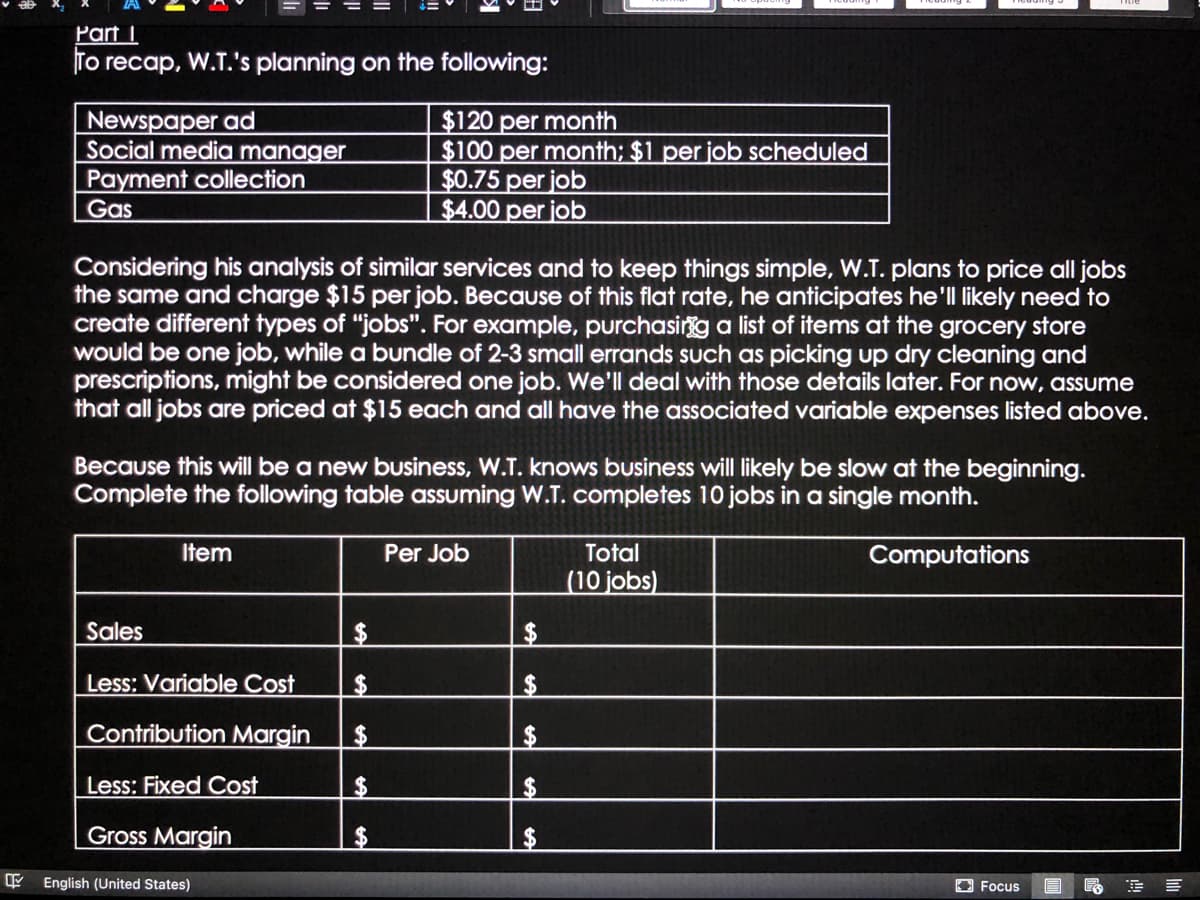

To recap, W.T.'s planning on the following:

Newspaper ad

Social media manager

Payment collection

Gas

$120 per month

$100 per month; $1 per job scheduled

$0.75 per job

$4.00 per job

Considering his analysis of similar services and to keep things simple, w.T. plans to price all jobs

the same and charge $15 per job. Because of this flat rate, he anticipates he'll likely need to

create different types of "jobs". For example, purchasirg a list of items at the grocery store

would be one job, while a bundle of 2-3 small errands such as picking up dry cleaning and

prescriptions, might be considered one job. We'll deal with those details later. For now, assume

that all jobs are priced at $15 each and all have the associated variable expenses listed above.

Because this will be a new business, W.T. knows business will likely be slow at the beginning.

Complete the following table assuming W.T. completes 10 jobs in a single month.

Item

Per Job

Total

Computations

(10 jobs)

Sales

$

Less: Variable Cost

Contribution Margin

$4

Less: Fixed Cost

%$4

%24

Gross Margin

%24

English (United States)

回Focus

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,